Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

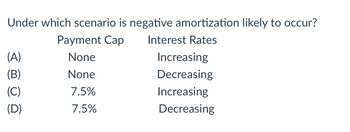

Transcribed Image Text:Under which scenario is negative amortization likely to occur?

Payment Cap

Interest Rates

(A)

None

Increasing

None

Decreasing

7.5%

Increasing

7.5%

Decreasing

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Q)5) One standard assumption for annuities and gradients is A) each payment occurs at the beginning of the period. B) annuities and gradients coincide with the beginning of sequential periods. C) annuities and gradients coincide with the end of preceding periods. D) payment period and compounding period differ. E) payment period and compounding period are the same. and why? Choose correct option with explanation.arrow_forwardTo account for a down payment, adjust the _____ of the loan by subtracting it from the loan amount. O present value (pv) future value (fv) rate O typearrow_forwardWhich of the following break-even analyses yields a negative net present value? I. accounting break-even II. cash break-even III. financial break-even O a. I only O b. ll only О с. Ill only O d. I and II only e. II and III onlyarrow_forward

- 5) One standard assumption for annuities and gradients is A) each payment occurs at the beginning of the period. B) annuities and gradients coincide with the beginning of sequential periods. C) annuities and gradients coincide with the end of preceding periods. D) payment period and compounding period differ. E) payment period and compounding period are the same. and why? Solve it early and give explanation.arrow_forwardLowering the discount rate on a cash flow will its present value. A. decrease, then increase O B. increase, then decrease O C. decrease D. increasearrow_forwardExplain Payment Caps and Negative Amortization?arrow_forward

- An increase in the discount rate will______ O a. Reduce the present value of future cash flows O b. Increase the present value of future cash flows c.Have no effect on net present value Od. Compensate for reduced riskarrow_forward[Question 6 Which one of the followingsituations will decrease the cash cycle as all elseheld constant?Select one:rateA. Decreasing the accounts payable periodB. Increasing the accounts receivable turnoverC. Increasing the inventory periodD. Decreasing the inventory turnover ratearrow_forward3- Explain briefly demerits of Pay Back Period. One of the demerits of the pay back period method is that it does not consider time value money. Explain with example how discounted pay back period method could sort this shortcoming?arrow_forward

- Which of the following is not a factor in explaining why the present value of a future dollar is less than one dollar?A. InterestB. Inflation C. Risk of failure to receive expected cash inflows D. Historic costarrow_forwardAn increase in the discount rate will____ a. Reduce the present value of future cash flows b. Increase the present value of future cash flows c. Have no effect on net present value d. Compensate for reduced riskarrow_forwardplease avoid solutions in image thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage