FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

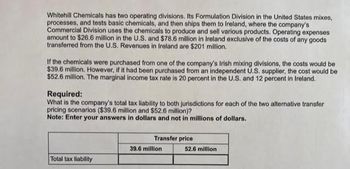

Transcribed Image Text:Whitehill Chemicals has two operating divisions. Its Formulation Division in the United States mixes,

processes, and tests basic chemicals, and then ships them to Ireland, where the company's

Commercial Division uses the chemicals to produce and sell various products. Operating expenses

amount to $26.6 million in the U.S. and $78.6 million in Ireland exclusive of the costs of any goods

transferred from the U.S. Revenues in Ireland are $201 million.

If the chemicals were purchased from one of the company's Irish mixing divisions, the costs would be

$39.6 million. However, if it had been purchased from an independent U.S. supplier, the cost would be

$52.6 million. The marginal income tax rate is 20 percent in the U.S. and 12 percent in Ireland.

Required:

What is the company's total tax liability to both jurisdictions for each of the two alternative transfer

pricing scenarios ($39.6 million and $52.6 million)?

Note: Enter your answers in dollars and not in millions of dollars.

Total tax liability

Transfer price

39.6 million

52.6 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with this question: IrishCo, a manufacturing corporation resident in Ireland, distributes products through a U.S. office. Current-year taxable income from such sales in the United States is $12,000,000. IrishCo's U.S. office deposits working capital funds in short-term certificates of deposit with U.S. banks. Current-year interest income from these deposits is $150,000. IrishCo also invests in U.S. securities traded on the New York Stock Exchange. This investing is done by the home office. For the current year, IrishCo has realized capital gains of $300,000 and dividend income of $50,000 from these stock investments. Compute IrishCo's U.S. tax liability, assuming that the U.S.-Ireland income tax treaty reduces withholding on dividends to 15% and on interest to 5%. Assume a 21% U.S. tax rate. IrishCo's U.S. tax liability is $arrow_forward(6)(a)Identify the revenue and cost related motives for direct foreign investment. (b)Suppose a U.S. based MNC plans to invest in a new plant either in the U.S or in Zambia. The MNC intends to invest 30% of its investment spending in this new plant while the remainder is devoted to the firm's existing structure in the U.S. The characteristics of the proposed new project are given below: If located in U.S If located in Zambia Mean expected annual returns on investment 25% 25% Standard deviation of expected annual returns on investment 0.09 0.11 Correlation of expected annual returns on investment with returns on prevailing U.S business 0.80 -0.05 Determine, with robust quantitative explanation, which location will best provide the firm with a more stable flow of revenue.arrow_forwardPulaski Inc. wants to establish a new subsidiary in Colombia that will sell cell phones to Colombian customers and remit earnings back to the U.S. parent. The value of this project will be favorably affected if the value of the peso ____ while it establishes the new subsidiary and ____ when the subsidiary starts operations. appreciates; appreciates depreciates; appreciates appreciates; depreciates depreciates; depreciatesarrow_forward

- Chinook, Inc. purchases components from a Japanese company that requires payment in yen (Y); it sells finished products to a German company that pays in euros. On June 1, Chinook ordered components from the Japanese Company costing Y6,890,000 and sold finished goods to the German company with a selling price of $150,000 to be paid in euros. The June 1 spot rates of U.S. dollars for yen and for euros was: $1 = Y106.0 $1 = E0.84 Required: 1. What is the cost of the Y6,890,000 in dollars? 2. How many euros will Chinook receive from the German company in payment for the finished product? 3. What if the exchange rate of dollars for yen was $1 = Y108? What is the cost of the Y6,890,000 in dollars (rounded to the nearest dollar)?arrow_forwardWhitehill Chemicals has two operating divisions. Its Formulation Division in the United States mixes, processes, and tests basic chemicals, and then ships them to Ireland, where the company's Commercial Division uses the chemicals to produce and sell various products. Operating expenses amount to $27.2 million in the U.S. and $79.2 million in Ireland exclusive of the costs of any goods transferred from the U.S. Revenues in Ireland are $207 million. If the chemicals were purchased from one of the company's Irish mixing divisions, the costs would be $40.2 million. However, if it had been purchased from an independent U.S. supplier, the cost would be $53.2 million. The marginal income tax rate is 20 percent in the U.S. and 12 percent in Ireland. Required: What is the company's total tax liability to both jurisdictions for each of the two alternative transfer pricing scenarios ($40.2 million and $53.2 million)? Note: Enter your answers in dollars and not in millions of dollars. Total tax…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education