FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

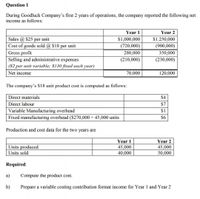

Transcribed Image Text:Question 1

During Goodluck Company's first 2 years of operations, the company reported the following net

income as follows:

Year 1

Year 2

Sales @ $25

Cost of goods sold @ $18 per unit

Gross profit

Selling and administrative expenses

per

unit

$1,000,000

$1.250,000

(720,000)

(900,000)

280,000

350,000

(210,000)

(230,000)

($2 per unit variable; $130 fixed each year)

Net income

70,000

120,000

The company's $18 unit product cost is computed as follows:

Direct materials

$4

Direct labour

$7

Variable Manufacturing overhead

Fixed manufacturing overhead ($270,000 + 45,000 units

$1

$6

Production and cost data for the two years are

Year 1

Year 2

Units produced

Units sold

45,000

40,000

45,000

50,000

Required:

а)

Compute the product cost.

b)

Prepare a variable costing contribution format income for Year 1 and Year 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please solve question 4 to question 7. thanksarrow_forwardWhitman Company has just completed its first year of operations. The company's traditional format income statement for the year follows: Whitman Company Income Statement Sales (35,000 units × $25 per unit) Cost of goods sold (35,000 units × $15 per unit) Gross margin Selling and administrative expenses Net operating income Amount $ 875,000 525,000 350,000 278,000 $ 72,000 The company's selling and administrative expenses consist of $208,000 per year in fixed expenses and $2 per unit sold in variable expenses. The $15 unit product cost given above is computed as follows: Direct materials Direct labor Variable overhead Fixed overhead ($100,000 ÷ 50,000 units) Unit product cost (under traditional costing) $ 6 6 1 2 $15 Required: 1. Prepare a contribution format income statement for the year ended December 31. 2. What was the contribution toward fixed expenses and profits for each unit sold? (State this figure in a single dollar amount per snowboard.) 3. What would operating income be if…arrow_forwardDuring the current year, Sokowski Manufacturing earned income of $347,760 from total sales of $5,520,000 and average capital assets of $12,000,000. A. Based on this information, calculate asset turnover. If required, round your answer to two decimal places. fill in the blank 1 times B. Assume sales margin is 6.3%, what is the total ROI for the company during the current year?. If required, round your answer to one decimal place. fill in the blank 2%arrow_forward

- A company has a net profit margin of 5%, an operating profit margin of 10%, and a gross profit margin of 25%. Sales revenue amounted P7,500,000. The general and administrative, and selling expenses are P1,125,000. Determine the amount of cost of goods sold. * Garrow_forwardDuring the current year, Sokowski Manufacturing earned income of $292,400 from total sales of $4,300,000 and average capital assets of $10,000,000. A. Based on this information, calculate asset turnover. If required, round your answer to two decimal places. fill in the blank times B. Assume sales margin is 6.8%, what is the total ROI for the company during the current year?. If required, round your answer to one decimal place. fill in the blank %arrow_forwardThe following is the year ended data for Tiger Company: Sales Revenue $58,000 Cost of Goods Manufactured 21,000 Beginning Finished Goods Inventory 1,100 Ending Finished Goods Inventory 2,200 Selling Expenses 15,000 Administrative Expenses 3,900 What is the gross profit? A. $22,100 B. $38,100 C. $19,200 D.arrow_forward

- Provide Answer please providearrow_forwardLast year a company had sales of $410,000, a turnover of 2.1, and a return on investment of 29.4%. The company's net operating income for the year was: Multiple Cholce $63,140 $195,238 $120,540 $57.400arrow_forwardFlamengo Co is a sporting goods manufacturing. Last year, report the following Income Statement: Sales $620,000 Cost of goods sold 316,000 Gross margin $304,000 Selling and administrative expense 246,000 Operating income $ 58,000 Less: Income taxes (at 40%) 34,000 Net income $ 24,000 At the beginning of the year, the value of operating assets was $263,000. At the end of the year, the value of operating assets was $363,000. Flamengo Co. requires a minimum rate of return of 15%. Total capital employed equals $350,000 and the actual cost of capital is 6%, Calculate the Return on Investment. (Carry computations out to two decimal places.)arrow_forward

- Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill’s data are expressed in dollars. The electronics industry averages are expressed in percentages. TannenhillCompany ElectronicsIndustryAverage Sales $800,000 100 % Cost of goods sold 512,000 70 Gross profit $288,000 30 % Selling expenses $176,000 17 % Administrative expenses 64,000 7 Total operating expenses $240,000 24 % Operating income $48,000 6 % Other revenue 16,000 2 $64,000 8 % Other expense 8,000 1 Income before income tax $56,000 7 % Income tax expense 24,000 5 Net income $32,000 2 % a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers.arrow_forwardCalculating Economic Value Added Barnard Manufacturing earned operating income last year as shown in the following income statement: Sales $4,000,000 Cost of goods sold 2,100,000 Gross margin $1,900,000 Selling and administrative expense 1,100,000 Operating income $800,000 Less: Income taxes (@ 40%) 320,000 Net income $480,000 At the beginning of the year, the value of operating assets was $2,700,000. At the end of the year, the value of operating assets was $2,300,000. Total capital employed equaled $1,400,000. Barnard’s actual cost of capital is 12%. Required: Calculate the EVA for Barnard Manufacturing.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education