EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Want answer with Explanation

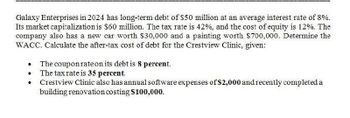

Transcribed Image Text:Galaxy Enterprises in 2024 has long-term debt of $50 million at an average interest rate of 8%.

Its market capitalization is $60 million. The tax rate is 42%, and the cost of equity is 12%. The

company also has a new car worth $30,000 and a painting worth $700,000. Determine the

WACC. Calculate the after-tax cost of debt for the Crestview Clinic, given:

•

The coupon rate on its debt is 8 percent.

• The tax rate is 35 percent.

•

Crestview Clinic also has annual software expenses of $2,000 and recently completed a

building renovation costing $100,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Digital Organics (DO) has the opportunity to invest $1.06 million now (t = 0) and expects after-tax returns of $660,000 in t = 1 and $760,000 in t= 2. The project will last for two years only. The appropriate cost of capital is 13% with all-equity financing, the borrowing rate is 9%, and DO will borrow $360,000 against the project. This debt must be repaid in two equal installments of $180,000 each. Assume debt tax shields have a net value of $0.40 per dollar of interest paid. Calculate the project's APV. (Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole number.) Adjusted present valuearrow_forwardABC Industries is considering a 3-year project that will cost $200 today followed by free cash flows to firm of $100 in year 1, $80 in year 2, and $160 in year 3. ABC has $1000 of assets with a debt ratio of 40.00%. ABC's before-tax cost of debt is 7.00% and its cost of equity is 12.00%. Suppose ABC pays a fee of$6 to the investment bankers who help them to raise the $120 Debt capital. Assuming the tax rate is 35.00% and that the flotation cost can be amortized (i.e. deducted) for tax purposes over the 3 year life of the project. The NPV of the project using the APV method, taking into account the flotation costs, is closest to: $8.40 $11.34 $10.66 $7.72arrow_forwardYour firm is considering two one-year loan options for a $506,000 loan. The first carries fees of 2.4% of the loan amount and charges interest of 3.6% of the loan amount. The other carries fees of 1.8% of the loan amount and charges interest of 4.7% of the loan amount. a. What is the net amount of funds from each loan? b. Based on the net amount of funds, what is the true interest rate of each loan?arrow_forward

- Jolly Banker is calculating the loan price for a $500,000 operating loan to Kelly business. If approved, this loan will be funded with 35% equity capital, and the remaining funds will come from the bank's debt capital. You have the following information about your bank’s outlays: Administrative costs 0.45% Cost of debt 7.00% Cost of equity 5.00% Probability of loss 0.55% Fees paid by the borrower 1.00% Calculate the weighted average cost of debt for this funding request. (Enter your answer in percentage. Round your answer to 2 decimal places)arrow_forwardYou want to purchase an office building in Brooklyn that is expected to generate $475554 net operating income (NOI) in the following year. You decide you want to take out a loan to finance the purchase of this property. It will be an IO loan at a rate of 6.82%, compounded annually, with annual payments. The lender will provide financing up to a minimum Debt Service Coverage Ratio (DSCR) of 1.2 based off the next year's NOI. What is the largest loan amount the lender will allow you to take based on the DSCR requirement? State your answer as a number rounded to the nearest cent (e.g. if you get $13.57654, write 13.58)arrow_forwardKohwe Corporation plans to issue equity to raise $50.7 million to finance a new investment. After making the investment, Kohwe expects to earn free cash flows of $10.4 million each year. Kohwe's only asset is this investment opportunity. Suppose the appropriate discount rate for Kohwe's future free cash flows is 7.7%, and the only capital market imperfections are corporate taxes and financial distress costs. a. What is the NPV of Kohwe's investment? b. What is the value of Kohwe if it finances the investment with equity? a. What is the NPV of Kohwe's investment? The NPV of Kohwe's investment is $ million. (Round to two decimal places.) b. What is the value of Kohwe if it finances the investment with equity? The Kohwe finances stment with equity $ million. (Round decimal places.)arrow_forward

- An investor owns a property that produces an NOI of $110,000 and has an annual debt service of $70,000 and the forecast of cost recovery and interest deductions are $38,427 and $58,593 respectively. The investor’s marginal tax rate is 35 percent. The investor’s projected cash flow after taxes is: A. $30,000 B. $35,457 C. $43,256 D. $25,821arrow_forward(Ignore income taxes in this problem.) Your Company is considering an investment proposal in which a working capital investment of $45,000 would be required. The investment would provide cash inflows of $5,000 per year for seven years. The company's discount rate is 8%. What is the investment's net present value? a- $4,115 b- $3,530 c- $7,265 d- $5,645arrow_forwardYour firm needs to borrow $1.0 million for one year. The firm has no other short term borrowings and it's combined state and federal tax rate is 25%. Your banker offers several lending alternatives. Which one will you choose? Select one: A)6.50% simple interest with a 20.00% compensating balance b) . 8.25% simple interest c) . 7.00% simple interest with a 15.00% compensating balance d) . 8.25% discount interestarrow_forward

- igital Organics (DO) has the opportunity to invest $1.03 million now (t = 0) and expects after 2. The project will last for two years = - tax returns of $630,000 in t = 1 and $730,000 in t only. The appropriate cost of capital is 11% with all - equity financing, the borrowing rate is 7%, and DO will borrow $330,000 against the project. This debt must be repaid in two equal installments of $165,000 each. Assume debt tax shields have a net value of $0.20 per dollar of interest paid. Calculate the project's APV.arrow_forwardPlease help with B-1 You need to choose between making a public offering and arranging a private placement. In each case, the issue involves $9.2 million face value of 10-year debt. You have the following data for each: A public issue: The interest rate on the debt would be 8.1%, and the debt would be issued at face value. The underwriting spread would be 1.68%, and other expenses would be $72,000. A private placement: The interest rate on the private placement would be 8.7%, but the total issuing expenses would be only $22,000. Required: a-1. Calculate the net proceeds from public issue. a-2. Calculate the net proceeds from private placement. b-1. Calculate the PV of the extra interest on the private placement. b-2. Other things being equal, which is the better deal?arrow_forwardGive both answer correctly. If u don't know correct answer then don't accept it. Otherwise I will give u unhelpful rate. Need step by step accurate answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT