FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

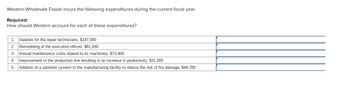

Transcribed Image Text:Western Wholesale Foods incurs the following expenditures during the current fiscal year.

Required:

How should Western account for each of these expenditures?

1. Salaries for the repair technicians, $147,000

2. Remodeling of the executive offices, $81,600

3. Annual maintenance costs related to its machinery, $73,400

4. Improvement of the production line resulting in an increase in productivity, $31,000

5. Addition of a sprinkler system to the manufacturing facility to reduce the risk of fire damage, $44,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The income statement of Mid-South Logistics includes $12 million for amortized prior service cost. Does MidSouth Logistics prepare its financial statements according to U.S. GAAP or IFRS? Explainarrow_forwardYou are looking into the accounts of a company that has presented using LIFO for inventory. You see in the notes the LIFO Reserve in 2019 and 2020 were 160,000 and 240,000 respectively. The company pays tax at 30% in both years. Show the relevant adjustments you would have to make to the Balance Sheet and income statement to convert the company to a FIFO basis. Describe the effect that this conversion would have on net profit margin, gross profit margin, debt to equity, inventory turnover and current ratio in 2020. Another company has written down some inventory. Explain why a company would need to write down inventory and the effects this would have on the company accounts.arrow_forwardA corporation pays $15 per unit for the product it sells. For the corporation, is that revenue, a variable expense or a fixed expense?arrow_forward

- What is the answer and how do you get the answer? Dixon Development began operations in December 2021. When lots for industrial development are sold, Dixon recognizes income for financial reporting purposes in the year of the sale. For some lots, Dixon recognizes income for tax purposes when collected. Income recognized for financial reporting purposes in 2021 for lots sold this way was $15 million, which will be collected over the next three years. Scheduled collections for 2022–2024 are as follows: 2022 $ 5 million 2023 7 million 2024 3 million $ 15 million Pretax accounting income for 2021 was $20 million. The enacted tax rate is 30%. Required:1. Assuming no differences between accounting income and taxable income other than those described above, prepare the journal entry to record income taxes in 2021.2. Suppose a new tax law, revising the tax rate from 30% to 25%, beginning in 2023, is enacted in 2022, when pretax accounting income was $17…arrow_forwardIsaac Inc. began operations in January 2021. For some property sales, Isaac recognizes income in the period of sale for financial reporting purposes. However, for income tax purposes, Isaac recognizes income when it collects cash from the buyer's installment payments. In 2021, Isaac had $676 million in sales of this type. Scheduled collections for these sales are as follows: 2021 $ 83 million 2022 137 million 2023 129 million 2024 162 million 2025 165 million $ 676 million Assume that Isaac has a 25% income tax rate and that there were no other differences in income for financial statement and tax purposes. Ignoring operating expenses, what deferred tax liability would Isaac report in its year-end 2021 balance sheet?arrow_forwardPatriot Corporation reports the following results for the current year: View the current year results. Read the requirements. Requirement a. What are Patriot's taxable income and income tax liability for the current year? Begin by computing Patriot's taxable income. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Gross income Minus: Taxable income Requirements a. What are Patriot's taxable income and income tax liability for the current year? b. How would your answers to Part a change if Patriot's short-term capital loss is $12,000 instead of $2,000? Print Done - X Current Year Results Gross profits on sales Long-term capital gain Long-term capital loss Short-term capital gain Short-term capital loss Operating expenses Print $ 159,000 7,000 8,000 9,000 2,000 70,000 Done Xarrow_forward

- Income from Continuing Operationsarrow_forwardAfter making four quaterly estimated payments of $3,500, a corporation's actual income tax liability for the year is $17,200. The year-end adjusting entry would require:arrow_forward11. The Dot Corporation has changed its year-end from a calendar year-end to August 31. The income for its short period from January 1 to August 31 is $54,000. The tax for this short period is: a.$2,040 b.$8,667 c.$11,340 d.$6,250arrow_forward

- Concerning accounting for warranties, which of the following statements is true? Federal income tax regulations require companies to accrue warranty expense in the year of the sale. The modified cash basis method is required for tax reporting. The modified cash basis method uses a percentage of completion approach to warranty revenue recognition. The modified cash basis recognizes warranty expense when cash is received on the sale.arrow_forwardDeferred tax accounting adjustments are recorded at what point in time? a. At the end of each month b. At balance date c. As each transaction arises or is incurred d. As the cash flows from each transaction occurarrow_forwardSubject: accountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education