Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

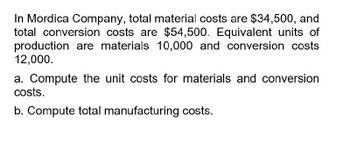

Transcribed Image Text:In Mordica Company, total material costs are $34,500, and

total conversion costs are $54,500. Equivalent units of

production are materials 10,000 and conversion costs

12,000.

a. Compute the unit costs for materials and conversion

costs.

b. Compute total manufacturing costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardRocks Industries has two products. They manufactured 12,539 units of product A and 8.254 units of product B. The data are: Â What is the activity rate for each cost pool?arrow_forward

- A production department within a company received materials of $7,000 and conversion costs of $5,000 from the prior department. It added material of $78400 and conversion costs of $47000. The equivalent units are 5,000 for material and 4,000 for conversion. What is the unit cost for materials and conversion?arrow_forwardThe cost of direct materials transferred into the Rolling Department of Kraus Company is 3,000,000. The conversion cost for the period in the Rolling Department is 462,600. The total equivalent units for direct materials and conversion are 4,000 tons and 3,855 tons, respectively. Determine the direct materials and conversion costs per equivalent unit.arrow_forwardCool Pool has these costs associated with production of 20,000 units of accessory products: direct materials, $70; direct labor, $110; variable manufacturing overhead, $45; total fixed manufacturing overhead, $800,000. What is the cost per unit under both the variable and absorption methods?arrow_forward

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardWyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardA firm has 100,000 in direct materials costs, 50,000 in direct labor costs, and 80,000 in overhead. Which of the following is true? a. Prime costs are 150,000; conversion costs are 180,000. b. Prime costs are 130,000; conversion costs are 150,000. c. Prime costs are 150,000; conversion costs are 130,000. d. Prime costs are 180,000; conversion costs are 150,000.arrow_forward

- Medical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardProvide Answerarrow_forwardGeneral accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,