Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

2

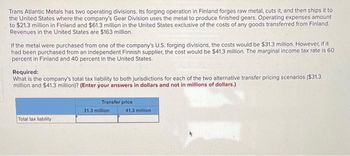

Transcribed Image Text:Trans Atlantic Metals has two operating divisions. Its forging operation in Finland forges raw metal, cuts it, and then ships it to

the United States where the company's Gear Division uses the metal to produce finished gears. Operating expenses amount

to $21.3 million in Finland and $61.3 million in the United States exclusive of the costs of any goods transferred from Finland.

Revenues in the United States are $163 million.

If the metal were purchased from one of the company's U.S. forging divisions, the costs would be $31.3 million. However, if it

had been purchased from an independent Finnish supplier, the cost would be $41.3 million. The marginal income tax rate is 60

percent in Finland and 40 percent in the United States.

Required:

What is the company's total tax liability to both jurisdictions for each of the two alternative transfer pricing scenarios ($31.3

million and $41.3 million)? (Enter your answers in dollars and not in millions of dollars.)

Total tax liability

Transfer price

31.3 million

41.3 million

11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Godoarrow_forwardWhitehill Chemicals has two operating divisions. Its Formulation Division in the United States mixes, processes, and tests basic chemicals, and then ships them to Ireland, where the company's Commercial Division uses the chemicals to produce and sell various products. Operating expenses amount to $27.2 million in the U.S. and $79.2 million in Ireland exclusive of the costs of any goods transferred from the U.S. Revenues in Ireland are $207 million. If the chemicals were purchased from one of the company's Irish mixing divisions, the costs would be $40.2 million. However, if it had been purchased from an independent U.S. supplier, the cost would be $53.2 million. The marginal income tax rate is 20 percent in the U.S. and 12 percent in Ireland. Required: What is the company's total tax liability to both jurisdictions for each of the two alternative transfer pricing scenarios ($40.2 million and $53.2 million)? Note: Enter your answers in dollars and not in millions of dollars. Total tax…arrow_forwardWhitehill Chemicals has two operating divisions. Its Formulation Division in the United States mixes, processes, and tests basic chemicals, and then ships them to Ireland, where the company's Commercial Division uses the chemicals to produce and sell various products. Operating expenses amount to $26.7 million in the U.S. and $78.7 million in Ireland exclusive of the costs of any goods transferred from the U.S. Revenues in Ireland are $202 million. If the chemicals were purchased from one of the company's Irish mixing divisions, the costs would be $39.7 million. However, if it had been purchased from an independent U.S. supplier, the cost would be $52.7 million. The marginal income tax rate is 20 percent in the U.S. and 12 percent in Ireland. Required: What is the company's total tax liability to both jurisdictions for each of the two alternative transfer pricing scenarios ($39.7 million and $52.7 million)? Note: Enter your answers in dollars and not in millions of dollars. Total tax…arrow_forward

- Hanshabenarrow_forward5arrow_forwardA U.S. manufacturing company operating a subsidiary in an LDC (less-developed country) shows the following results: U.S. LDC Sales (units) 110,000 19,950 Labor (hours) 20,100 15,100 Raw materials (currency) $ 19,980 FC* 20,100 Capital equipment (hours) 60,300 5,100 *Foreign Currency unit a. Calculate partial labor and capital productivity figures for the parent and subsidiary. (Round your answers to 2 decimal places.) b. Compute the multifactor productivity figures for labor and capital together. (Round your answers to 2 decimal places.) c. Calculate raw material productivity figures (units/$ where $1 = FC 10). (Round your answers to 2 decimal places.)arrow_forward

- The Burton Company manufactures chainsaws at its plant in Sandusky, Ohio. The company has marketing divisions throughout the world. A Burton marketing division in Lille, France, imports 200,000 chainsaws annually from the United States. The following information is available: U.S. income tax rate on the U.S. division’s operating income 40% French income tax rate on the French division’s operating income 45% French import duty 20% Variable manufacturing cost per chainsaw $100 Full manufacturing cost per chainsaw $175 Selling price (net of marketing and distribution costs) in France $300 Suppose the United States and French tax authorities only allow transfer prices that are between the full manufacturing cost per unit of $175 and a market price of $250, based on comparable imports into France. The French import duty is charged on the price at which the product is transferred into France. Any import duty paid to the French authorities is a deductible expense for calculating French income…arrow_forwardThe Burton Company manufactures chainsaws at its plant in Sandusky, Ohio. The company has marketing divisions throughout the world. A Burton marketing division in Lille, France, imports 200,000 chainsaws annually from the United States. The following information is available: U.S. income tax rate on the U.S. division’s operating income 40% French income tax rate on the French division’s operating income 45% French import duty 20% Variable manufacturing cost per chainsaw $100 Full manufacturing cost per chainsaw $175 Selling price (net of marketing and distribution costs) in France $300 Suppose the United States and French tax authorities only allow transfer prices that are between the full manufacturing cost per unit of $175 and a market price of $250, based on comparable imports into France. The French import duty is charged on the price at which the product is transferred into France. Any import duty paid to the French authorities is a deductible expense for calculating French income…arrow_forwardA3arrow_forward

- Kamber, Inc., owns a factory located close to, but not inside, a foreign trade zone. The plant imports volatile chemicals that are used in the manufacture of chemical reagents for laboratories. Each year, Kamber imports about $14,200,000 of chemicals subject to a 30% tariff when shipped into the United States. About 15% of the imported chemicals are lost through evaporation during the manufacturing process. In addition, Kamber has a carrying cost of 10% per year associated with the duty payment. On average, the chemicals are held in inventory for 9 months. Assume that Kamber is considering building a new plant inside a foreign trade zone to replace its chemical manufacturing plant. Required: 1. How much duty will be paid per year by the factory located inside the foreign trade zone?$fill in the blank 1 2. How much in duty and duty-related carrying costs will be saved by relocating inside the foreign trade zone?$fill in the blank 2arrow_forwardA U.S. manufacturing company operating a subsidiary in an LDC (less-developed country) shows the following results: U.S. LDCSales (units) 100,000 20,000Labor (hours) 20,000 15,000Raw materials (currency) $20,000 FC 20,000Capital equipment (hours) 60,000 5,000a. a. Calculate partial labor and capital productivity i gures for the parent and subsidiary. Do the results seem confusing?b. Compute the multifactor productivity i gures for labor and capital…arrow_forwardLynch Corporation has a wholly owned subsidiary in Mexico (Lynmex) with two distinct and unrelated lines of business. Lynmex’s Small Appliance Division manufactures small household appliances such as toasters and coffeemakers at a factory in Monterrey, Nuevo Leon, and sells them directly to retailers such as Gigantes throughout Mexico. Lynmex’s Electronics Division imports finished products produced by Lynch Corporation in the United States and sells them to a network of distributors operating throughout Mexico.Lynch’s CFO believes that the two divisions have different functional currencies. The functional currency of the Small Appliance Division is the Mexican peso, whereas the functional currency of the Electronics Division is the U.S. dollar. The CFO is unsure whether to designate the Mexican peso or the U.S. dollar as Lynmex’s functional currency, or whether the subsidiary can be treated as two separate foreign operations with different functional currencies.RequiredSearch current…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT