Century 21 Accounting General Journal

11th Edition

ISBN: 9781337680059

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

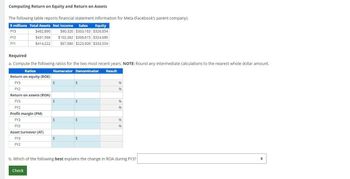

Transcribed Image Text:Computing Return on Equity and Return on Assets

The following table reports financial statement information for Meta (Facebook's parent company).

$ millions Total Assets Net Income Sales Equity

FY3

FY2

$482,890

$431,566

$60,320 $303,183 $326,854

$102,362 $306,615 $324,685

FY1

$414,222

$67,980 $223,509 $333,554

Required

a. Compute the following ratios for the two most recent years. NOTE: Round any intermediate calculations to the nearest whole dollar amount.

Ratios

Numerator Denominator

Return on equity (ROE)

Result

FY3

FY2

Return on assets (ROA)

FY3

FY2

Profit margin (PM)

FY3

FY2

Asset turnover (AT)

FY3

FY2

$

$

96

96

$

$

96

96

$

$

96

96

b. Which of the following best explains the change in ROA during FY3?

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Interpret the results: • Return on equity • Return on assets • Gross profit margin • Operating profit margin • Net profit marginarrow_forwardFind the ROE for Potbelly Corporation for the year 2015, use highlighted excel company information for 2014 and 2015 to find average shareholders equity. List steps taken pleasearrow_forwardPlease analyze company Savola using below table of common size balance sheet compared to other companies:arrow_forward

- Use the information provided from Sapphire Ltd calculate and comment on the following ratios:1. Profit margin2. Return on equityarrow_forwardCalculate the following ratios: return on equity, return on assets (levered), return on sales (levered), asset turnover, and financial leverage.arrow_forwardUse the common-size financial statements found here: ommon-Size Balance Sheet 2016Cash and marketable securities $ 480 1.5 %Accounts receivable 6,030 18.2Inventory 9,540 28.8Total current assets $ 16,050 48.5 %Net property, plant, and equipment 17,020 51.5Total assets $33,070 100.0 %Accounts payable $ 7,150 21.6 %Short-term notes 6,850 20.7Total current liabilities $ 14,000 42.3 %Long-term liabilities 7,010 21.2Total liabilities $ 21,010 63.5 %Total common shareholders’ equity 12,060 36.5Total liabilities and shareholders’ equity $33,070 100.0 %Common-Size Income Statement 2016Revenues $ 30,000 100.0 %Cost of goods sold (20,050) 66.8Gross profit $ 9,950 33.2 %Operating expenses (7,960) 26.5Net operating income $ 1,990 6.6 %Interest expense (940) 3.1Earnings before taxes $ 1,050 3.5 %Income taxes (382) 1.3Net income $668 2.2 % Specifically, write up a brief narrative that responds to the following questions: a. How much cash does Patterson have on hand relative to its total…arrow_forward

- I need question answer financial accountingarrow_forwardAccounting equation The total assets and total liabilities (in millions) of McDonalds Corporation (MCD) and Star-bucks Corporation (SBUX) follow:arrow_forwardUse the following balance sheet and income statement to calculate the firm's return on equity: Balance Sheet Assets: Cash Accounts Receivable Inventories Land Other Fixed Assets Liabilities & Owners' Equity Accounts Payable Long Term Debt Common Stock Paid in Capital Retained Earnings 30.3% 28.0% 27.5% O 45.1% 36.2% $9,000 26,000 19,500 49,000 70,000 12,000 53,400 2,000 80,000 26,100 Income Statement Sales (all credit) Cost of Goods Sold Operating Expenses Depreciation Interest Expense Taxes $255,000 (153,000) (45,000) (3,000) (9,000) (15,300)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning