FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please Provide Answer of this Question

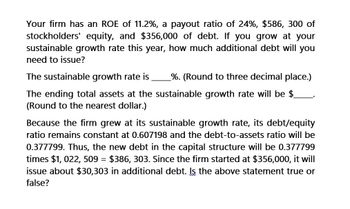

Transcribed Image Text:Your firm has an ROE of 11.2%, a payout ratio of 24%, $586, 300 of

stockholders' equity, and $356,000 of debt. If you grow at your

sustainable growth rate this year, how much additional debt will you

need to issue?

The sustainable growth rate is %. (Round to three decimal place.)

The ending total assets at the sustainable growth rate will be $

(Round to the nearest dollar.)

Because the firm grew at its sustainable growth rate, its debt/equity

ratio remains constant at 0.607198 and the debt-to-assets ratio will be

0.377799. Thus, the new debt in the capital structure will be 0.377799

times $1,022, 509 = $386, 303. Since the firm started at $356,000, it will

issue about $30,303 in additional debt. Is the above statement true or

false?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- XYZ Corp. is anticipating a sustained growth rate of 15% per year. Is it possible for them to achieve this growth rate given the following numbers. Debtequity ratio of 0.40 times Profit margin is 5.3 percent Capital Intensity Ratio is 0,75 times to answer: determine what the dividend payout ratio must be. How do you interpret the result?arrow_forwardYour firm has an ROE of 12.1%, a payout ratio of 21%, $581,200 of stockholders' equity, and $366,400 of debt. If you grow at your sustainable growth rate this year, how much additional debt will you need to issue? The sustainable growth rate is %. (Round to three decimal place.)arrow_forwardYou’ve collected the following information about Odyssey, Inc.:Sales =$165,000Net income = $14,800Dividends = $9,300Total debt = $68,000Total equity = $51,000What is the sustainable growth rate for the company? If it does grow at this rate, how much new borrowing will take place in the coming year, assuming a constant debt –equity ratio? What growth rate could be supported with no outside financing at all?arrow_forward

- Your firm has an ROE of 12.1%, a payout ratio of 27%, $594,200 of stockholders' equity, and $386,100 of debt. If you grow at your sustainable growth rate this year, how much additional debt will you need to issue?arrow_forwardVWX Inc., has sales of $500,000, net income of $80,000, dividend payout of 50%, total assets of $700,000 and target debt-equity ratio of 1.5. If the company grows at its sustainable growth rate in the coming year, how much new borrowing (to the nearest dollar) will take place?arrow_forwardA firm will earn a taxable net return of $500 million next year. If it took on debt today, it would have to pay creditors\varepsilon(rDebt) = 5% + 10% x wDebt2. Thus, if the firm has 100% debt, the financial markets would demand 15% expected rate of return. Further, assume that the financial markets will lend the firm capital at this overall net cost of 15%, regardless of how the firm is financed. The firm is in the 25% marginal tax bracket. 1. If the firmis fully equity-financed, what is its value? 2. Using APV, if the firm is financed with equal amounts of debt and equity today, what is its value? 3. Using WACC, if the firm is financed with equal amounts of debt and equity today, what is its value? 4. Does this firm have an optimal capital structure? If so, what is its APV and WACC?arrow_forward

- XYZ Corp. is anticipating a sustained growth rate of 15% per year. Is it possible for them to achieve this growth rate given the following numbers. Debtequity ratio of 0.40 times Profit margin is 5.3 percent Capital Intensity Ratio is 0.75 times To answer: determine what the dividend payout ratio must be. How do you interpret the result? no excel plzarrow_forwardA firm’s current profits are P550,000. These profits are expected to grow indefinitely at a constant annual rate of 5 percent. If the firm’s opportunity cost of funds is 8 percent, determine the value of the firm: a. The instant before it pays out current profits as dividends: b. The instant after it pays out current profits as dividends.arrow_forwardYou have located the following information on Webb’s Heating & Air Conditioning: debt ratio is 63 percent, capital intensity is 1.20 times, profit margin is 11.6 percent, and the dividend payout is 16.00 percent. Calculate the sustainable growth rate for Webb. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Sustainable growth rate = ____.__ %arrow_forward

- I need help with this problem and how to set it up in excel with formulas.arrow_forwardFor the next fiscal year, you forecast net income of $51,100 and ending assets of $506,900. Your firm's payout ratio is 10.2%. Your beginning stockholders' equity is $298,800, and your beginning total liabilities are $120,700. Your non-debt liabilities, such as accounts payable, are forecasted to increase by $10,000. What will be your net new financing needed for next year? The net financing required will be $. (Round to the nearest dollar.) Carrow_forwardA firm's current profits are $700,000. These profits are expected to grow indefinitely at a constant annual rate of 3 percent. If the firm's opportunity cost of funds is 5 percent, determine the value of the firm: Instructions: Enter your responses rounded to two decimal places. a. The instant before it pays out current profits as dividends. million b. The instant after it pays out current profits as dividends. millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education