Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Hi expart Provide solution

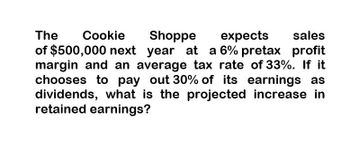

Transcribed Image Text:The

Cookie

Shoppe

expects

sales

of $500,000 next year at a 6% pretax profit

margin and an average tax rate of 33%. If it

chooses to pay out 30% of its earnings as

dividends, what is the projected increase in

retained earnings?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose a firm's tax rate is 25 %. What effect would a $ 11.4 million capital expense have on this year's earnings if the capital expenditure is depreciated at a rate of $ 2.28 million per year for five years? What effect would it have on next year's earnings?arrow_forwardA firm will report annual Net Income of $50 and depreciation expense of $20 forever in the future. With a tax rate of 30%, how much is the present value of all future “tax shields”? Assume r = 4%.arrow_forwardSuppose a firm's tax rate is 25%. a. What effect would a$9.85 million operating expense have on this year's earnings? What effect would it have on next year's earnings? b. What effect would an $8.95million capital expense have on this year's earnings if the capital is depreciated at a rate of $1.79 million per year for five years? What effect would it have on next year's earnings?arrow_forward

- Suppose a firm's tax rate is 35%. a. What effect would a $9.64 million operating expense have on this year's earnings? What effect would it have on next year's earnings? b. What effect would an $8.70 million capital expense have on this year's earnings if the capital is depreciated at a rate of $1.74 million per year for five years? What effect would it have on next year's earnings? a. What effect would a $9.64 million operating expense have on this year's earnings? Earnings would increase (decline) by $ ☐ million. (Round to two decimal places, and use a negative number for a decline.) What effect would it have on next year's earnings? (Select the best choice below.) A. There would be no effect on next year's earnings. B. Next year's earnings will be affected by a decline of $3.37 million. C. Next year's earnings will be affected by an increase of $3.37 million. D. Next year's earnings will be affected by the same amount. b. What effect would an $8.70 million capital expense have on…arrow_forwardSuppose a firm’s tax rate is 25%. 1. What effect would a $9.26 million operating expense have on this year's earnings? What effect would it have on next year's earnings? (Select all the choices thatapply.) A. A $9.26 million operating expense would be immediately expensed, increasing operating expenses by $9.26 million. This would lead to a reduction in taxes of 25%×$9.26 million=$2.32 million. B. A $9.26 million operating expense would be immediately expensed, increasing operating expenses by $9.26 million. This would lead to an increase in taxes of 25%×$9.26 million =$2.32 million. C. Earnings would decline by $9.26 million−$2.32 million=$6.94 million. The same effect would be seen on next year's earnings. D. Earnings would decline by $9.26 million−$2.32 million=$6.94 million. There would be no effect on next year's earnings. 2. What effect would a $11.75 million capital expense have on this year's earnings if the capital expenditure is depreciated at a rate of $2.35 million…arrow_forwardSuppose a firm's tax rate is 25%. 1. What effect would a $10.92 million operating expense have on this year's earnings? What effect would it have on next year's earnings? (Select all the choices that apply.) A. $10.92 million operating expense would be immediately expensed, increasing operating expenses by $10.92 million. This would lead to a reduction in taxes of 25%×$10.92 million=$2.73 million. B. A $10.92 million operating expense would be immediately expensed, increasing operating expenses by $10.92 million. This would lead to an increase in taxes of 25%×$10.92 million=$2.73 million C. Earnings would decline by $10.92 million−$2.73 million=$8.19 million. There would be no effect on next year's earnings. D. Earnings would decline by $10.92 million−$2.73 million=$8.19 million. The same effect would be seen on next year's earnings 2. What effect would a $10.25 million capital expense have on this year's earnings if the capital expenditure is depreciated at a rate of $2.05…arrow_forward

- Suppose you sell a fixed asset for $115,000 when it's book value is $135,000. If your company's marginal tax rate is 21%, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)?arrow_forwardAfter tax cash flows are 100,000 a year for 5 years. There is no terminal value. The payback period occurs exactly at the end of 3 years. Calculate the internal rate of return, net present value, and profitability index. Use an interest rate of 10%.arrow_forwardAn investment will provide after-tax revenue of $22,336 per year for 7 years. What is the present value of this revenue stream assuming a discount rate of 5.25%?arrow_forward

- Hello please help me option for b part are also givenarrow_forwardFor the following cash flow, calculate the equivalent AW. Assume i= 8% per year. Year Incomes Outcomes 4600 1 4600 2 6000 4600 7000 4600 4 8000 4600 9000 10000 Answer: 3.arrow_forwardYou have invested $10,000 in this ETF at the beginning of year 2020 and its year-end value was $13,600. Then what was your estimate of its daily arithmetic mean rate of return for Daily rate of return((=P¡/Po-1) in year 2020 Arithmetic Mean the year 2020? → (1) 0.1231%; (2) 0.1303%; (3) 0.1440%; (4) 0.1473; (5) 0.1512%; 4 |(6) 0.1640%; (7) 0.1682%; Daily standard deviation 1.2% # of trading days 250arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT