Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

I need answer of this question general accounting

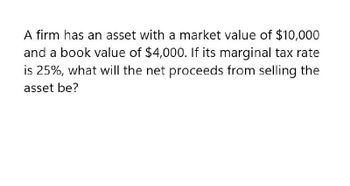

Transcribed Image Text:A firm has an asset with a market value of $10,000

and a book value of $4,000. If its marginal tax rate

is 25%, what will the net proceeds from selling the

asset be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What are its after tax earnings?arrow_forwardWhat is the firms ROE?arrow_forwardAssume that in 20X2, sales increase by 10 percent and cost of goods sold increases by 20 percent. The firm is able to keep all other expenses the same. Assume a tax rate of 30 percent on income before taxes. What is income after taxes and the profit margin for 20X2?arrow_forward

- What are its after tax earnings? General accountingarrow_forwardPlease give me answerarrow_forwardA firm will earn a taxable net return of $500 million next year. If it took on debt today, it would have to pay creditors\varepsilon(rDebt) = 5% + 10% x wDebt2. Thus, if the firm has 100% debt, the financial markets would demand 15% expected rate of return. Further, assume that the financial markets will lend the firm capital at this overall net cost of 15%, regardless of how the firm is financed. The firm is in the 25% marginal tax bracket. 1. If the firmis fully equity-financed, what is its value? 2. Using APV, if the firm is financed with equal amounts of debt and equity today, what is its value? 3. Using WACC, if the firm is financed with equal amounts of debt and equity today, what is its value? 4. Does this firm have an optimal capital structure? If so, what is its APV and WACC?arrow_forward

- Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forward4. Binford Tools has an expected perpetual EBITDA equal to $67k. Its tax rate is 35%. Binford has $139k in debt at a cost of 6.85%. The unlevered capital cost is 10.25%. What is Binford's total value assuming interest is tax deductible?arrow_forwardVapor Lock Motors’ EBIT is $7,000,000, the company’s interest expense is $2,000,000,and its tax rate is 40 percent. Vapor Lock’s beta is 1.5.a. What is Vapor Lock’s DFL?b. If Vapor Lock were able to grow its EBIT by 50%, what would be the percentageincrease in net income?c. If Vapor Lock were able to grow its EBIT by 50%, what would be the resultingnet income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT