Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't use hand rating and don't use Ai solution

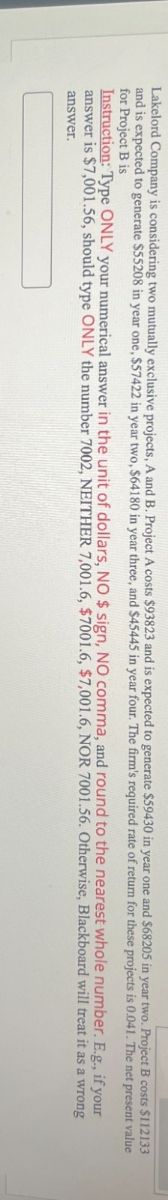

Transcribed Image Text:Lakelord Company is considering two mutually exclusive projects, A and B. Project A costs $93823 and is expected to generate $59430 in year one and $68205 in year two. Project B costs $112133

and is expected to generate $55208 in year one, $57422 in year two, $64180 in year three, and $45445 in year four. The firm's required rate of return for these projects is 0.041. The net present value

for Project B is

Instruction: Type ONLY your numerical answer in the unit of dollars, NO $ sign, NO comma, and round to the nearest whole number. E.g., if your

answer is $7,001.56, should type ONLY the number 7002, NEITHER 7,001.6, $7001.6, $7,001.6, NOR 7001.56. Otherwise, Blackboard will treat it as a

answer.

wrong

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Lakelord Company is considering two mutually exclusive projects, A and B. Project A costs $87067 and is expected to generate $55568 in year one and $66818 in year two. Project B costs $119753 and is expected to generate $57784 in year one, $67180 in year two, $64184 in year three, and $48397 in year four. The firm's required rate of return for these projects is 0.062. The net present value for Project A isarrow_forwardLithium, Inc. is considering two mutually exclusive projects, A and B. Project A costs $100,000 and is expected to generate $65,000 in year one and $75,000 in year two. Project B costs $120,000 and is expected to generate $64,000 in year one, $67,000 in year two, $56,000 in year three, and $45,000 in year four. The firm's required rate of return for these projects is 10%. The net present value for Project A is a.$26,074. b.$21,074. c.$12,358. d.$16,947.arrow_forwardLithium Inc. is considering two mutually exclusive projects, A & B. project cost $95,000 and is expected to generate $65,000 in year one and $75,000 in year two. project B costs $120,000 and is expected to generate $64,000 in year one, $67,000 in year two, $56,000 in year three and $45,000 in year four. Lithium Inc.’s required rate of return for these projects is 10%. The modified internal rate of return for project A is? A. 29.63% B. 19.19% C. 26.89% D. 24.18%arrow_forward

- Lithium, Inc. is considering two mutually exclusive projects, A and B. Project A costs $95,000 and is expected to generate $65,000 in year one and $75,000 in year two. Project B costs $120,000 and is expected to generate $64,000 in year one, $67,000 in year two, $56,000 in year three, and $45,000 in year four. Lithium, Inc.'s required rate of return for these projects is 10%. The internal rate of return for Project B is a.30.79%. b.36.77%. c.29.74%. d.35.27%.arrow_forwardKOMH Blankets Inc. is considering two mutually exclusive projects. Both projects require an initial after-tax investment of $89,000 and are typical average-risk projects for the firm. Project A has an expected life of 3 years with after-tax cash inflows of $25,000 at the end of years 1 and 2 and $75,000 at the end of Year 3. Project B has an expected life of 9 years with after-tax cash inflows of $18,500 at the end of each of the next 9 years. The firm's WACC is 13%. If the projects cannot be repeated, which project should be selected if KOMH Blankets uses NPV as its criterion for project selection (A or B)? Blank 1 Assume that the projects can be repeated and that there are no anticipated changes in the cash flows. Using the replacement chain analysis, what is the NPV of Project A Extended? $14,515.00 If the projects can be repeated, which project should be selected (A or B)? Project A Using the equivalent annual annuity (EAA) method, which project should you select (A or B)? Blank 4…arrow_forwardCrockett Graphic Designs Inc. is considering two mutually exclusive projects. Both projects require an initial after-tax investment of $10,000 and are typical average-risk projects for the firm. Project A has an expected life of 2 years with after-tax cash inflows of $8,000 and $10,000 at the end of Years 1 and 2, respectively. Project B has an expected life of 4 years with after-tax cash inflows of $5,000 at the end of each of the next 4 years. The firm's WACC is 13%. a. If the projects cannot be repeated, which project should be selected if Crockett uses NPV as its criterion for project selection? Project A should be selected. b. Assume that the projects can be repeated and that there are no anticipated changes in the cash flows. Use the replacement chain analysis to determine the NPV of the project selected. Do not round intermediate calculations. Round your answer to the nearest cent. Since Project B 's extended NPV = $ it should be selected over Project -Select- with an NPV = $ c.…arrow_forward

- Crockett Graphic Designs Inc. is considering two mutually exclusive projects. Both projects require an initial after-tax investment of $11,000 and are typical average-risk projects for the firm. Project A has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,000 at the end of Years 1 and 2, respectively. Project B has an expected life of 4 years with after-tax cash inflows of $5,000 at the end of each of the next 4 years. The firm's WACC is 10%. a. If the projects cannot be repeated, which project should be selected if Crockett uses NPV as its criterion for project selection? Project should be selected. b. Assume that the projects can be repeated and that there are no anticipated changes in the cash flows. Use the replacement chain analysis to determine the NP of the project selected. Do not round intermediate calculations. Round your answer to the nearest cent. Since Project 's extended NPV = $ , it should be selected over Project A ~ with an…arrow_forwardGarry Manufacturing Company is considering a three-year project that has a cost of $75,000. The project will generate after-tax cash flows of $33,100 in Year 1, $31,500 in Year 2, and $31,200 in Year 3. Assume that the firm's proper rate of discount is 10% and that the firm's tax rate is 40%. What is the project's payback and outline any limitations in using the payback period method in selecting acceptable projects?arrow_forwardA Garry Manufacturing Company is considering a three-year project that has a cost of $75,000. The project will generate after-tax cash flows of $33,100 in Year 1, $31,500 in Year 2, and $31,200 in Year 3. Assume that the firm's proper rate of discount is 10% and that the firm's tax rate is 40%. What is the project's payback and outline any limitations in using the payback period method in selecting acceptable projects? Tetious Dimensions is introducing a new product that is expected to increase it net operating income by $775,000. Tetious Dimensions has a 21% marginal tax rate. This project will also produce $200,000 of depreciation per year. In addition, this project will cause the following changes: Without the Project With the Project Accounts Receivable $55,000 $89,000 Inventory $100,000…arrow_forward

- Management is considering two alternatives. Alternative A has projected revenue per year of $100,000 and costs of $70,000 while Alternative B has revenue of $100,000 and costs of $60,000. Both projects require an initial investment of $250,000 of which $75,000 has already been set aside and will be used as a down payment on the project that is chosen. There are also other qualitative factors that management must consider before making a final choice.Required: Which of the following statements is correct about relevant costs and relevant revenues. a. The sunk cost of $75,000 is relevant b. The projected revenues are relevant to the decision c. The only relevant item are the costs as they differ between alternative d. The initial investment of $250,000, the projected revenues, and the projected costs are all relevantarrow_forwardCullumber Corp. management is expecting a project to generate after-tax income of $76,300 in each of the next three years. The average book value of the project’s equipment over that period will be $194,140. If the firm’s investment decision on any project is based on an ARR of 37.5 percent. What is the project's accounting rate of return? - Accounting rate of return is ?arrow_forwardThe total capital investment for a proposed chemical plant, which will produce $1,500,000 worth of goods per year, is estimated to be $1M. It will be necessary to do a considerable amount of research and development work on the project before the final plant can be constructed, and mgt wishes to estimate the permissible Rand D costs. It has been decided that the after-tax return from the plant should be sufficient to pay off the total cap. Investment plus all res. And dev. Costs in 7 years. A return after taxes of at least 12 % 0f sales must be obtained. Bec. R and D is an expense and the co. income tax rate is 35% of gross earnings , only 65% of the funds spent on R and D must be recovered after taxes are paid. Under these conditions , what is the total amount the company can afford to pay for res. And dev.?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,