CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

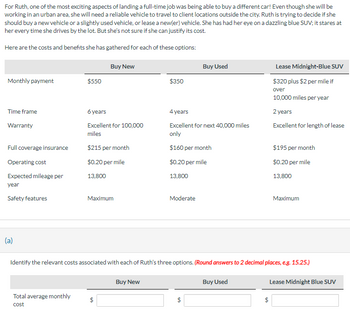

Transcribed Image Text:For Ruth, one of the most exciting aspects of landing a full-time job was being able to buy a different car! Even though she will be

working in an urban area, she will need a reliable vehicle to travel to client locations outside the city. Ruth is trying to decide if she

should buy a new vehicle or a slightly used vehicle, or lease a new(er) vehicle. She has had her eye on a dazzling blue SUV; it stares at

her every time she drives by the lot. But she's not sure if she can justify its cost.

Here are the costs and benefits she has gathered for each of these options:

Buy New

Buy Used

Lease Midnight-Blue SUV

Monthly payment

$550

$350

$320 plus $2 per mile if

over

10,000 miles per year

Time frame

6 years

4 years

2 years

Warranty

Excellent for 100,000

miles

Excellent for next 40,000 miles

Excellent for length of lease

only

Full coverage insurance

$215 per month

$160 per month

Operating cost

$0.20 per mile

$0.20 per mile

Expected mileage per

13,800

13,800

$195 per month

$0.20 per mile

13,800

year

Safety features

Maximum

Moderate

Maximum

(a)

Identify the relevant costs associated with each of Ruth's three options. (Round answers to 2 decimal places, e.g. 15.25.)

Buy New

Buy Used

Lease Midnight Blue SUV

Total average monthly

cost

+A

+A

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For Lisa, one of the most exciting aspects of landing a full-time job was being able to buy a different car! Even though she will be working in an urban area, she will need a reliable vehicle to travel to client locations outside the city. Lisa is trying to decide if she should buy a new vehicle or a slightly used vehicle, or lease a new(er) vehicle. She has had her eye on a dazzling blue SUV; it stares at her every time she drives by the lot. But she's not sure if she can justify its cost. Here are the costs and benefits she has gathered for each of these options: Monthly payment Time frame Warranty Full coverage insurance Operating cost Expected mileage per year Safety features $490 Buy New 6 years Excellent for 100,000 miles $190 per month $0.20 per mile 13,200 Maximum $380 Buy Used 4 years Excellent for next 40,000 miles only $160 per month $0.20 per mile 13,200 Moderate Lease Midnight-Blue SUV $300 plus $2 per mile if over 10,000 miles per year 2 years Excellent for length of…arrow_forwardFor Michelle, one of the most exciting aspects of landing a full-time job was being able to buy a different car! Even though she will be working in an urban area, she will need a reliable vehicle to travel to client locations outside the city. Michelle is trying to decide if she should buy a new vehicle or a slightly used vehicle, or lease a new(er) vehicle. She has had her eye on a dazzling blue SUV; it stares at her every time she drives by the lot. But she's not sure if she can justify its cost. Here are the costs and benefits she has gathered for each of these options: Monthly payment Time frame Warranty Full coverage insurance Operating cost Expected mileage per year Safety features $470 Buy New 6 years Excellent for 100,000 miles $210 per month $0.20 per mile 13,500 Maximum $330 Buy Used 4 years Excellent for next 40,000 miles only $160 per month $0.20 per mile 13,500 Moderate Lease Midnight-Blue SUV $280 plus $2 per mile if over 10,000 miles per year 2 years Excellent for length…arrow_forwardFor Sarah, one of the most exciting aspects of landing a full-time job was being able to buy a different car! Even though she will be working in an urban area, she will need a reliable vehicle to travel to client locations outside the city. Sarah is trying to decide if she should buy a new vehicle or a slightly used vehicle, or lease a new(er) vehicle. She has had her eye on a dazzling blue SUV; it stares at her every time she drives by the lot. But she's not sure if she can justify its cost. Here are the costs and benefits she has gathered for each of these options: Monthly payment Time frame Warranty Full coverage insurance Operating cost Expected mileage per year Safety features $520 6 years Excellent for 100,000 miles $195 per month $0.20 per mile 13,500 Buy New Maximum * Your answer is incorrect. Total average monthly cost $ Buy New $320 940 4 years Excellent for next 40,000 miles only $150 per month $0.20 per mile 13.500 Moderate Buy Used Identify the relevant costs associated…arrow_forward

- For Patricia, one of the most exciting aspects of landing a full-time job was being able to buy a different car! Even though she will be working in an urban area, she will need a reliable vehicle to travel to client locations outside the city. Patricia is trying to decide if she should buy a new vehicle or a slightly used vehicle, or lease a new(er) vehicle. She has had her eye on a dazzling blue SUV; it stares at her every time she drives by the lot. But she's not sure if she can justify its cost. Here are the costs and benefits she has gathered for each of these options: Monthly payment Time frame Warranty Full coverage insurance Operating cost Expected mileage per year Safety features $520 Total average $ monthly cost 6 years Excellent for 100,000 miles $195 per month $0.20 per mile 17,100 Buy New Maximum Buy New $370 $ Buy Used 4 years Excellent for next 40,000 miles only $155 per month $0.20 per mile 17,100 Moderate Buy Used Lease Midnight-Blue SUV $280 plus $2 per mile if over…arrow_forwardFor Maria, one of the most exciting aspects of landing a full-time job was being able to buy a different car! Even though she will be working in an urban area, she will need a reliable vehicle to travel to client locations outside the city. Maria is trying to decide if she should buy a new vehicle or a slightly used vehicle, or lease a new(er) vehicle. She has had her eye on a dazzling blue SUV; it stares at her every time she drives by the lot. But she's not sure if she can justify its cost. Here are the costs and benefits she has gathered for each of these options: Monthly payment Time frame Warranty Full coverage insurance Operating cost Expected mileage per year Safety features $510 Buy New 6 years Excellent for 100,000 miles $210 per month $0.20 per mile 13,800 Maximum $370 4 years Excellent for next 40,000 miles only $145 per month $0.20 per mile 13,800 Buy Used Moderate Lease Midnight-Blue SUV $290 plus $2 per mile if over 10,000 miles per year 2 years Excellent for length of…arrow_forwardGodoarrow_forward

- Hanshabenarrow_forwardDogarrow_forwardMs. Faye Santos is an accounting major at a Midwestern state university located approximately 60 miles from a major city. Ms. Faye Santos is an accounting major at a Midwestern state university located approximately 60 miles from a major city. Many of the students attending the university are from the metropolitan areas and visit their homes regularly on the weekends. Faye, an entrepreneur at heart, realizes that few good commuting alternatives are available for students doing weekend travel. She believes that a weekend commuting service could be organized and run profitably from several suburban and downtown shopping mall locations. Faye has gathered the following investment information. Five used vans would cost a total of $75,000 to purchase and would have a three-year useful life with negligible salvage value. Faye plans to use straight-line depreciation. Ten drivers would have to be employed at a total payroll expense of $48,000. 3. Other annual out-of-pocket expenses…arrow_forward

- Lon Timur is an accounting major at a midwestern state university located approximately 60 miles from a major city. Many of the students attending the university are from the metropolitan area and visit their homes regularly on the weekends. Lon, an entrepreneur at heart, realizes that few good commuting alternatives are available for students doing weekend travel. He believes that a weekend commuting service could be organized and run profitably from several suburban and downtown shopping mall locations. Lon has gathered the following investment information. 1. 2. 3. 4. 5. Five used vans would cost a total of $75,000 to purchase and would have a 3-year useful life with negligible salvage value. Lon plans to use straight-line depreciation. Ten drivers would have to be employed at a total payroll expense of $48,000. Other annual out-of-pocket expenses associated with running the commuter service would include Gasoline $16,000, Maintenance $3,300, Repairs $4,000, Insurance $4,200, and…arrow_forwardLon Timur is an accounting major at a midwestern state university located approximately 60 miles from a major city. Many of the students attending the university are from the metropolitan area and visit their homes regularly on the weekends. Lon, an entrepreneur at heart, realizes that few good commuting alternatives are available for students doing weekend travel. He believes that a weekend commuting service could be organized and run profitably from several suburban and downtown shopping mall locations. Lon has gathered the following investment information. 1. Five used vans would cost a total of $75,551 to purchase and would have a 3-year useful life with negligible salvage value. Lon plans to use straight-line depreciation. 2. Ten drivers would have to be employed at a total payroll expense of $48,300. 3. Other annual out-of-pocket expenses associated with running the commuter service would include Gasoline $16,200, Maintenance $3,300, Repairs $3,800, Insurance…arrow_forwardHh.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning