EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

A company has a dividend payout ratio of 40% and a net income of 250000 what amount is paid out as dividends? General finance

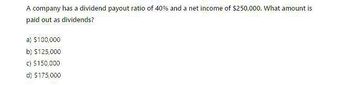

Transcribed Image Text:A company has a dividend payout ratio of 40% and a net income of $250,000. What amount is

paid out as dividends?

a) $100,000

b) $125,000

c) $150,000

d) $175,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardA company has a dividend payout ratio of 40% and a net income of $250,000. What amount is paid out as dividends? a) $100,000 b) $125,000 c) $150,000 d) $175,000arrow_forward

- Calculate (a) interest expense, (b) taxable income, and (c) earnings per share if: DFL = 1.56, EBIT = $702,000; tax rate = 25%, common stock outstanding = 100,000 shares. Show work.arrow_forwardA firm paid 60% of net income out in dividends. Its dividend payout ratio was 60%. The dividend per share was $1.20. If the firm had 70,000 shares of common stock outstanding, what was its net income? O $35,000 O $280,000 O $70,000 O $105,000 O $140,000arrow_forwardGeneral accountingarrow_forward

- What is the net asset value of an investment company with $9,500,000 in assets, $610,000 in current liabilities, and 1,110,000 shares outstanding? Round your answer to the nearest cent. $ per sharearrow_forwardA firm with sales of $500,000, net profits after taxes of $20,000, total liabilities of $200,000, and stockholders’ equity of $100,000 will have a return on equity of Select one: a. 5% b. 40% c. 20% d. 10%arrow_forwardIf a firm has the following sources of finance, Current liabilities $ 90,000 Long-term debt 380,000 Preferred stock 75,000 Common stock 240,000 earns a profit of $50,000 after taxes, and pays $8,000 in preferred stock dividends, what is the return on assets, the return on total equity, and the return on common equity? Round your answers to two decimal places. Return on assets: % Return on total equity: % Return on common equity: %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning