Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need answer with explanation

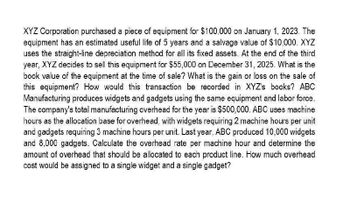

Transcribed Image Text:XYZ Corporation purchased a piece of equipment for $100,000 on January 1, 2023. The

equipment has an estimated useful life of 5 years and a salvage value of $10,000. XYZ

uses the straight-line depreciation method for all its fixed assets. At the end of the third

year, XYZ decides to sell this equipment for $55,000 on December 31, 2025. What is the

book value of the equipment at the time of sale? What is the gain or loss on the sale of

this equipment? How would this transaction be recorded in XYZ's books? ABC

Manufacturing produces widgets and gadgets using the same equipment and labor force.

The company's total manufacturing overhead for the year is $500,000. ABC uses machine

hours as the allocation base for overhead, with widgets requiring 2 machine hours per unit

and gadgets requiring 3 machine hours per unit. Last year, ABC produced 10,000 widgets

and 8,000 gadgets. Calculate the overhead rate per machine hour and determine the

amount of overhead that should be allocated to each product line. How much overhead

cost would be assigned to a single widget and a single gadget?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.arrow_forwardThe following intangible assets were purchased by Hanna Unlimited: A. A patent with a remaining legal life of twelve years is bought, and Hanna expects to be able to use it for six years. It is purchased at a cost of $48,000. B. A copyright with a remaining life of thirty years is purchased, and Hanna expects to be able to use it for ten years. It is purchased for $70,000. Determine the annual amortization amount for each intangible asset.arrow_forwardOn January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.arrow_forward

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.arrow_forwardReferring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?arrow_forwardColquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.arrow_forward

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.arrow_forwardMontello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one the company expects the truck to be driven for 26,000 miles; in year two, 30,000 miles; and in year three, 40,000 miles. Consider how the purchase of the truck will impact Montellos depreciation expense each year and what the trucks book value will be each year after depreciation expense is recorded.arrow_forwardUrquhart Global purchases a building to house its administrative offices for $500,000. The best estimate of the salvage value at the time of purchase was $45,000, and it is expected to be used for forty years. Urquhart uses the straight-line depreciation method for all buildings. After ten years of recording depreciation, Urquhart determines that the building will be useful for a total of fifty years instead of forty. Calculate annual depreciation expense for the first ten years. Determine the depreciation expense for the final forty years of the assets life, and create the journal entry for year eleven.arrow_forward

- Alfredo Company purchased a new 3-D printer for $900,000. Although this printer is expected to last for ten years, Alfredo knows the technology will become old quickly, and so they plan to replace this printer in three years. At that point, Alfredo believes it will be able to sell the printer for $15,000. Calculate yearly depreciation using the double-declining-balance method.arrow_forwardMontezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and is expected to be driven for ten years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After five years of recording depreciation, Montezuma determines that the delivery truck will be useful for another five years (ten years in total, as originally expected) and that the salvage value will increase to $10,000. Determine the depreciation expense for the final five years of the assets life, and create the journal entry for years 6–10 (the entry will be the same for each of the five years).arrow_forwardTree Lovers Inc. purchased 2,500 acres of woodland in which it intends to harvest the complete forest, leaving the land barren and worthless. Tree Lovers paid $5,000,000 for the land. Tree Lovers will sell the lumber as it is harvested and it expects to deplete it over ten years (150 acres in year one, 300 acres in year two, 250 acres in year three, 150 acres in year four, and 100 acres in year five). Calculate the depletion expense for the next five years and create the journal entry for year one.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College