Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

MND

Transcribed Image Text:$

SA

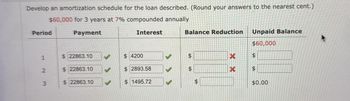

Develop an amortization schedule for the loan described. (Round your answers to the nearest cent.)

$60,000 for 3 years at 7% compounded annually

Period

Payment

Interest

Balance Reduction

Unpaid Balance

$60,000

1 2 3

$22863.10

$ 22863.10

$ 22863.10

$ 4200

$ 2893.58

$ 1495.72

$

$

$

XX

$

SA

$0.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- fill this out pleasearrow_forwardDevelop an amortization schedule for the loan described. (Round your answers to the nearest cent.) $200,000 for 3 years at 9% compounded annually Period Payment Interest Balance Reduction Unpaid Balance $200,000 $ 200,000 $1500 $ 195,140.05X 2 $ 200,000 $ 1500 3. $ 200,000 $0.00arrow_forwardDevelop an amortization schedule for the loan described. (Round your answers to the nearest cent.) $40,000 for 1 year at 12% compounded quarterly Period Payment Interest Balance Reduction Unpaid Balance $40,000 1 $ $ $ $ 2 $ $ $ $ 3 $ $ $ $ 4 $ $ $ $0.00arrow_forward

- Consider a loan of $8,000 charging interest at j12-6% with monthly payments of $321.50 Calculate the missing amounts in the amortization table. Place the value for A in the first answer box, B in the second and C in the third. PMT Interest Principall Balance 8,000.00 1321.50 40.00 281.50 7,718.50 2 321.50 A Carrow_forwardquestion on the picarrow_forwardTake a look at the chart pls..arrow_forward

- urgent pleasearrow_forwardConstruct an amortization schedule for a $1,000, 3.9% annual rate loan with 3 equal payments. The first payment will be made at the end of the 1st year. Find the required annual payments Selected Answer: $356.9 Answers: $356.9 $359.7 $367.2 $370.5 what’s the ending balance of the amortized loan at the end of the first year? Selected Answer: $678.1 Answers: $650.2 $669.1 $678.1 $679.3arrow_forwardfill the payment necessary to amortize the loan $10,500, 12% compound monthly , 48 monthly payment Answer : 276.50arrow_forward

- Fl in an amortization table (in dollars) for a loan of $8,500 to be paid back over 2 years, at an annual interest rate of 1.3, compounded quarterly. For eech value in the table, round your answer to the nearest cent and use this value to calculate the next value. Payment number Payment amount Payment amount to interest Payment amount to debt Outstanding principal S0.500 13 14arrow_forwardOn a loan of $1400, interest at 9% effective must be paid at the end of each year. The borrower also deposits $X at the beginning of each year into a sinking fund earning 4.7% effective. At the end of 10 years the sinking fund is exactly sufficient to pay off the loan. Calculate X. A. $ 1617.11 B. $ 1078.07 C. $ 1347.59 D. $ 1724.92 E. $ 1232.09arrow_forwardAssessment I. Construct an amortization table for a loan of PHP1000 to be paid in 4 annual payments at 10% annual effective interest rate. Complete the table below. Periodic Starting Balance Payment Principal Remaining Balance Period Interest 1. 1,000 100.00 784.53 2 784.53 315.47 237.02 315.47 54.75 286.79 4 286.79 315.47 0.00 3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education