FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

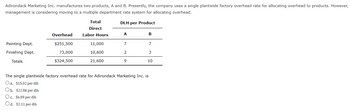

Adirondack Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory

Overhead |

Total Direct Labor Hours |

DLH per Product | ||||

| A | B | |||||

| Painting Dept. | $251,500 | 11,000 | 7 | 7 | ||

| Finishing Dept. | 73,000 | 10,600 | 2 | 3 | ||

| Totals | $324,500 | 21,600 | 9 | 10 |

The single plantwide factory overhead rate for Adirondack Marketing Inc. is

Transcribed Image Text:Adirondack Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However,

management is considering moving to a multiple department rate system for allocating overhead.

DLH per Product

Painting Dept.

Finishing Dept.

Totals

Overhead

$251,500

73,000

$324,500

Total

Direct

Labor Hours

11,000

10,600

21,600

A

7

2

9

B

7

3

10

The single plantwide factory overhead rate for Adirondack Marketing Inc. is

Oa. $15.02 per dlh

Ob. $22.86 per dlh

Oc. $6.89 per dlh

Od. $2.11 per dlh

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Spacely, Corp. makes sprockets in two models: regular and professional, and wants to refine its costing system by allocating overhead using departmental rates. The estimated $843,100 of manufacturing overhead has been divided into two cost pools: Assembly Department and Packaging Department.The following data has been compiled: Spacely, Corp. Assembly Department Packaging Department Total Overhead costs $550,000 $293,100 $843,100 Machine Hours: Regular Model 153,000 35,100 188,100 Professional Model 352,400 12,600 365,000 Direct Labor Hours: Regular Model 40,300 80,600 120,900 Professional Model 322,700 413,400 736,100 (Round your answers to two decimal places when needed and use rounded answers for all future calculations).arrow_forwardMultiple Production Department Factory Overhead Rate Method Four Finger Appliance Company manufactures small kitchen appliances. The product line consists of blenders and toaster ovens. Four Finger Appliance presently uses the multiple production department factory overhead rate method. The factory overhead is as follows: Assembly Department Test and Pack Department Total The direct labor information for the production of 7,500 units of each product is as follows: Blender Toaster oven Total $186,000 120,000 $306,000 Assembly Department Test and Pack Department 750 dih 2,250 dlh 750 Product Blender 2,250 3,000 dih Four Finger Appliance used direct labor hours to allocate production department factory overhead to products. Toaster oven 3,000 dlh If required, round all per unit answers to the nearest cent. a. Determine the two production department factory overhead rates. Assembly Department Test and Pack Department b. Determine the total factory overhead and the factory overhead per unit…arrow_forwardAdirondack Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. Painting Dept. Finishing Dept. Totals Overhead $254,100 80,200 $334,300 Ob. $2.07 per dlh Oc. $7.71 per dlh Od. $24.20 per dlh Total Direct Labor Hours 10,500 10,400 20,900 DLH per Product A 9 6 15 B 10 The single plantwide factory overhead rate for Adirondack Marketing Inc. is Oa. $16.00 per dlh 6 16arrow_forward

- Adirondack Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. Total DLH per Product Direct Overhead Labor Hours B Painting Dept. $248,400 10,300 Finishing Dept. 65,700 10,000 6 Totals $314,100 20,300 11 12 The single plantwide factory overhead rate for Adirondack Marketing Inc. is Oa. $6.57 per dlh Ob. $15.47 per dlh Oc. $2.09 per dlh Od. $24.12 per dlharrow_forwardVaughn Company manufactures two products, Mini A and Maxi B. Vaughn's overhead costs consist of setting up machines- $890,000; machining- $2,030,000; and inspecting- $640,000. Information on the two products is: Mini A Мaxi В Direct labour hours 14,000 26,000 Machine setups 700 500 Machine hours 21,000 23,000 Inspections 700 600 Overhead applied to Maxi B using traditional costing and direct labour hours isarrow_forwardRequlred Information Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z Estimated Overhead Cost $ 242,400 $114,400 86,000 $ 302,400 Expected Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours 12,000 MHs 220 setups 2 products 12,000 DLHS Activity Measure Machining, Number of setups Number of products Direct labor-hours Product Y 8,200 40 1. 8,200 Product Z 3,800 180 1. 3,800 Required: 1. What is the company's plantwide overhead rate? (Round your enswer to 2 declmal places.) Predetermined overhead rate, per DLH of 15 甜…arrow_forward

- Spacely, Corp. makes sprockets in two models: regular and professional, and wants to refine its costing system by allocating overhead using departmental rates. The estimated $843,100 of manufacturing overhead has been divided into two cost pools: Assembly Department and Packaging Department.The following data has been compiled: Spacely, Corp. Assembly Department Packaging Department Total Overhead costs $550,000 $293,100 $843,100 Machine Hours: Regular Model 153,000 35,100 188,100 Professional Model 352,400 12,600 365,000 Direct Labor Hours: Regular Model 40,300 80,600 120,900 Professional Model 322,700 413,400 736,100 (Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the predetermined overhead allocation rates using machine hours as the allocation base for the Assembly Department and direct labor hours for the Packaging Department.arrow_forwardComputing departmental overhead allocation rates The Oakman Company (see Short Exercise S19-1) has refined its allocation system by separating manufacturing overhead costs into two cost pools—one for each department. The estimated costs for the Mixing Department, $510,000, will be allocated based on direct labor hours, and the estimated direct labor hours for the year are 170,000. The estimated costs for the Packaging Department, $300,000, will be allocated based on machine-hours, and the estimated machine hours for the year are 40,000. In October, the company incurred 38,000 direct labor hours in the Mixing Department and 10,000 machine hours in the Packaging Department. Requirements Compute the predetermined overhead allocation rates. Round to two decimal places. Determine the total amount of overhead allocated in October.arrow_forwardActivity-Based Costing and Product Cost Distortion Four Finger Appliance Company manufactures small kitchen appliances. The product line consists of blenders and toaster ovens. Four Finger Appliance presently uses the multiple production department factory overhead rate method. The factory overhead is as follows: Assembly Department Test and Pack Department Total The direct labor information for the production of 7,500 units of each product is as follows: Blender Toaster oven Total $186,000 120,000 $306,000 Four Finger Appliance used direct labor hours to allocate production department factory overhead to products. Assembly Activity Test and Pack Activity Setup Activity Assembly Department Test and Pack Department 750 dih 2,250 dlh 750 3,000 dlh The management of Four Finger Appliance Company has asked you to use activity-based costing to allocate factory overhead costs to the two products. You have determined that $81,000 of factory overhead from each of the 2,250 3,000 dlh production…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education