Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

If you give me wrong answer, I will give you UN helpful rate.

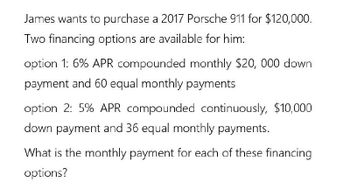

Transcribed Image Text:James wants to purchase a 2017 Porsche 911 for $120,000.

Two financing options are available for him:

option 1: 6% APR compounded monthly $20, 000 down

payment and 60 equal monthly payments

option 2: 5% APR compounded continuously, $10,000

down payment and 36 equal monthly payments.

What is the monthly payment for each of these financing

options?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- If I buy a truck at17,000 and plan to finance my purchase with a loan and repay over two years. The dealer offer two options either dealer financing with 0% or a 1700 rebate on the purchase price. If I take the rebate I will get a loan for $15,300 at an apr of 5.5%. What will my monthly payments be if I take the rebatearrow_forwardSuppose that you decide to borrow 13000 for a new car. You can select one of the following loans each requiring regular monthly payments. Installment loan A three-year loan at 5.9% Installment loan B five -year loan at 5.8% What would be the monthly payments for each loan and total interest for them also?arrow_forwardExplain well with proper answer. And type the answer.arrow_forward

- Answer each of the following. 1. Lisha Yvette is going to purchase a home theather system with a purchase price of P118,000.00. She has P24,000.00 to pay as a down payment. She is going to finance the home theatre system monthly for 2 years at an 8% interest rate. What is the Amount Financed? a. b. What is the monthly payment amount?arrow_forwardAsher wants to buy a car that costs $29,660. He qualifies for a 4-year loan at a 2.8% annual interest rate, and he can afford a $500 monthly payment. What minimum down payment must Asher make to keep his monthly payment at or below $500? Round your answer to the nearest dollar. $6,980 $20,325 $22,680 $9,336arrow_forwardChuck Wells is planning to buy a Winnebago motor home. The listed price is $145,000. Chuck can get a secured add-on interest loan from his bank at 7.45% for as long as 60 months if he pays 15% down. Chuck's goal is to keep his payments below $3,400 per month and amortize the loan in 42 months. (a) Find Chuck's monthly payment (in $) with these conditions. (Round your answer to the nearest cent.) $ Can he pay off the loan and keep his payments under $3,400? Yes, under these conditions, Chuck will meet his goal.No, the monthly payment is too high. (b) What are Chuck's options to get his payments closer to his goal? (Select all that apply.) try to bargain for a lower sale price make a higher down payment make a lower down payment try to bargain for a higher sale price try to negotiate a higher interest rate try to negotiate a lower interest rate (c) Chuck spoke with his bank's loan officer, who has agreed to finance the deal with a 6.85% loan if Chuck can pay 20% down.…arrow_forward

- I need help solving this on excel 9.You a buying a home for $425,000 and would like to determine the monthly mortgage payment. You can obtain a $340,000 30-year fixed-rate mortgage at 3.5%. What is your monthly payment?arrow_forwardSuppose that you decide to borrow 16000 for a new car. You can select one of the following loans each requiring regular monthly payments. Installment loan A three-year loan at 6.3% Installment loan B five -year loan at 6.4% What would be the monthly payments for each loan and total interest for them also? How much will the buyer save in interest?arrow_forwardKelly Robins is considering purchasing a usedautomobile. The price including the title and taxes is$15,455. Kelly is able to make a $2,455 down payment. The balance of $13,000 will be borrowed fromher credit union at an interest rate of 9.45% compounded daily. The loan should be paid in 36 equalmonthly payments. Compute the monthly payment.What is the total amount of interest Kelly has to payover the life of the loan?arrow_forward

- After starting your full-time job out of college, you decide to buy a new car for $85,000. Create a complete amortization table in excel for this car loan: You make 84 equal end-of-month payments. The discount rate is 6.5 percent compounded quarterly. How much would you owe after the 75 th payment? Please show both regualr and formula format of the spreadsheet.arrow_forwardTim smith is shopping for a used luxury car. He has found one priced at $27,000. The dealer has told Tim that if he can come up with a down payment of $4,800, the dealer will finance the balance of the price at a 8% annual rate over 3 years (36 months). Assuming that tim accepts the dealer's offer, what will his monthly ( end of month) payment amount be? What will Tim's monthly payment be if the dealer were willing ot finance the balance of the car price at an annual rate of 3.1%?arrow_forwardSuppose Mary Grace needs to borrow $8,900 for the purchase of a car and is considering two loan options. Loan A is a four-year loan at 7.6% interest while loan B is a seven-year loan at 7.9% interest.Determine the monthly payment required to repay Loan A and the total interest paid over the life of Loan A. Round solutions to the nearest cent, if necessary.The monthly payment for Loan A is $ .The total interest paid for Loan A is $ .Determine the monthly payment required to repay Loan B and the total interest paid over the life of Loan B. Round solutions to the nearest cent, if necessary.The monthly payment for Loan B is $ .The total interest paid for Loan B is $ .Determine the lower-cost option of the two loans. Loan A is the lower-cost option. Loan B is the lower cost option. Determine the amount of savings Mary Grace will experience if she chooses the lower-cost loan option.Savings = $ Hint: Related FormulaThe loan payment formula for fixed installment loans is given by the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning