Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

??

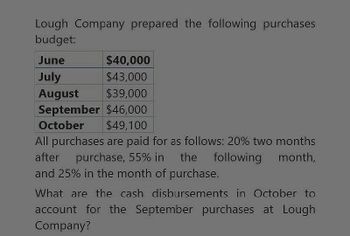

Transcribed Image Text:Lough Company prepared the following purchases

budget:

June

$40,000

July

$43,000

August $39,000

September $46,000

October $49,100

All purchases are paid for as follows: 20% two months

after purchase, 55% in the following month,

and 25% in the month of purchase.

What are the cash disbursements in October to

account for the September purchases at Lough

Company?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Amusement tickets estimated sales are: What are the balances in accounts receivable for April, May, and June if 60% of sales are collected in the month of sale, 30% are collected the month after the sale, and 10% are collected the second month after the sale?arrow_forwardGear Up Co. pays 65% of its purchases in the month of purchase, 30% in the month after the purchase, and 5% in the second month following the purchase. What are the cash payments if it made the following purchases in 2018?arrow_forwardFitbands estimated sales are: What are the balances in accounts receivable for January, February, and March if 65% of sales is collected in the month of sale, 25% is collected the month after the sale, and 10% is second month after the sale?arrow_forward

- Desiccate purchases direct materials each month. Its payment history shows that 70% is paid in the month of purchase with the remaining balance pad the month after purchase. Prepare a cash payment schedule for March if in January through March, it purchased $35,000, $37,000, and $39,000, respectively.arrow_forwardNonnas Re-Appliance Store collects 55% of its accounts receivable in the month of sale and 40% in the month after the sale. Given the following sales, how much cash will be collected in February?arrow_forwardCash collections for Renew Lights found that 65% of sales were collected in the month of sale, 25% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in March and April?arrow_forward

- Ranger Industries has provided the following information at June 30: Other information: Average selling price, 196 Average purchase price per unit, 110 Desired ending inventory, 40% of next months unit sales Collections from customers: In month of sale20% In month after sale50% Two months after sale30% Projected cash payments: Inventory purchases are paid for in the month following acquisition. Variable cash expenses, other than inventory, are equal to 25% of each months sales and are paid in the month of sale. Fixed cash expenses are 40,000 per month and are paid in the month incurred. Depreciation on equipment is 2,000 per month. REQUIREMENT You have been asked to prepare a master budget for the upcoming quarter (July, August, and September). The components of this budget are a monthly sales budget, a monthly purchases budget, a monthly cash budget, a forecasted income statement for the quarter, and a forecasted September 30 balance sheet. The worksheet MASTER has been provided to assist you. Ranger Industries desires to maintain a minimum cash balance of 8,000 at the end of each month. If this goal cannot be met, the company borrows the exact amount needed to reach its goal. If the company has a cash balance greater than 8,000 and also has loans payable outstanding, the amount in excess of 8,000 is paid to the bank. Annual interest of 18% is paid on a monthly basis on the outstanding balance.arrow_forwardf) The Cathy Specialist Corporation approached you to compile a cash disbursement schedule for the month of March, April and May. Use the following information. Sales: January-RMS20,000; February-RM540,000; March-RM550,000; April=RM600,000; May-RM660,000; June-RM670,000. Purchases: Purchases are calculated as 70% of the following month's sales, 50% of purchase are made in cash, 30% of purchases are settled one month after purchase, and the remaining 20% of purchase are settled two months after purchase. c) d) e) g) h) the firm's expected cash receipts for a) b) Rent: The firm pays rent of RM9,500 per month. Wages & salaries: the fixed wage and salary costs are RM7,500 per month plus a variable cost of 6.5% of the current month's sales. Taxes: the tax bill to be paid in May amount to RM57,500. Fixed asset outlay: new equipment will be acquired during March at a cost of RM85,000. Interest payment: an amount of RM32,000 for interest is due in March. Cash Dividend: Dividends of RM15,000…arrow_forwardWhat is the amount of the April collections?arrow_forward

- a. Record Navis, Incorporated's sales for a month at $75,000. The items sold cost $62,500. Navis records sales at the total invoice amount. b. Record the return of $7,500 of the above sales within the 30-day return period. c. Record the receipt of payment on the remainder of the month's sales, assuming that customers purchasing $50,000 took advantage of a 2 percent cash discount for early payment. None of the customers taking advantage of the cash discount were among those that returned their purchases. Complete this question by entering your answers in the tabs below. Required A Required B Required C Record the receipt of payment on the remainder of the month's sales, assuming that customers purchasing $50,000 took advantage of a 2 percent cash discount for early payment. None of the customers taking advantage of the cash discount were among those that returned their purchases. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first…arrow_forwardMarlin Company projects the follwoing sales for the first thre months of the year: $11500 in January; $10100 in February and $10400 in March. the company expects 60% of the sales to be cash and the remainder on accounts. Sales on account are collected 50% in the month of the sale and 50% in the following month. The Account Receivable account has a zero on January. 1. Prepare a schedule of cash receipts for Marlin for January, February and March. What is the balance in Accounts Receivable on March 31? 2. Prepare a revised schedule of cash receipts if receipts from sales on account are 70% in the month of the sale, 20% in the following month of the sale and 10% in the second month of the sale. What is the balance in Accounts Receivable on March 31?arrow_forwarda. Prepare the expected cash collections during August.b. Prepare the expected cash disbursements during August. c. Calculate the expected cash balance on August 31.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning