FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

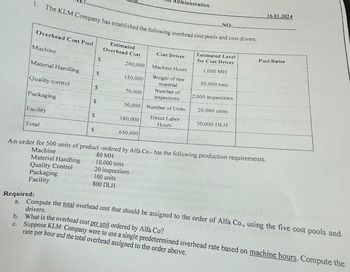

Transcribed Image Text:1. The KLM Company has established the following overhead cost pools and cost drivers.

Overhead Cost Pool

Machine

Material Handling

Quality control

Packaging

Facility

Total

Material Handling

Quality Control

Packaging

Facility

Required:

a.

S

$

$

S

S

S

Estimated

Overhead Cost

200,000

150,000

70,000

180,000

dministration

Number of

inspections

50,000 Number of Units

650,000

Cost Driver

10,000 tons

20 inspections

100 units

800 DLH

Machine Hours

Weight of raw

material

Direct Labor

Hours

.NO:.

Estimated Level

for Cost Driver

1,000 MH

50,000 tons

2,000 inspections

20,000 units

An order for 500 units of product -ordered by Alfa Co.- has the following production requirements.

Machine

80 MH

30,000 DLH

16.01.2024

Pool Rates

Compute the total overhead cost that should be assigned to the order of Alfa Co., using the five cost pools and

drivers.

b. What is the overhead cost per unit ordered by Alfa Co?

c. Suppose KLM Company were to use a single predetermined overhead rate based on machine hours. Compute the

rate per hour and the total overhead assigned to the order above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dengararrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardUnits produced Production runs per quarter Direct materials cost per unit Direct labor cost per unit Supervision Setup labor Incoming inspection Total overhead Manufacturing overhead in the plant has three main functions: supervision, setup labor, and Incoming material Inspection. Data on manufacturing overhead for a representative quarter follow: $ 288,750 336,000 241,500 $ 866,250 Standard 14,000 a. Using current costing system b. Using proposed ABC system 50 $30 50 Required: a. Compute the unit costs for the two products, Standard and Premium, using the current costing system at Benton (using direct labor costs as the allocation basis for overhead). b. Compute the unit costs for the two products, Standard and Premium, using the proposed ABC system at Benton. Note: For all requirements, do not round Intermediate calculations. Round your answers to 2 decimal places. S S Answer is complete but not entirely correct. Premium 3,500 25 $64 75 Unit cost Standard 120.00 X S 117.67 X S…arrow_forward

- S Activity Cost Pool Labor-related Purchase orders Product testing Template etching General factory Activity Cost Pool Labor-related (DLHS) Activity Measure Direct labor-hours Number of orders Number of tests Number of templates Machine-hours Product A Product B Product C Product D Cost $ 19,250 $ 1,820 $ 6,320 $ 960 $ 68,600 Total Overhead Cost 2. The expected activity for the year was distributed among the company's four products as follows: Expected Activity 1,375 DLHS Expected Activity Product A Product B Product C Product D 300 650 125 300 20 65 180 190 Purchase orders (orders) Product testing (tests) 65 0 80 Template etching (templates) 250 0 26 10 4 General factory (MHs) 3,800 2,000 1,200 2,800 Using the ABC data, determine the total amount of overhead cost assigned to each product. 455 orders 395 tests 40 templates S 9,800 MHsarrow_forwardProduction and sales (units) Materials cost ($) Labour cost per unit ($) at $12 per hour Machine hours (per unit) Total no. of production runs Total no. of purchase orders Total no. of deliveries to retail division Market/Retail prices Overhead costs: Machine set-up costs ($) Machine maintenance costs ($) Ordering costs ($) Delivery costs ($) Total ($) Product S Product R 3,200 5,450 117 95 9 1 12 64 80 260 total: 6 2 30 82 64 320 306,435 415,105 11,680 144,400 877,620 Rinse @ $241.69 = full cost +10% oll Retail price Rinse: $260 The company's policy is to transfer the washing machines from the assembly division to the retail division at full cost plus 10% resulting in internal transfer prices, of $220.17 and $241.69 for S and R when transferred to the retail division. The retail division sells S for $320 per machine and R for $260 per machine to the market. (a) Use activity based costing to allocate the overheads and recalculate the transfer prices for S and R. (b) Calculate the…arrow_forwardCompute conversion costs given the following data: direct materials, $356,600; direct labor, $196,300; factory overhead, $194,500 and selling expenses, $40,900. a.$390,800 b.$153,600 c.$551,100 d.$747,400arrow_forward

- Equivalent Units of Production and Related Costs The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 8,000 units, 65% completed 31,880 To Finished Goods, 184,000 units ? Direct materials, 188,000 units @ $2.10 394,800 Direct labor 404,400 Factory overhead 157,320 Bal., ? units, 20% completed ? Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount is zero or a blank, enter in "0". Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs WholeUnits Equivalent UnitsDirect Materials Equivalent UnitsConversion Inventory in process, beginning…arrow_forwardQ. 2arrow_forwardA local picnic table manufacturer has budgeted these overhead costs - ERROR: "Handling materials" is $33,350 - (note their order as you will use the same order down below): Purchasing Handling materials Machine setups $70,000 33,333 70,500 25,500 45,000 Inspections Utilities They are considering adapting ABC costing and have estimated the cost drivers for each pool as shown (again, note their order): Cost Driver Activity Orders 700 Material moves Machine setups Number of inspections Square feet 1,334 15,000 5,000 180,000 Recent success has yielded an order for 1,000 tables. Assume direct labor costs per hour of $20. Determine how much the job would cost given the following activities (once more, note their order for the last worksheet): Activity Order (units) Direct materials 1,000 112,700 15,200 5,300 60 Machine hours Direct labor hours Number of purchase orders Number of material moves Number of machine setups Number of inspections Number of square feet occupied 800 100 450 8,000…arrow_forward

- Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Activity data have been supplied for the following two products: Number of units produced per year Direct labor-hours Machine-hours Machine setups Production orders Shipments Product sustaining Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Total overhead cost Activity Rates $9 per direct labor-hour $3 per machine-hour $45 per setup $150 per order $ 130 per shipment $ 875 per product K425 0 $ Total Expected Activity K425 M67 2,000 M67 200 1,000 2,800 Required: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? 0 7 7 14 2 50 40 2 NNNN 2arrow_forwardEstimated Estimated Cost Drivers Activity Cost Overhead Street Mountain Pools Costs Tires Tires Machine set ups $ 90,000 150 350 Assembling $500,000 25,000 15,000 Inspection $400,000 180 320 Question Using the activity-based costing approach, determine the applied overhead rates for Darter Company.arrow_forwardProduction and cost data Production and sales units Selling price (per unit) Materials (per unit) Labor (per unit) Manufacturing overheads Dept. A Standrad 192000 24000 $15 1.7 4.3 Dept. B Designer wear Number of machine set-ups 4 Marketing overheads $50 8 14.2 24 Engineering and PC Marketing and CS 745200 1296000 Use single-rate; direct method to allocate engineering and marketing overheads Engineering overheads include machine setting ($460,800) and inspection ($284,400) activities. Marketing involves channel ($496,000) and branding ($800,000) activities. The inspection and channel costs are driven by the number of units produced & sold. Computing product costs and profits under conventional and ABC approachesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education