Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:III

MT217_Unit...

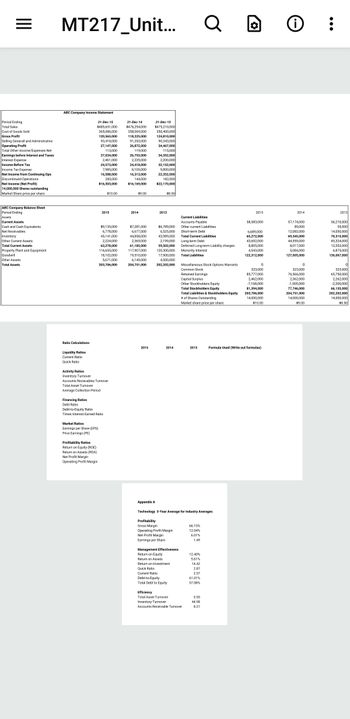

Period Ending

Total Sales

ABC Company Income Statement

31-Dec-15

Cost of Goods Sold

$485,651,000

365,086,000

31-Dec-14

$476,294,000

358,069,000

31-Dec-13

$475,210,000

350,400,000

Gross Profit

120,565,000

118,225,000

124,810,000

Selling Generall and Adminstrative

93,418,000

91,353,000

90,343,000

Operating Profit

27,147,000

26,872,000

34,467,000

Total Other Income/Expenses Net

113,000

119,000

115,000

Earnings before Interest and Taxes

27,034,000

26,753,000

34,352,000

Interest Expense

2,461,000

2,335,000

2,200,000

Income Before Tax

24,573,000

24,418,000

32,152,000

Income Tax Expense

7,985,000

8,105,000

9,800,000

Net Income from Continuing Ops

16,588,000

16,313,000

22,352,000

Discontinued Operations

285,000

Net Income (Net Profit)

$16.303,000

144,000

$16,169,000

182,000

$22,170,000

14,000,000 Shares outstanding

Market Share price per share

$10.00

$9.00

$8.50

Q

ABC Company Balance Sheet

Period Ending

2015

2014

2013

Assets

Current Liabilities

Current Assets

Accounts Payable

2015

58.583,000

2014

57,174,000

2013

56,210,000

Cash and Cash Equivalents

Net Receivables

Inventory

Other Current Assets

$9,135,000

6,778,000

45,141,000

2,224,000

Total Current Assets

63,278,000

Property Plant and Equipment

116,655,000

Goodwill

Other Assets

Total Assets

18,102,000

5,671,000

203,706,000

$7,281,000

6,677,000

44.858.000

2,369,000

61,185,000

117,907,000

19,510,000

6,149,000

204,751,000

$6,789,000

Other current Liabilities

6,525,000

Short-term Debt

6,689,000

89,000

12,082,000

55,000

14,050,000

43,989,000

Total Current Liabilities

65,272,000

69,345,000

70,315,000

2,199,000

Long-term Debt

43,692,000

44,559,000

45,324,000

59,502,000

120,300,000

17,900,000

4,500,000

202,202,000

Deferred Long-term Liability charges

Monority Interest

8,805,000

8,017,000

13,553,000

4,543,000

5,084,000

6,875,000

Total Liabilities

122,312,000

127,005,000

136,067,000

Miscellaneous Stock Options Warrants

이

Common Stock

323,000

Retained Earnings

85,777,000

323,000

76,566,000

323,000

65,750,000

Captial Surplus

2,462,000

2,362,000

2,262,000

Other Stockholders Equity

-7,168,000

-1,505,000

-2,200,000

Total Stockholders Equity

81,394,000

77,746,000

Total Liabilities & Stockholders Equity

203,706,000

# of Shares Outstanding

14,000,000

204,751,000

14,000,000

Market share price per share

$10.00

$9.00

66,135,000

202,202,000

14,000,000

$8.50

Ratio Calculations

Liquidity Ratios

Current Ratio

Quick Ratio

Activity Ratios

Inventory Turnover

Accounts Recievables Turnover

Total Asset Turnover

Average Collection Period

Financing Ratios

Debt Ratio

Debt-to-Equity Ratio

Times Interest Earned Ratio

Market Ratios

Earnings per Share (EPS)

Price Earnings (PE)

Profitability Ratios

Return on Equity (ROE)

Return on Assets (ROA)

Net Profit Margin

Operating Profit Margin

2015

2014

2013

Formula Used (Write out formulas)

Appendix A

Technology 3-Year Average for Industry Averages

Profitability

Gross Margin

66.15%

Operating Profit Margin

12.04%

Net Profit Margin

6.01%

Earnings per Share

1.49

Management Effectiveness

Return on Equity

12.40%

Return on Assets

5.61%

Return on Investment

14.42

Quick Ratio

2.87

Current Ratio

2.57

Debt-to-Equity

61.01%

Total Debt to Equity

57.08%

Efficiency

Total Asset Turnover

0.55

Inventory Turnover

44.98

Accounts Receivable Turnover

8.21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ABC Company Income Statement Period Ending 31-Dec-15 31-Dec-14 31-Dec-13 Total Sales $485,651,000 $476,294,000 $475,210,000 Cost of Goods Sold 365,086,000 358,069,000 350,400,000 Gross Profit 120,565,000 118,225,000 124,810,000 Selling Generall and Adminstrative 93,418,000 91,353,000 90,343,000 Operating Profit 27,147,000 26,872,000 34,467,000 Total Other Income/Expenses Net 113,000 119,000 115,000 Earnings before Interest and Taxes 27,034,000 26,753,000 34,352,000 Interest Expense 2,461,000 2,335,000 2,200,000 Income Before Tax 24,573,000 24,418,000 32,152,000 Income Tax Expense 7,985,000 8,105,000 9,800,000 Net Income from Continuing Ops 16,588,000…arrow_forwardToys "R" Ltd. had cost of goods sold of $6,000 million, ending inventory of $2,500 million, and average inventory of $2,000 million. The merchandise turnover is Multiple Choice 0.33 240 0.4 12.00arrow_forwardCalculate this Questionarrow_forward

- A B C D E Sales revenue $40,400 $75,400 $573,700 $34,800 $54,100 Cost of goods sold 19,200 50,500 273,600 19,400 30,500 Operating expenses 9,800 39,800 230,700 11,800 17,900 Total expenses 29,000 90,300 504,300 31,200 48,400 Operating profit (loss) $11,400 $(14,900) $69,400 $3,600 $5,700 Identifiable assets $34,500 $80,000 $501,100 $64,700 $50,400 Sales of segments B and C included intersegment sales of $20,000 and $101,000, respectively. (a) Determine which of the segments are reportable based on the: 1. Revenue test. 2 Operating profit (loss) test. 3. Identifiable assets test. Reportable Segmentarrow_forwardSales $ 150,000 $ 550,000 $ 38,700 $ 255,700 Sales discounts 5,000 17,500 600 4,800 Sales returns and allowances 20,000 6,000 5,100 900 Cost of goods sold 79,750 329,589 24,453 126,500 Compute net sales, gross profit, and the gross margin ratio for each of the four separate companies. (Round your gross margin ratio to 1 decimal place; i.e.; 0.2367 should be entered as 23.7%.) Company columns from above. A. Carrier B. Lennox C. Trane D. York Net sales Gross profits Gross margin ratioarrow_forwardGive me correct answer for this questionarrow_forward

- harrow_forwardQuestion 7 - HW 1 (Chapter 2) ezto.mheducation.com xtmap/index.html?_con=c ernal browser=081aunchUr=https253A232252E Saved Required information (The following information applies to the questions displayed below.] Alexandria Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1. Inventory Classification Raw material Work in process Finished goods January 1, 20x1 $ 50,000 120,000 170,000 December 31, 20x1 $ 70,000 115,000 165,000 Durjng 20x1, the company purchased $250,000 of raw material and spent $400,000 on direct labor. Manufacturing overhead costs were as follows: Indirect material Indirect labor Depreciation on plant and equipment Utilities 12,000 26,000 100,000 26,000 30, 000 Other Sales revenue was $1,110,000 for the year. Selling and administrative expenses for the year amounted to $110.000, The firm's tax rate is 40 percent. 3. Prepare an income statement. Prisc Insert F8 F10 F11 F12 F9 24 & 4. 7 8. 10arrow_forward9arrow_forward

- PROBLEM 23-10A IS MY QUESTION. POSTED 23-9A FOR REFERENCE FOR 23-10A. Problem 23-9A: Zowine Company's condensed income statement for the year ended December 31, 20-2, was as follows: Net sales 765,000 Cost of goods sold 550,000 Gross profit 215,000 Operating expenses 30,000 Income before taxes 185,000 Income tax expense 65,000 Net income 120,000 Additional information obtained from Zowine's comparative balance sheets as of December 31, 20-2 and 20-1, was as follows: 20-2 20-1 Cash $60,000 $ 20,000 Accounts receivable 70,000 100,000 Merchandise inventory 80,000 125,000 Accounts payable 55,000 90,000 Required Prepare a partial statement of cash flows reporting cash provided by operating activities for the year ended December 31, 20-2. (NO ANSWER IS NEEDED FOR THIS... REFER TO BELOW) Refer to Problem 23-9A (above). The following additional information was obtained from Zowine's financial statements and auxiliary records for…arrow_forwardSales revenue Variable cost of goods sold Fixed cost of goods sold Gross profit Variable operating expenses Fixed operating expenses Common fixed costs Operating income (a) $1,360,000 Q Search Baseball V V 919,000 V 123,800 317,200 183,800 85,200 65,000 ($16,800) Soccer $3,900,000 2,535,000 $ 202,200 $ 1,162,800 624,000 91,000 139,000 Basketball $2,560,000 2,065,600 178,000 316,400 Baseball 256,000 78,900 104,900 $308,800 ($123,400) Doug is concerned that two of the company's divisions are showing a loss, and he wonders if the company should stop selling baseball and basketball gear to concentrate solely on soccer gear. Prepare a segment margin income statement. Fixed cost of goods sold and fixed operating expenses can be traced to each division (If the amount is negative then enter with a negative sign preceding the number, e.g.-5.125 or parenthesis, eg (5,125)) C $ Total $7,820,000 5,519,600 $ 504,000 F 1,796,400 1,063,800 255,100 308,900 $168,600 Soccer $ B:arrow_forwardAnswer in subparts: A. 0.57895 or 11:19 B. 0.90476 or 19:21 C. 0.3258 Note: Please answer d, e and f only.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education