Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hi expart Provide solution

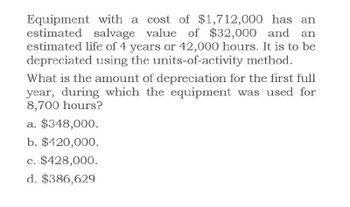

Transcribed Image Text:Equipment with a cost of $1,712,000 has an

estimated salvage value of $32,000 and

estimated life of 4 years or 42,000 hours. It is to be

depreciated using the units-of-activity method.

What is the amount of depreciation for the first full

year, during which the equipment was used for

8,700 hours?

a. $348,000.

b. $420,000.

c. $428,000.

d. $386,629

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- DEPLETION: CALCULATING AND JOURNALIZING Mineral Works Co. acquired a salt mine at a cost of 1,700,000, with no expected salvage value. The estimated number of units available for production from the mine is 3,400,000 tons. (a) During the first year, 200,000 tons are mined and sold. (b) During the second year, 600,000 tons are mined and sold. REQUIRED 1. Calculate the amount of depletion expense for both years. 2. Prepare general journal entries for depletion expense.arrow_forwardA machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years. Prepare depreciation schedules reporting the depreciation expense, accumulated depreciation, and book value of the machine for each year under the double-declining-balance and sum-of-the-years-digits methods. For the double-declining-balance method, round the depreciation rate to two decimal places.arrow_forwardDEPLETION: CALCULATING AND JOURNALIZING Mining Works Co. acquired a copper mine at a cost of 1,200,000, with no expected salvage value. The estimated number of units available for production from the mine is 3,000,000 tons. (a) During the first year, 400,000 tons are mined and sold. (b) During the second year, 700,000 tons are mined and sold. REQUIRED 1. Calculate the amount of depletion expense for both years. 2. Prepare general journal entries for depletion expense.arrow_forward

- IMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE CALCULATION OF DEPRECIATION On January 1, 20-1, Dans Demolition purchased two jackhammers for 2,500 each with a salvage value of 100 each and estimated useful lives of four years. On January 1, 20-2, a stronger blade to improve performance was installed in Jackhammer A for 800 cash and the compressor was replaced in Jackhammer B for 200 cash. The compressor is expected to extend the life of Jackhammer B one year beyond the original estimate. REQUIRED 1. Using the straight-line method, prepare general journal entries for depreciation on December 31, 20-1, for Jackhammers A and B. 2. Enter the transactions for January 20-2 in a general journal. 3. Assuming no other additions, improvements, or replacements, calculate the depreciation expense for each jackhammer for 20-2 through 20-4.arrow_forwardDunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. With DEPREC5 still on the screen, click the Chart sheet tab. This chart shows the accumulated depreciation under all three depreciation methods. Identify below the depreciation method that each represents. Series 1 _____________________ Series 2 _____________________ Series 3 _____________________ When the assignment is complete, close the file without saving it again. Worksheet. The problem thus far has assumed that assets are depreciated a full year in the year acquired. Normally, depreciation begins in the month acquired. For example, an asset acquired at the beginning of April is depreciated for only nine months in the year of acquisition. Modify the DEPREC2 worksheet to include the month of acquisition as an additional item of input. To demonstrate proper handling of this factor on the depreciation schedule, modify the formulas for the first two years. Some of the formulas may not actually need to be revised. Do not modify the formulas for Years 3 through 8 and ignore the numbers shown in those years. Some will be incorrect as will be some of the totals. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as DEPRECT. Hint: Insert the month in row 6 of the Data Section specifying the month by a number (e.g., April is the fourth month of the year). Redo the formulas for Years 1 and 2. For the units of production method, assume no change in the estimated hours for both years. Chart. Using the DEPREC5 file, prepare a line chart or XY chart that plots annual depreciation expense under all three depreciation methods. No Chart Data Table is needed; use the range B29 to E36 on the worksheet as a basis for preparing the chart if you prepare an XY chart. Use C29 to E36 if you prepare a line chart. Enter your name somewhere on the chart. Save the file again as DEPREC5. Print the chart.arrow_forwardDunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. Dunedin buys equipment frequently and wants to print a depreciation schedule for each assets life. Review the worksheet called DEPREC that follows these requirements. Since some assets acquired are depreciated by straight-line, others by units of production, and others by double-declining balance, DEPREC shows all three methods. You are to use this worksheet to prepare depreciation schedules for the new machine.arrow_forward

- Need helparrow_forwardA machine with a cost of $480,000 has an estimated salvage value of $30,000 and an estimated useful life of 5 years or 15,000 hours. It is to be depreciated using the units-of-activity method of depreciation. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours? Select one: a. $160,000 b. $130,000 c. $90,000 d. $150,000 Drago Company purchased equipment on January 1, 2016, at a total invoice cost of $1,200,000. The equipment has an estimated salvage value of $30,000 and an estimated useful life of 5 years. What is the amount of accumulated depreciation at December 31, 2017, if the straight-line method of depreciation is used? Select one: a. $234,000 b. $468,000 c. $240,000 d. $480,000 Sargent Corporation bought equipment on January 1, 2017. The equipment cost $360,000 and had an expected salvage value of $60,000. The life of the equipment was estimated to be 6 years. Assuming straight-line deprecation, the book value of…arrow_forwardplease solve upper first as per guideline thnxarrow_forward

- Gadubhaiarrow_forwardDepletion: Calculating and Journalizing Mineral Works Co. acquired a salt mine at a cost of $1,925,000, with no expected salvage value. The estimated number of units available for production from the mine is 3,500,000 tons. a. During the first year, 220,000 tons are mined and sold. b. During the second year, 290,000 tons are mined and sold. Required: 1. Calculate the amount of depletion expense for both years. Year 1 Year 2 2. Prepare general journal entries for depletion expense. Page: 1 DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 1 Year 1 1 2 3 3 4 Year 2 4 5arrow_forwardDepletion: Calculating and Journalizing Mineral Works Co. acquired a salt mine at a cost of $1,700,000, with no expected salvage value. The estimated number of units available for production from the mine is 3,400,000 tons. a. During the first year, 200,000 tons are mined and sold. b. During the second year, 600,000 tons are mined and sold. Required: 1. Calculate the amount of depletion expense for both years. Year 1 Year 2 2. Prepare general journal entries for depletion expense. Page: 1 DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 1 Year 1 2 3 3 4 Year 2 4 5 6 6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning