FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

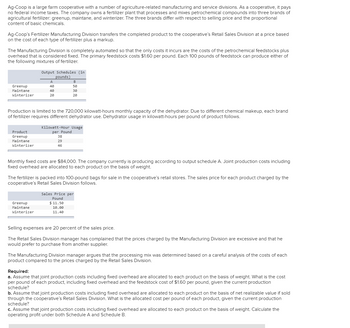

Transcribed Image Text:Ag-Coop is a large farm cooperative with a number of agriculture-related manufacturing and service divisions. As a cooperative, it pays

no federal income taxes. The company owns a fertilizer plant that processes and mixes petrochemical compounds into three brands of

agricultural fertilizer: greenup, maintane, and winterizer. The three brands differ with respect to selling price and the proportional

content of basic chemicals.

Ag-Coop's Fertilizer Manufacturing Division transfers the completed product to the cooperative's Retail Sales Division at a price based

on the cost of each type of fertilizer plus a markup.

The Manufacturing Division is completely automated so that the only costs it incurs are the costs of the petrochemical feedstocks plus

overhead that is considered fixed. The primary feedstock costs $1.60 per pound. Each 100 pounds of feedstock can produce either of

the following mixtures of fertilizer.

Greenup

Maintane

Winterizer

Product

Greenup

Maintane

Winterizer

Output Schedules (in

pounds)

A

40

40

20

Production is limited to the 720,000 kilowatt-hours monthly capacity of the dehydrator. Due to different chemical makeup, each brand

of fertilizer requires different dehydrator use. Dehydrator usage in kilowatt-hours per pound of product follows.

Greenup

Maintane

Winterizer

B

50

30

20

Kilowatt-Hour Usage

per Pound

38

29

46

Monthly fixed costs are $84,000. The company currently is producing according to output schedule A. Joint production costs including

fixed overhead are allocated to each product on the basis of weight.

The fertilizer is packed into 100-pound bags for sale in the cooperative's retail stores. The sales price for each product charged by the

cooperative's Retail Sales Division follows.

Sales Price per

Pound

$11.50

10.00

11.40

Selling expenses are 20 percent of the sales price.

The Retail Sales Division manager has complained that the prices charged by the Manufacturing Division are excessive and that he

would prefer to purchase from another supplier.

The Manufacturing Division manager argues that the processing mix was determined based on a careful analysis of the costs of each

product compared to the prices charged by the Retail Sales Division.

Required:

a. Assume that joint production costs including fixed overhead are allocated to each product on the basis of weight. What is the cost

per pound of each product, including fixed overhead and the feedstock cost of $1.60 per pound, given the current production

schedule?

b. Assume that joint production costs including fixed overhead are allocated to each product on the basis of net realizable value if sold

through the cooperative's Retail Sales Division. What is the allocated cost per pound of each product, given the current production

schedule?

c. Assume that joint production costs including fixed overhead are allocated to each product on the basis of weight. Calculate the

operating profit under both Schedule A and Schedule B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In a joint processing operation, Scarecrow Gardens Ltd. manufactures three varieties of products from a common input, corn. Joint processing costs up to the split-off point total $90,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows: whole corn $57,000; dried corn kernels $65,000; and ground corn meal $74,500. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product (on an annual basis) are shown below: Product Additional Processing Costs Sales Value Whole Corn $27,175 $95,250 Dried Corn Kernels $29,760 $104,470 Ground Corn Meal $20,400 $92,300 REQUIRED: Which product or products should be sold at the split-off point, and which product or products should be processedfurther. Explain why…arrow_forwardCarla Vista Company manufactures products ranging from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $200,000 to $1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications, Carla Vista has the following arrangement with Pharoah Inc. Pharoah purchases equipment from Carla Vista for a price of $1,008,900 and contracts with Carla Vista to install the equipment. Carla Vista charges the same price for the equipment irrespective of whether it does the installation or not. The cost of the equipment is $654,000. Pharoah is obligated to pay Carla Vista the $1.008,900 upon the delivery of the equipment. Carla Vista delivers the equipment on June 1, 2025, and completes the installation of the equipment on September 30, 2025. The…arrow_forwardCarving Creations jointly produces wood chips and sawdust used in agriculture. The wood chips and sawdust are actually by-products of the company’s core operations, but Carving Creations accounts for them just like normally produced goods because of their large volumes. One jointly produced batch yields 3,000 cubic yards of wood chips and 10,000 cubic yards of sawdust, and the estimated cost per batch is $21,400. However, the joint production of each good is not equally weighted. Management at Carving Creations estimates that for the time it takes to produce 10 cubic yards of wood chips in the joint production process, only 2 cubic yards of sawdust are produced. Given this information, allocate the joint costs of production to each product using the weighted average method.arrow_forward

- Bradbo owned two adjoining restaurants, the Pork Palace and the Chicken Hut. Each restaurant was treated as a profit center for performance evaluating purposes.arrow_forwardim.arrow_forwardBranded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $48. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-101,000 units. The fixed costs for the Polishing Division are assumed to be $17 per pair at 101,000 units. Stitching's costs per pair of shoes are: Direct materials $11 Direct labor $9 Variable overhead $7 Division fixed costs $5 Polishing's costs per completed pair of shoes are:…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education