FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A1

Required A2

Required B

Required C

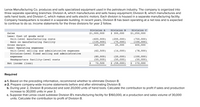

Based on the preceding information, recommend whether to eliminate Division B. (Negative amounts should be indicated by a

minus sign.)

Contribution to profit (loss)

Should Division B be eliminated?

< Required A1

Required A2 >

Transcribed Image Text:Lenox Manufacturing Co. produces and sells specialized equipment used in the petroleum industry. The company is organized into

three separate operating branches: Division A, which manufactures and sells heavy equipment; Division B, which manufactures and

sells hand tools; and Division C, which makes and sells electric motors. Each division is housed in a separate manufacturing facility.

Company headquarters is located in a separate building. In recent years, Division B has been operating at a net loss and is expected

to continue to do so. Income statements for the three divisions for year 2 follow.

Division A

Division B

Division C

Sales

$1,000,000

$ 300,000

$1,250,000

Less: Cost of goods sold

Unit-level manufacturing costs

Rent on manufacturing facility

Gross margin

Less: Operating expenses

Unit-level selling and administrative expenses

Division-level fixed selling and administrative

(600,000)

(135,000)

265,000

(200,000)

(75,000)

25,000

(750,000)

(100,000)

400,000

(62,500)

(14,000)

(78,000)

(80,000)

(50,000)

(20,000)

(50,000)

(100,000)

(50,000)

expenses

Headquarters facility-level costs

Net income (loss)

$

72,500

$ (59,000)

$

172,000

Required

a-1. Based on the preceding information, recommend whether to eliminate Division B.

a-2. Prepare company-wide income statements before and after eliminating Division B.

b. During year 2, Division B produced and sold 20,000 units of hand tools. Calculate the contribution to profit if sales and production

increase to 30,000 units in year 3.

c. Suppose that Lenox could sublease Division B's manufacturing facility for $160,000, at a production and sales volume of 30,000

units. Calculate the contribution to profit of Division B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Farleigh Petroleum, Inc., is a small company that acquires high-grade crude oil from low-volume production wells owned by individuals and small partnerships. The crude oil is processed in a single refinery into Two Oil, Six Oil, and impure distillates. Farleigh Petroleum does not have the technology or capacity to process these products further and sells most of its output each month to major refineries. There were no beginning finished goods or work-in-process inventories on April 1. The production costs and output of Farleigh Petroleum for April are as follows: Crude oil placed into production Direct labor and related costs Manufacturing overhead Data on barrels produced and selling price: $6,400,000 1,500,000 3,000,000 Two Oil, 300,000 barrels produced; sales price, $45 per barrel Six Oil, 180,000 barrels produced; sales price, $25 per barrel Distillates, 90,000 barrels produced; sales price, $14 per barrel Required: 1. Calculate the amount of joint production cost that Farleigh…arrow_forwardAg-Coop is a large farm cooperative with a number of agriculture-related manufacturing and service divisions. As a cooperative, it pays no federal income taxes. The company owns a fertilizer plant that processes and mixes petrochemical compounds into three brands of agricultural fertilizer: greenup, maintane, and winterizer. The three brands differ with respect to selling price and the proportional content of basic chemicals. Ag-Coop's Fertilizer Manufacturing Division transfers the completed product to the cooperative's Retail Sales Division at a price based on the cost of each type of fertilizer plus a markup. The Manufacturing Division is completely automated so that the only costs it incurs are the costs of the petrochemical feedstocks plus overhead that is considered fixed. The primary feedstock costs $1.60 per pound. Each 100 pounds of feedstock can produce either of the following mixtures of fertilizer. Greenup Maintane Winterizer Product Greenup Maintane Winterizer Output…arrow_forwardWhitehill Chemicals has two operating divisions. Its Formulation Division in the United States mixes, processes, and tests basic chemicals, and then ships them to Ireland, where the company's Commercial Division uses the chemicals to produce and sell various products. Operating expenses amount to $26.6 million in the U.S. and $78.6 million in Ireland exclusive of the costs of any goods transferred from the U.S. Revenues in Ireland are $201 million. If the chemicals were purchased from one of the company's Irish mixing divisions, the costs would be $39.6 million. However, if it had been purchased from an independent U.S. supplier, the cost would be $52.6 million. The marginal income tax rate is 20 percent in the U.S. and 12 percent in Ireland. Required: What is the company's total tax liability to both jurisdictions for each of the two alternative transfer pricing scenarios ($39.6 million and $52.6 million)? Note: Enter your answers in dollars and not in millions of dollars. Total tax…arrow_forward

