Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer

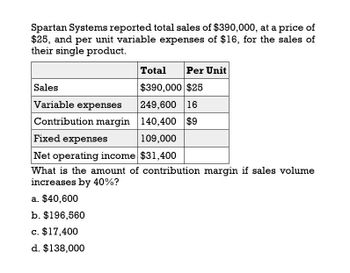

Transcribed Image Text:Spartan Systems reported total sales of $390,000, at a price of

$25, and per unit variable expenses of $16, for the sales of

their single product.

Total

Per Unit

Sales

$390,000 $25

Variable expenses

249,600 16

Contribution margin

140,400 $9

109,000

Fixed expenses

Net operating income $31,400

What is the amount of contribution margin if sales volume

increases by 40%?

a. $40,600

b. $196,560

c. $17,400

d. $138,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For Sheridan Company, sales is $2000000, fixed expenses are $900000, and the contribution margin ratio is 36%. What is required sales in dollars to earn a target net income of $700000? A. $4444444 B. $5555556 C. $2500000 D. $1944444arrow_forwardWesley's income statement is as follows: Sales (10,000 units) Less variable costs Contribution margin Less fixed costs Net income $150,000 - 48,000 $102,000 - 24,000 $ 78,000 What is the unit contribution margin? A. $12.00 B. $ 7.20 C. $ 4.80 D. $10.20arrow_forwardsolve this account queryarrow_forward

- Consider the following: Fixed expenses P78,000; Unit contribution margin 12;Target net profit 42,000. How many unit sales are required to earn the target net profit? A. 15,000 unitsB. 10,000 unitsC. 12,800 unitsD. 20,000 unitsarrow_forwardRemmel Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (6,000 units) Variable expenses Contribution margin Fixed expenses Net operating income $ 300,000 240,000 60,000 59,000 $ 1,000 If sales increase to 6,020 units, the increase in net operating income would be closest to: Multiple Choice ○ $1,000.00 ○ $200.00 ○ $800.00 ○ $3.33arrow_forwardNeed help pleasearrow_forward

- Assume the following (1) variable expenses = $294,000, (2) unit sales = 10,000, (3) the contribution margin rotio =25%, ond (4) net operoting income S10,000. Given these four assumptions, which of the following is true? Multiple Cholce The break-even polnt In sales dollars Is $352,000 The total contributlon margin = $220,500 The total sales 5367500 The total fixed expenses= $73,500arrow_forwardHow do I solve this question?arrow_forwardRemmel Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (6,000 units) Variable expenses Contribution margin Fixed expenses Net operating income If the selling price increases by $3 per unit and the sales volume decreases by 400 units, the net operating income would be closest to: Multiple Choice $13,800 $19,000 $17,733 $ 300,000 240,000 60,000 59,000 $ 1,000 $16,800arrow_forward

- McGordon Corporation has provided the following data: 1. The contribution margin is: $240,000B. $560,000C. $632,000D. $72,000 2. The break-even point in sales dollars is: $240,000B. $560,000C. $728,000D. $408,000arrow_forwardFor Crane Company, sales is $3000000, fixed expenses are $900000, and the contribution margin ratio is 36%. What is required sales in dollars to earn a target net income of $600000? $8333333 $2500000 $1666667 $4166667arrow_forwardDavidson company has sales of 100,000 variable cost of goods sold od $40,000 variables seeing expenses of $15,000 variable administrative expensive of 5,000 fixed selling expenses of $7000 and fixed administrative expenses of $9,000 what is Davidson's contribution Margin?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub