Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't use hand raiting

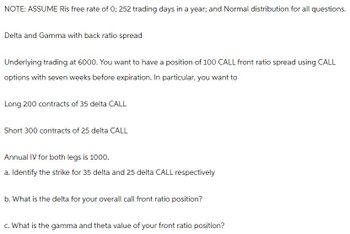

Transcribed Image Text:NOTE: ASSUME Ris free rate of 0; 252 trading days in a year; and Normal distribution for all questions.

Delta and Gamma with back ratio spread

Underlying trading at 6000. You want to have a position of 100 CALL front ratio spread using CALL

options with seven weeks before expiration. In particular, you want to

Long 200 contracts of 35 delta CALL

Short 300 contracts of 25 delta CALL

Annual IV for both legs is 1000.

a. Identify the strike for 35 delta and 25 delta CALL respectively

b. What is the delta for your overall call front ratio position?

c. What is the gamma and theta value of your front ratio position?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following parameters are provided:S = $40, K= $45, r = 5% (continuously compounded), Time to maturity = 6 months, p = $6, Using put-call parity, the price of the call is $1.92 $2.11 $2.47 $2.78arrow_forwardPrice a 3 month call using a one step binomial tree where the risk free rate is 1.00%. Where S0 is $50, the strike price is 52 and it can increase or decrease by 10% with equal probability.arrow_forwardCalculate yields on 3-month T-bills for each of the prices in the following table and enter your the T-bills have a maturity value (M) of $1,000. (Note: Be sure to use a negative sign if the Price (PB) of a 3-Month T-Bill with 90 Days Left to Maturity 1,005.00 1,000.00 995.00 990.00 987.50 Yield 0% 2% % 00 Its rounded to the rest percent. Assume that d is negative. Based on the data from the previous table, use the black points (cross symbol) to plot the relationship between T-bill prices and their yields on the following graph. Be sure to plot from left to right. Line segments will automatically connect the points.arrow_forward

- Assume that Epping Co. expects to receive S$500,000 in one year. Epping created a probability distribution for the future spot rate in one year as follows: Future Spot Rate $.68 Probability 20% 62 50 30 61 Assume that one-year put options on Singapore dollars premium of $.04 per unit. One-year call options on Singapore dollars are available with an exercise price of S.60 and a premium of $.03 per unit. a are available, with an exercise price of $0.63 and Use the appropriate options hedge to determine whether the firm would exercise the option using each of the three different spot rates i.e. what would the firm do if each spot rate existed at the time it is considering exercising the option (assume the option is about to expire). Then, show the total amount of receivables (in US dollars) based on the appropriate strategy that would be implemented for each of the three spot rates. Indicate whether the amount would be a maximum or a minimum or neither.arrow_forwardAssume the following: LC Exposure = 10,000; Spot Rate = $1.00/LC1.00; 1 Year Forward = $0.98/LC1.00; 1 Year Strike Price = $0.975; Premium = $0.005; and WACC = 8.0% p.a. Please calculate the cost of the forward contract and the option.arrow_forwardAssume that the strike price is $100. The time to maturity T is 2 months. Risk free rate is 0.1, U=1.21, D=0.82 price the European and American binary calls if the spot price differs from the strike price by 0.01 using the 2 step binomial tree. Use monthly compounding.arrow_forward

- 1. Given an American call option and knowing that S(0) = 19$, X = 20$, r = 10%, T- 5 months, CE = 1.50$, find the interval in which PA can be. =arrow_forwardHi expert please give me answer general accountingarrow_forwardThe 1-year spot rate is 8%p.a. effective. The term structure of 1-year effective forwardratesisasfollows: attimet=1therateis7%,attimet=2therate is 6%, at time t = 3 the rate is 5%. (a) Determine the term structure of spot rates. (b) A fixed income security pays £10 annual coupons and it is redeemed after 4 years for £100. Compute its price at time t = 0.arrow_forward

- a. Calculate the intrinsic value for each of the following call options. (Round your answers to 2 decimal places.) Company RJay RJay Sell-Mart Xenon Time to Expiration (months) RJay RJay Sell-Mart Xenon 1 2 Time to Company Expiration (months) 5 6 LO Strike 1 2 5 6 60 70 60 7.50 b. Now assume that the effective annual interest rate is 7.18%, which corresponds to a monthly interest rate of 0.58%. Calculate the present value of each call option's exercise price and the adjusted intrinsic value for each call option. (Round your answers to 2 decimal places.) Strike SO 60 70 60 7.50 62.77 62.57 67.80 6.48 Intrinsic Value SO 62.77 62.57 67.80 6.48 PV(X) Adjusted Intrinsic Valuearrow_forwardSubject: physicsarrow_forwardCalculate the Forward Price of an asset with the following data points: • Current Spot Price: $58.75 • Risk Free Rate: 2.0% • Contract Length: 3 months • Known Income (1): $5.00 • Average Yield (q): 0.0% • Delivery Price (K): $60 Round to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education