FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

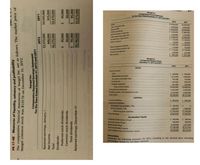

Transcribed Image Text:## Financial Statement Analysis

This educational overview covers key financial ratios and metrics used in analyzing financial statements. Students and professionals can use this guide to understand how these metrics provide insight into a company's performance, financial health, and efficiency.

### Key Ratios and Metrics:

1. **Inventory Turnover**: Measures how many times a company's inventory is sold and replaced over a period.

2. **Number of Days' Sales in Inventory**: Indicates the average number of days it takes for inventory to be sold.

3. **Ratio of Fixed Assets to Long-term Liabilities**: Assesses the proportion of fixed assets funded by long-term liabilities.

4. **Ratio of Liabilities to Stockholders' Equity**: Reflects the relationship between the funds provided by creditors versus those provided by owners.

5. **Times Interest Earned**: Shows the ability to meet interest payments, calculated as earnings before interest and taxes divided by interest expense.

6. **Asset Turnover**: Efficiency ratio showing how well a company uses its assets to generate sales revenue.

7. **Return on Total Assets**: Indicates how effectively a company is using its assets to generate profit.

8. **Return on Stockholders' Equity**: Measures the return generated on the owners' investment in the company.

9. **Return on Common Stockholders' Equity**: Focuses specifically on the return generated for common shareholders.

10. **Earnings per Share on Common Stock**: Indicates the portion of a company's profit allocated to each outstanding share of common stock.

11. **Price-Earnings Ratio**: Valuates a company’s current share price compared to its per-share earnings.

12. **Dividends per Share of Common Stock**: Displays the amount of cash returned to shareholders per share, indicating a company's profitability and dividend policy.

13. **Dividend Yield**: Measures the dividend income relative to the market value per share, offering insight into the income generated from an investment in shares.

### Charts and Diagrams:

- **Data Entry Blocks**: On the right, there are fields corresponding to each metric. These blocks are meant for users to input data from a company’s financial reports to facilitate calculations and analysis.

Through mastering these metrics and ratios, individuals can enhance their ability to evaluate financial statements and make informed investment or managerial decisions.

Transcribed Image Text:**Stargel Inc. Financial Overview for Educational Purposes**

### Comparative Retained Earnings Statement

**For the Years Ended December 31, 2012 and 2011**

- **Retained Earnings, January 1:**

- 2012: $5,375,000

- 2011: $4,545,000

- **Net Income:**

- 2012: $1,130,000

- 2011: $925,000

- **Dividends:**

- Preferred Stock Dividends:

- 2012: $5,000

- 2011: $5,000

- Common Stock Dividends:

- 2012: $90,000

- 2011: $95,000

- Total Dividends:

- 2012: $95,000

- 2011: $100,000

- **Retained Earnings, December 31:**

- 2012: $6,410,000

- 2011: $5,370,000

---

### Comparative Income Statement

**For the Years Ended December 31, 2012 and 2011**

- **Sales:**

- 2012: $10,000,000

- 2011: $9,400,000

- **Cost of Goods Sold:**

- 2012: $5,350,000

- 2011: $4,950,000

- **Gross Profit:**

- 2012: $4,650,000

- 2011: $4,450,000

- **Selling Expenses:**

- 2012: $1,350,000

- 2011: $1,320,000

- **Administrative Expenses:**

- 2012: $1,800,000

- 2011: $1,700,000

- **Total Operating Expenses:**

- 2012: $3,150,000

- 2011: $3,020,000

- **Operating Income:**

- 2012: $1,500,000

- 2011: $1,430,000

- **Other Revenue (Expenses):**

- Other Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PLZZ EXPLAINarrow_forwardQuestion attached in screenshot below need help asap thanks aprpeciated i51oiyji1o5j1io5yj51oijygmi lo1 51arrow_forwardHomework i A company reports the following sales-related information. Sales, gross Sales discounts $295,000 Sales returns and allowances 5,900 Sales salaries expense Prepare the net sales portion only of this company's multiple-step income statement. Net sales Multiple-Step Income Statement (Partial) Saved < Prev. $ 22,000 11,900 10 of 10 HH hp narrow_forward

- 9arrow_forwardBased on the table given below, Net Income Model Data 1 B Sales Cost of Goods Sold $10.000.000 6400.000 Administrative Expenses 500,000 Selling Expenses 5.900.000 Depreciation Expenses 250.000 10 Interest Expenses 20000 11 Taxes $620,000 12 13 Model 14 15 Kiss Profi 1,000,000 16 Operating Expenses 52.110.000 19 Net Operating Inome 1.450.000 arnings Before Tenes 1350.000 19 20 Net Income which of the following formulas would be used to calculate the net income value using only the information in the Model, and not in the Data section?. -B6-B15 -B15-B16-B17+B18 -B5-B17 -B18-B11arrow_forwardFinancial information is presented below: Operating expenses $ 33000 Sales revenue 211000 Cost of goods sold 129000 Gross profit would be $178000. $ 82000. $ 33000. $ 49000.arrow_forward

- Use the following information (in thousands):a. ¥126,000 d. ¥63,000Answer:1Sales revenue¥300,000 Gain on sale of equipment90,000 Cost of goods sold164,000 Interest expense16,000 Selling & administrative expenses30,000 Income tax rate30%Determine the amount of net income.arrow_forward00 Chapter 1 PROBLEM 1-19 Traditional and Contribution Format Income Statements L01-6 Todrick Company is a merchandiser that reported the following information based on 1,000 units sold: Sales..... Beginning merchandise inventory. Purchases..... 1. 2. 3. 4. 5. 6. Ending merchandise inventory Fixed selling expense...... Fixed administrative expense. Variable selling expense. Variable administrative expense Contribution margin. Net operating income $300,000 $20,000 $200,000 $7,000 ? $12,000 $15,000 ? $60,000 $18,000 Required: Prepare a contribution format income statement. Prepare a traditional format income statement. Calculate the selling price per unit. Calculate the variable cost per unit. Calculate the contribution margin per unit. Which income statement format (traditional format or contribution format) would be more useful to managers in estimating how net operating income will change in responses to changes in unit sales? Why?arrow_forwardK The following information relates to Fantastic Clothing, Inc. Net Sales Revenue Cost of Goods Sold Interest Expense Operating Expenses Calculate the net income. OA. $260,700 OB. $265,000 O C. $315,700 OD. $320,000 $550,000 230,000 4,300 55,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education