- Carla Vista Company manufactures products ranging from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications, Carla Vista has the following arrangement with Pharoah Inc. Pharoah purchases equipment from Carla Vista for a price of $1,008,900 and contracts with Carla Vista to install the equipment. Carla Vista charges the same price for the equipment irrespective of whether it does the installation or not. The cost of the equipment is $654,000. Pharoah is obligated to pay Carla Vista the $1.008,900 upon the delivery of the equipment. Carla Vista delivers the equipment on June 1, 2025, and completes the installation of the equipment on September 30, 2025. The…arrow_forwardCarving Creations jointly produces wood chips and sawdust used in agriculture. The wood chips and sawdust are actually by-products of the company’s core operations, but Carving Creations accounts for them just like normally produced goods because of their large volumes. One jointly produced batch yields 3,000 cubic yards of wood chips and 10,000 cubic yards of sawdust, and the estimated cost per batch is $21,400. However, the joint production of each good is not equally weighted. Management at Carving Creations estimates that for the time it takes to produce 10 cubic yards of wood chips in the joint production process, only 2 cubic yards of sawdust are produced. Given this information, allocate the joint costs of production to each product using the weighted average method.arrow_forwardXYZ Ltd. is a manufacturing company that produces specialized machinery. The company has been in business for the last 10 years and has always used the straight-line method of depreciation to calculate the depreciation expense for its machinery. However, the company's financial controller has recently proposed that they switch to the double- declining balance method instead. The financial controller argues that this method would result in a more accurate depreciation expense calculation and better reflect the actual usage of the machinery over time. Questions: 1. What is the straight-line method of depreciation? 2. What is the double-declining balance method of depreciation? 3. What are the advantages and disadvantages of using the straight-line method? 4. What are the advantages and disadvantages of using the double-declining balance method? 5. Should XYZ Ltd. switch to the double-declining balance method of depreciation? Why or why not?arrow_forward

- Shady Fabrication Group (SFG) manufactures components for manufacturing equipment at several facilities. The company produces two, related, parts at its Park River Plant, the models SF-08 and SF-48. The differences in the models are the quality of the materials and the precision to which they are produced. The SF-48 model is used in applications where the precision is critical and thus requires greater oversight in the production process. Although sales remain reasonably strong, managers at SFG have noticed that the company is meeting more resistance to the pricing for SF-08, although there seems to be little need for negotiation on the price of the SF-48 model. As a result, the marketing manager at SFG has asked the financial staff to review the costs of the two products to understand better what might be happening in the market. Manufacturing overhead is currently assigned to products based on their direct labor costs. For the most recent month manufacturing overhead was $208,800.…arrow_forwardFederated Manufacturing Incorporated (FMl) produces electronic components in three divisions: industrial, commercial, and consumer products. The commercial products division annually purchases 10,000 units of part 23-6711, which the industrial division produces for use in manufacturing one of its own products. The commercial division is growing rapidly; it is expanding its production and now wants to increase its purchases of part 23-6711 to 15,000 units per year. The problem is that the industrial division is at full capacity. No new investment in the industrial division has been made for some years because top management sees little future growth in its products, so its capacity is unlikely to increase soon. The commercial division can buy part 23-6711 from Advanced Micro Incorporated or from Admiral Electric, a customer of the industrial division now purchasing 650 units of part 88-461. The industrial division's sales to Admiral would not be affected by the commercial division's…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education