EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Need Answer Please Providr

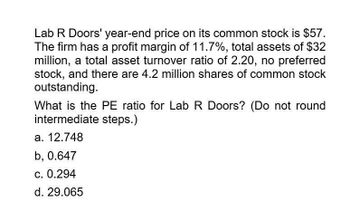

Transcribed Image Text:Lab R Doors' year-end price on its common stock is $57.

The firm has a profit margin of 11.7%, total assets of $32

million, a total asset turnover ratio of 2.20, no preferred

stock, and there are 4.2 million shares of common stock

outstanding.

What is the PE ratio for Lab R Doors? (Do not round

intermediate steps.)

a. 12.748

b, 0.647

c. 0.294

d. 29.065

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardGive me helparrow_forwardLeonatti Labs’ year-end price on its common stock is $22. The firm has a profit margin of 12 percent, total assets of $35 million, a total asset turnover of 0.60, no preferred stock, and 2 million shares of common stock outstanding. Calculate the PE ratio for Leonatti Labs. (Do not round intermediate calculations. Round your answer to 2 decimal places.) PE ration = _____.__ timesarrow_forward

- Please given correct answer don't use ai...arrow_forwardFancy Paws' year-end price on its common stock is $20. The firm has a profit margin of 12 percent, total assets of $20 million, a total asset turnover ratio of 0.5, no preferred stock, and there are 2 million shares of common stock outstanding. What is the PE ratio for Fancy Paws?arrow_forwardOn the balance sheet of Bearcat Inc., you notice "Common Stock ($0.10 par)" of $248,655, "Capital Surplus" of $282,621, and "Retained Earnings" of $210,534. If Bearcat Inc. has Sales of $292,6836 and a profit margin of 30.52%, what is the price/earnings (P/E) ratio of the firm if their stock is currently selling for $21.94 per share? O None of these options are correct 67.18 54.97 240.97 61.07 DISCLarrow_forward

- (Market value analysis)The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per sharetimestotal shares outstanding) of $ 1,369,000. Furthermore, the firm's income statement for the year just ended has a net income of $ 505,000, which is $ 0.243 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 18.55. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? Question content area bottom Part 1 a.What price would you expect Underwood Motors shares to sell for? The market price per share is $4.51.(Round to the nearest cent.) Part 2 b.What is the book value per share for Underwood's shares? The book value per share is $ ??? enter your response here. (Round to the nearest cent.)arrow_forward(Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share x total shares outstanding) of $1,391,000. Furthermore, the firm's income statement for the year just ended has a net income of $505,000, which is $0.232 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 20.54. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is $ (Round to the nearest cent.)arrow_forwardjPhone, Inc., has an equity multiplier of 1.42, total asset turnover of 1.71, and a profit margin of 9 percent. What is the company's ROE? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ROE %arrow_forward

- (Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share x total shares outstanding) of $1,314,000. Furthermore, the firm's income statement for the year just ended has a net income of $578,000, which is $0.264 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 21.81. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is $ (Round to the nearest cent.) C...arrow_forward(Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share total shares outstanding) of $1,367,000. Furthermore, the firm's income statement for the year just ended has a net income of $513,000, which is $0.276 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 19.86. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is $. (Round to the nearest cent.)arrow_forwardjPhone, Inc., has an equity multiplier of 1.35, total asset turnover of 1.63, and a profit margin of 7 percent. What is the company's ROE? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning