EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

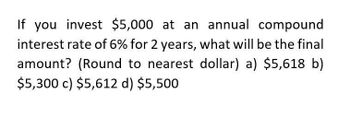

Transcribed Image Text:If you invest $5,000 at an annual compound

interest rate of 6% for 2 years, what will be the final

amount? (Round to nearest dollar) a) $5,618 b)

$5,300 c) $5,612 d) $5,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How much would you invest today in order to receive $30,000 in each of the following (for further Instructions on present value In Excel, see Appendix C): A. 10 years at 9% B. 8 years at 12% C. 14 years at 15% D. 19 years at 18%arrow_forwardIf you invest $15,000 today, how much will you have in (for further instructions on future value in Excel, see Appendix C): A. 20 years at 22% B. 12 years at 10% C. 5 years at 14% D. 2 years at 7%arrow_forwardYou want to invest $8,000 at an annual Interest rate of 8% that compounds annually for 12 years. Which table will help you determine the value of your account at the end of 12 years? A. future value of one dollar ($1) B. present value of one dollar ($1) C. future value of an ordinary annuity D. present value of an ordinary annuityarrow_forward

- How much must be invested now to receive $50,000 for 8 years if the first $50,000 is received in one year and the rate is 10%?arrow_forwardHow much would you invest today in order to receive $30,000 in each of the following (for further instructions on present value in Excel, see Appendix C): A. 20 years at 22% B. 12 years at 10% C. 5 years at 14% D. 2 years at 7%arrow_forwardProject A costs $5,000 and will generate annual after-tax net cash inflows of $1,800 for five years. What is the NPV using 8% as the discount rate?arrow_forward

- If you invest $12,000 today, how much will you have in (for further Instructions on future value in Excel, see Appendix C): A. 10 years at 9% B. 8 years at 12% C. 14 years at l5% D. 19 years at 18%arrow_forwardAn investment offers to pay you $8,000 a year for five years. If it costs $28,840, what will be your rate of return on the investment? Use Appendix D to answer the question. Round your answer to the nearest whole number. %arrow_forwardIf you invest $5,000 at an annual interest rate of 6% compounded annually, what will be the value of your investment after 5 years? a) $6,691.13 b) $6,500.00 c) $7,012.85 d) $6,802.44arrow_forward

- If you invest $9,700 per period for the following number of periods, how much would you have received at the end? Use Appendix C. (Round "Factor" to 3 decimal places. Round the final answers to the nearest whole dollar.) a. 11 years at 9 percent Future value $ b. 16 years at 11 percent Future value $ c. 30 periods at 10 percent Future value $arrow_forwardIf you invest $8,300 per period for the following number of periods, how much would you have received at the end? (Use a Financial calculator to arrive at the answers. Round the final answers to the nearest whole dollar.)a. 12 years at 6 percent.Future value$b. 20 years at 9 percent.Future value$c. 20 periods at 14 percent.Future value$arrow_forwardYou are considering the following 3 investments, each with an upfront cost of $45,000 today. Which would you choose? Show your work to support your answer. a) $5,000 at the end of each year for 15 years with the first payment one year from today (end of year 1). APR of 6% with semi-annual compounding b) $5,200 for 16 years with the first payment 2 years from today. APR of 7% with annual compounding c) $4,400 at the end of each for 17 years with the first payment one year from today (end of year 1). APR of 5% with monthly compoundingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College