FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

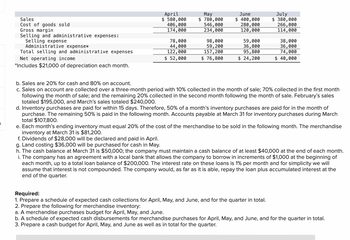

Transcribed Image Text:Sales

Cost of goods sold

Gross margin

Selling and administrative expenses:

Selling expense

Administrative expense*

Total selling and administrative expenses

Net operating income

546,000

April

$ 580,000

406,000

May

$ 780,000

June

$ 400,000

280,000

July

$ 380,000

266,000

174,000

234,000

120,000

114,000

78,000

98,000

59,000

38,000

44,000

59,200

36,800

36,000

122,000

157,200

95,800

74,000

$ 52,000

$ 76,800

$ 24,200

$ 40,000

*Includes $21,000 of depreciation each month.

5

b. Sales are 20% for cash and 80% on account.

c. Sales on account are collected over a three-month period with 10% collected in the month of sale; 70% collected in the first month

following the month of sale; and the remaining 20% collected in the second month following the month of sale. February's sales

totaled $195,000, and March's sales totaled $240,000.

d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of

purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for inventory purchases during March

total $107,800.

e. Each month's ending inventory must equal 20% of the cost of the merchandise to be sold in the following month. The merchandise

inventory at March 31 is $81,200.

f. Dividends of $28,000 will be declared and paid in April.

g. Land costing $36,000 will be purchased for cash in May.

h. The cash balance at March 31 is $50,000; the company must maintain a cash balance of at least $40,000 at the end of each month.

i. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of

each month, up to a total loan balance of $200,000. The interest rate on these loans is 1% per month and for simplicity we will

assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the

end of the quarter.

Required:

1. Prepare a schedule of expected cash collections for April, May, and June, and for the quarter in total.

2. Prepare the following for merchandise inventory:

a. A merchandise purchases budget for April, May, and June.

b. A schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total.

3. Prepare a cash budget for April, May, and June as well as in total for the quarter.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Question 16 A merchandising company reported the following results for July, shown here $402.800 $169,100 $17.100 $14.200 $7.600 $30,100 Sales Cost of goods sold (all variable)) Total variable selling expense Total fised selling expense Total variable administrative expense Total fixed administrative expensearrow_forwardSales revenue Variable cost of goods sold Fixed cost of goods sold Gross profit Variable operating expenses Fixed operating expenses Common fixed costs Operating income (a) $1,360,000 Q Search Baseball V V 919,000 V 123,800 317,200 183,800 85,200 65,000 ($16,800) Soccer $3,900,000 2,535,000 $ 202,200 $ 1,162,800 624,000 91,000 139,000 Basketball $2,560,000 2,065,600 178,000 316,400 Baseball 256,000 78,900 104,900 $308,800 ($123,400) Doug is concerned that two of the company's divisions are showing a loss, and he wonders if the company should stop selling baseball and basketball gear to concentrate solely on soccer gear. Prepare a segment margin income statement. Fixed cost of goods sold and fixed operating expenses can be traced to each division (If the amount is negative then enter with a negative sign preceding the number, e.g.-5.125 or parenthesis, eg (5,125)) C $ Total $7,820,000 5,519,600 $ 504,000 F 1,796,400 1,063,800 255,100 308,900 $168,600 Soccer $ B:arrow_forwardIncome Statement for Bearcat Hathaway, 2022 Sales Less Cost of Goods Sold Gross Profit Less General & Administrative Expenses $10,000,000 $2,470,732 $7,529,268 $1,438,438 $2,656,922 $3,433,908 $924,283 $2,509,625 $527,021 $1,982,604 $312,519 Less Depreciation Earnings Before Interest and Taxes Less Interest Paid Taxable Income (or Earnings Before Taxes) Less Taxes (21% Tax Rate) Net Income Dividends Calculate the operating cash flow. $6,090,830 $1,304,007 $3,433,908 $5,563,809 O $1,982,604arrow_forward

- Need helparrow_forwardAssume the following information for a merchandising company: Number of units sold Selling price per unit. Variable selling expense per unit Variable administrative expense per unit Fixed administrative expenses Beginning merchandise inventory Ending merchandise inventory Merchandise purchases What is the amount of total variable expenses? 20,700 $ 30 $ 3 $2 $ 50,000 $ 24,000 $ 19,000 $ 341,000arrow_forwardIII MT217_Unit... Period Ending Total Sales ABC Company Income Statement 31-Dec-15 Cost of Goods Sold $485,651,000 365,086,000 31-Dec-14 $476,294,000 358,069,000 31-Dec-13 $475,210,000 350,400,000 Gross Profit 120,565,000 118,225,000 124,810,000 Selling Generall and Adminstrative 93,418,000 91,353,000 90,343,000 Operating Profit 27,147,000 26,872,000 34,467,000 Total Other Income/Expenses Net 113,000 119,000 115,000 Earnings before Interest and Taxes 27,034,000 26,753,000 34,352,000 Interest Expense 2,461,000 2,335,000 2,200,000 Income Before Tax 24,573,000 24,418,000 32,152,000 Income Tax Expense 7,985,000 8,105,000 9,800,000 Net Income from Continuing Ops 16,588,000 16,313,000 22,352,000 Discontinued Operations 285,000 Net Income (Net Profit) $16.303,000 144,000 $16,169,000 182,000 $22,170,000 14,000,000 Shares outstanding Market Share price per share $10.00 $9.00 $8.50 Q ABC Company Balance Sheet Period Ending 2015 2014 2013 Assets Current Liabilities Current Assets Accounts Payable…arrow_forward

- The following is the year ended data for Tiger Company: Sales Revenue $58,000 Cost of Goods Manufactured 21,000 Beginning Finished Goods Inventory 1,100 Ending Finished Goods Inventory 2,200 Selling Expenses 15,000 Administrative Expenses 3,900 What is the gross profit? A. $22,100 B. $38,100 C. $19,200 D.arrow_forwardsarrow_forwardThe following is the year ended data for Tiger Company: Sales Revenue Cost of Goods Manufactured Beginning Finished Goods Inventory Ending Finished Goods Inventory Selling Expenses Administrative Expenses What is the cost of goods available for sale? O A. $5,700 OB. $29,300 OC. $26,700 O D. $24,300 $51,000 28,000 1,300 2,600 15,100 3,500arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education