Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Firm Z, a corporation with a 21 percent tax rate, has $100,000 to invest in year 0 and two investment choices. Investment 1 will generate $12,000 taxable

Required:

b1. Compute the NPV of each investment if Firm Z is a noncorporate taxpayer with a 35 percent tax rate and the gain on sale of Investment 2 is eligible for the 15 percent

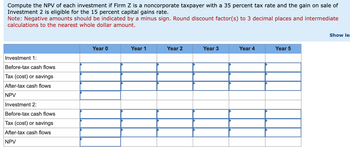

Transcribed Image Text:Compute the NPV of each investment if Firm Z is a noncorporate taxpayer with a 35 percent tax rate and the gain on sale of

Investment 2 is eligible for the 15 percent capital gains rate.

Note: Negative amounts should be indicated by a minus sign. Round discount factor(s) to 3 decimal places and intermediate

calculations to the nearest whole dollar amount.

Investment 1:

Before-tax cash flows

Tax (cost) or savings

After-tax cash flows

NPV

Investment 2:

Before-tax cash flows

Tax (cost) or savings

After-tax cash flows

NPV

Year 0

Year 1

Year 2

Year 3

Year 4

Year 5

Show le

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- .....is the after tax cash flow generated by a business minus the cost of the capital it has deployed to generate that cash flow a. Net Present Value (NPV) a. Ob Economic value added (EVA) Oc. Internal Rate of Return (IRR) d. Discounted Cash Flowarrow_forwardCalculate the Free Cash Flow for Polaris. Item EBITDA Depreciation Tax Rate, T Current Assets Current Liabilities CAPEX Polaris Inc. Selected Financial Information ($000's) Year 0 19,324 17,147 Year 1 10,000 1,188 31% 15,520 15,823 2,078arrow_forwardAssume a firm has EBAT of $590,000, and no amortization. It is in a 40 percent tax bracket. a. Compute its cash flow. $ 354,000 b. Assume it has $590,000 in amortization. Recompute its cash flow. $ 590,000 c. How large a cash flow benefit did the amortization provide? $T] Cash flow Cash flow Benefit in cash flowarrow_forward

- Assume a corportation has earnings before depreciation and taxes of $100,000, depreciation of $50,000, and is in a 30% percent tax bracket. Compute its cash flow using the format. Earnings before depreciation and taxes Depreciation Earnings before taxes Taxes @ 30% Earnings after taxes Depreciation 2a) In problem 1 , how much would cash flow be if there were only $10,000 in depreciation ? All other factors are the same. 2b) How much cash flow is lost due to the reduced depreciation between Problems 1 and 2a?arrow_forwardUse the table for the question below. Revenues -Cost of Goods Sold -Depreciation =EBIT -Taxes (30%) =Profit after tax +Depreciation -Change in NOWC -Capital Expenditures =Free Cash Flow Year 0 a. by 22.5% O b. by 19.5% c. by 25.5% d. by 27.5% -300,000 Year 1 400 000 -180 000 -100 000 120 000 -36 000 84 000 100 000 -20 000 164 000 Year 2 400 000 -180 000 -100 000 120 000 -36 000 84 000 100 000 -20 000 164 000 Year 3 400 000 -180 000 -100 000 120 000 -36 000 8 000 100 000 -20 000 164 000 Visby Rides, a limousine hire company, is considering buying some new luxury cars. After extensive research, they come up with the above estimates of free cash flow from this project. By how much could the opportunity cost of capital rise before the net present value (NPV) of this project is zero, given that it is currently 10%?arrow_forwardUse the table for the question below. Revenues -Cost of Goods Sold -Depreciation =EBIT -Taxes (30%) =Profit after tax +Depreciation -Change in NOWC -Capital Expenditures =Free Cash Flow Year 0 a. by 28.1% b. by 15.5% c. by 10.8% d. by 24.5% -300,000 Year 1 400 000 -180 000 -100 000 120 000 -36 000 84 000 100 000 -20 000 164 000 Year 2 400 000 -180 000 -100 000 120 000 -36 000 84 000 100 000 -20 000 164 000 Year 3 400 000 -180 000 -100 000 120 000 -36 000 8 000 100 000 -20 000 164 000 Visby Rides, a limousine hire company, is considering buying some new luxury cars. After extensive research, they come up with the above estimates of free cash flow from this project. Visby learns that a competitor is thinking of offering similar services, thus reducing Visby's sales. By how much could sales fall before the net present value (NPV) was zero, given that the opportunity cost of capital is 10%, and that cost of goods sold is 45% of revenues?arrow_forward

- Give answer with explanationarrow_forwardWorking needarrow_forwardUse the following information for Taco Swell, Incorporated, (assume the tax rate is 24 percent): Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2020 $ 18,549 2,416 5,890 Cash flow from assets Cash flow to creditors Cash flow to stockholders 1,371 1,130 GA 8,696 11,528 1,714 29,180 72,861 6,293 20,492 2,179 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. $ $ $ 2021 $ 18,888 2,524 6,771 1,198 1,345 9,367 13,602 1,681 35,329 77,730 6,760 21,902 2,354 -1,538.80 -4,804.00 7,250.00arrow_forward

- Answer the question in the picture.arrow_forwardGive typing answer with explanation and conclusionarrow_forwardDetermine the formula for EVA. (WACC = Weighted-average cost of capital) After tax operating inc. Current liabilities Market value of debt Market value of equity Operating income Revenues Total assets WACC x ( )) = EVAarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College