Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I need answer of this question general accounting

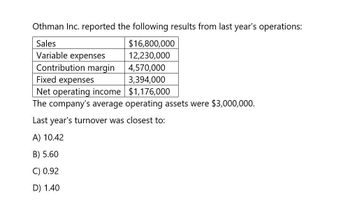

Transcribed Image Text:Othman Inc. reported the following results from last year's operations:

Sales

Variable expenses

$16,800,000

12,230,000

Contribution margin 4,570,000

Fixed expenses

3,394,000

Net operating income $1,176,000

The company's average operating assets were $3,000,000.

Last year's turnover was closest to:

A) 10.42

B) 5.60

C) 0.92

D) 1.40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000,000. A. Based on this information, calculate asset turnover. B. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forwardPlease help me to compute turnover for the year was....show calculationarrow_forwardGeneral Accountingarrow_forward

- The following data has been extracted from the year-end reports of two companies, Company X and Company Y: Company X Company Y Sales $2,700,000 Operating Income $ 256,000 Average Operating Assets $1,725,000 Margin 8.0% Turnover 2.0 Return on Investment 16% Required: Fill in the missing data for the above table. Show all calculations.arrow_forwardMargin, Turnover, Return on Investment, Average OperatingAssetsElway Company provided the following income statement for the last year:Sales $1,040,000,000Less: Variable expenses 700,250,000Contribution margin $ 339,750,000Less: Fixed expenses 183,750,000Operating income $ 156,000,000At the beginning of last year, Elway had $28,300,000 in operating assets. At the end of the year,Elway had $23,700,000 in operating assets.Required:1. Compute average operating assets.2. Compute the margin and turnover ratios for last year. (Note: Round the answer formargin ratio to two decimal places.)3. Compute ROI. (Note: Round answer to two decimal places.)4. CONCEPTUAL CONNECTION Briefly explain the meaning of ROI.5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company isrelatively high (as compared to the lower ROI of a typical manufacturing company).arrow_forwardAPX Co achieved $16 million revenue in the year that has just ended and expects revenue growth of 8.4% in the next year. Cost of sales in the year that has just ended was $10.88 million and other expenses were $1.44 million. The financial statements of APX for the year that has just ended contain the following statement of financial position: $m $m Non-current assets 22.0 Current assets 2.4 Inventory 2.2 Trade Receivables 4.6 Total Assets 26.6 $m $m Equity Finance 5.0 Ordinary Shares 7.5 Reserves 12.5 Long-term bank loan 10.0 22.5 Current Liabilities 1.9 Trade Payables 2.2 Overdraft 4.1 Total equity and liabilities 26.6 The long-term bank loan has a fixed annual interest rate of 8% per year. APX pays taxation at an annual rate of 30% per year.…arrow_forward

- Margin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: Sales $865,050,000 Less: Variable expenses 550,973,000 Contribution margin $314,077,000 Less: Fixed expenses 192,762,000 Operating income $121,315,000 At the beginning of last year, Elway had $38,661,000 in operating assets. At the end of the year, Elway had $41,350,000 in operating assets. Required: 1. Compute average operating assets.$fill in the blank 1 2. Compute the margin (as a percent) and turnover ratios for last year. If required, round your answers to two decimal places. Margin fill in the blank 2 % Turnover fill in the blank 3 3. Compute ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places.fill in the blank 4 % 4. ROI measures a company’s ability to generate relative to its investment in assets. The greater the ROI, the efficiently the company…arrow_forwardCalculating the Average Total Assets and the Return on Assets The income statement, statement of retained earnings, and balance sheet for Santiago Systems are as follows: Santiago Systems Income Statement For the Year Ended December 31, 20X2 Amount Percent Net sales $5,345,000 100.0% Less: Cost of goods sold (3,474,250) 65.0 Gross margin $1,870,750 35.0 Less: Operating expenses (1,140,300) 21.3 Operating income $730,450 13.7 Less: Interest expense (27,000) 0.5 Income before taxes Less: Income taxes (40%)* $703,450 13.2 (281,380) 5.3 Net income $422,070 7.9 * Includes both state and federal taxes.arrow_forwardComprehensive Incomearrow_forward

- Question: Comprehensive Income-Accounting Last year a company had sales of $460,000, a turnover of 2.5, and a return on investment of 62.5%. The company's net operating income for the year was: $184,000 $287,500 $172,500 $115,000arrow_forwardMargin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: Sales $879,510,000 Less: Variable expenses 558,460,000 Contribution margin $321,050,000 Less: Fixed expenses 198,790,000 Operating income $122,260,000 At the beginning of last year, Elway had $38,636,000 in operating assets. At the end of the year, Elway had $41,336,000 in operating assets. Required: 1. Compute average operating assets.$ 2. Compute the margin (as a percent) and turnover ratios for last year. If required, round your answers to two decimal places. Margin % Turnover 3. Compute ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places. % 4. ROI measures a company’s ability to generate relative to its investment in assets. The greater the ROI, the efficiently the company is generating from its assets. 5. CONCEPTUAL CONNECTION Comment on why the ROI…arrow_forwardPlease provide correct answer accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College