FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

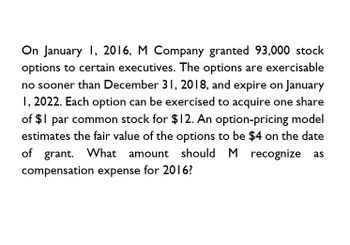

Transcribed Image Text:On January 1, 2016, M Company granted 93,000 stock

options to certain executives. The options are exercisable

no sooner than December 31, 2018, and expire on January

1, 2022. Each option can be exercised to acquire one share

of $1 par common stock for $12. An option-pricing model

estimates the fair value of the options to be $4 on the date

of grant. What amount should M recognize as

compensation expense for 2016?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2024, Sherwood Company granted 97,000 stock options to certain executives. The options are exercisable no sooner than December 31, 2026, and expire on January 1, 2030. Each option can be exercised to acquire one share of $1 par common stock for $8. An option-pricing model estimates the fair value of the options to be $3 on the date of grant. If unexpected turnover in 2025 caused the company to estimate that 15% of the options would be forfeited, what amount should Sherwood recognize as compensation expense for 2025?arrow_forwardWhat amount should stellar corp recognize as compensation expense for 2020 on these general accounting question?arrow_forwardOn January 1, 2021, M Company granted 90,000 stock options to certain executives. The options are exercisable no sooner than December 31, 2023, and expire on January 1, 2027. Each option can be exercised to acquire one share of $1 par common stock for $12. An option-pricing model estimates the fair value of the options to be $5 on the date of grant. If unexpected turnover in 2022 caused the company to estimate that 10% of the options would be forfeited, what amount should M recognize as compensation expense for 2022? O $30,000. O $60,000. O $120,000. O $150,000.arrow_forward

- Fortune Brands granted options on January 1, 2024, that allows the recipient to purchase 15.0 million of the company's $1 par common shares within the next eight years, but not before December 31, 2026 (the vesting date). The exercise price is the market price of the shares on the date of grant, $17 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. No forfeitures are anticipated. Ignoring taxes, what is the effect on earnings in the year after the options are granted to executives? Note: Round your answer to 1 decimal place. Multiple Choice O $60.0 million $90.0 million $0 $20.0 millionarrow_forwardOn January 1, 2024, Donnelly Company granted 97,000 stock options to certain executives. The options are exercisable no sooner than December 31, 2026, and expire on January 1, 2030. Each option can be exercised to acquire one share of $1 par common stock for $9. An option-pricing model estimates the fair value of the options to be $3 on the date of grant. What amount should Donnelly recognize as compensation expense for 2024? Note: Round your answer to the nearest dollar amount.arrow_forwardOn January 1, 2021, M Company granted 95,000 stock options to certain executives. The options are exercisable no sooner than December 31, 2023, and expire on January 1, 2027. Each option can be exercised to acquire one share of $1 par common stock for $13. An option-pricing model estimates the fair value of the options to be $4 on the date of grant. What amount should M recognize as compensation expense for 2021? (Round your answer to the nearest dollar amount.)arrow_forward

- Johnstone Co. purchased a put option on Ewing common shares on July 7, 2020, for $240. The put option is for 200 shares, and the strike price is $70. (The market price of a share of Ewing stock on that date is $70.) The option expires on January 31, 2021. The following data are available with respect to the put option. Date Market Price of Ewing Shares Time Value of Put Option September 30, 2020 $77 per share $125 December 31, 2020 75 per share 50 January 31, 2021 78 per share 0 Instructions Prepare the journal entries for Johnstone Co. for the following dates. a. July 7, 2020—Investment in put option on Ewing shares. b. September 30, 2020—Johnstone prepares financial statements. c. December 31, 2020—Johnstone prepares financial statements. d. January 31, 2021—Put option expires.arrow_forwardPlease Do not Give image formatarrow_forwardOn January 1, 2022, Rosewood Corp. purchased a put option on shares of ICM stock. Terms of the contract were as follows: Number of shares: 100 Strike price: $200 per share Expiration date: May 31, 2022 Total cost of the option contract: $80 Seller of the option contract: First Investment Bank On January 1, 2022, ICM stock was trading at $200 per share. The following additional information is known: On March 31, 2022, the price of ICM stock was $220 per share. A market appraisal indicated that the time value of the option contract was $60. On May 10, 2022, the price of ICM stock was $185 per share. A market appraisal indicated that the time value of the option contract was $50. On this date, Rosewood settled the option contract. What is the dollar value of put option that Rosewood Corp. would have included in its March 2022 quarterly financial statements?arrow_forward

- On January 1, 2022, Rosewood Corp. purchased a put option on shares of ICM stock. Terms of the contract were as follows: Number of shares: 100 Strike price: $200 per share Expiration date: May 31, 2022 Total cost of the option contract: $80 Seller of the option contract: First Investment Bank On January 1, 2022, ICM stock was trading at $200 per share.The following additional information is known: On March 31, 2022, the price of ICM stock was $220 per share. A market appraisal indicated that the time value of the option contract was $60. On May 10, 2022, the price of ICM stock was $185 per share. A market appraisal indicated that the time value of the option contract was $50. On this date, Rosewood settled the option contract. What is the dollar value of put option that Rosewood Corp. would have included in its March 2022 quarterly financial statements?arrow_forwardPlease help and show formulaarrow_forwardUnder its executive stock option plan, Mining Co. granted options on January 1, 2021, that permit executives to purchase 15 million of the company's $1 par common shares within the next eight years, but not before December 31, 2023 (the vesting date). The exercise price is the market price of the shares on the date of grant, $22 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. No forfeitures are anticipated. The options are exercised on April 2, 2024, when the market price is $21 per share. By what amount will the shareholders' equity increase when 100% of those options are exercised? O $60 million $270 million O $315 million. O $330 millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education