FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

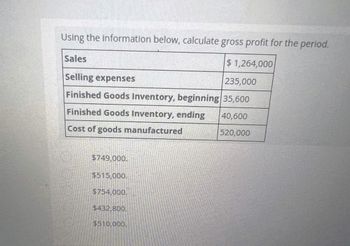

Transcribed Image Text:Using the information below, calculate gross profit for the period.

Sales

$1,264,000

Selling expenses

235,000

Finished Goods Inventory, beginning 35,600

Finished Goods Inventory, ending

40,600

Cost of goods manufactured

520,000

$749,000.

$515,000.

$754,000.

$432,800.

$510,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (1)Garcon Company | Pepper Company (2) Finished goods inventory, beginning $ 13,200 / $ 16, 750 Work in process inventory, beginning 18,000/ 22,650 Raw materials inventory, beginning 9, 800/12, 750 Rental cost on factory equipment 30, 250/26, 350 Direct labor 19, 400 / 39,400 Finished goods inventory, ending 17,300 / 16, 400 Work in process inventory, ending 26, 200/20, 400 Raw materials inventory, ending 8, 000/ 9,200 Factory utilities 14, 100/13, 750 General and administrative expenses 27, 500/53, 500 Indirect labor 12, 150 / 12, 260 Repairs-Factory equipment 4, 820/2, 350 Raw materials purchases 47,000/67,500 Selling expenses 62, 400 / 54,400 Sales 295, 320/394, 170 Cash 29, 000/24, 200 Accounts receivable, net 15,800 / 23,450arrow_forwardThe following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured $4,490,000 Selling expenses 530,000 Administrative expenses 340,000 Sales 6,600,000 Finished goods inventory, January 1 880,000 Finished goods inventory, January 31 775,000 a. For the month ended January 31, determine Bandera Manufacturing’s cost of goods sold. Bandera Manufacturing CompanyCost of Goods SoldJanuary 31 $Finished goods inventory, January 1 - Select - $- Select - - Select - $- Select - b. For the month ended January 31, determine Bandera Manufacturing’s gross profit. Bandera Manufacturing CompanyGross ProfitJanuary 31 $- Select - - Select - $- Select - c. For the month ended January 31, determine Bandera Manufacturing’s net income. Bandera Manufacturing CompanyNet IncomeJanuary 31 $- Select - Operating expenses:…arrow_forwardUrmilabenarrow_forward

- Give me correct answer for this questionarrow_forward11. The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured $229,440 Selling expenses 76,640 Administrative expenses 40,520 Sales 488,160 Finished goods inventory, January 1 55,160 Finished goods inventory, January 31 50,280 For the month ended January 31, determine Bandera's (a) cost of goods sold, (b) gross profit, and (c) net income.arrow_forwardThe following information is available for Bandera Manufacturing Company for the month ending January 31:Cost of goods manufactured $4,490,000Selling expenses 530,000Administrative expenses 340,000Sales 6,600,000Finished goods inventory, January 1 880,000Finished goods inventory, January 31 775,000For the month ended January 31, determine Bandera’s (a) cost of goods sold, (b) gross profit, and (c) net income.arrow_forward

- Revenue is $125,000. Cost of goods sold are $75,000. Calculate gross margin. O 20% O 40% 60% 80%arrow_forwardProvide answerarrow_forwardQuestion 7 - HW 1 (Chapter 2) ezto.mheducation.com xtmap/index.html?_con=c ernal browser=081aunchUr=https253A232252E Saved Required information (The following information applies to the questions displayed below.] Alexandria Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1. Inventory Classification Raw material Work in process Finished goods January 1, 20x1 $ 50,000 120,000 170,000 December 31, 20x1 $ 70,000 115,000 165,000 Durjng 20x1, the company purchased $250,000 of raw material and spent $400,000 on direct labor. Manufacturing overhead costs were as follows: Indirect material Indirect labor Depreciation on plant and equipment Utilities 12,000 26,000 100,000 26,000 30, 000 Other Sales revenue was $1,110,000 for the year. Selling and administrative expenses for the year amounted to $110.000, The firm's tax rate is 40 percent. 3. Prepare an income statement. Prisc Insert F8 F10 F11 F12 F9 24 & 4. 7 8. 10arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education