FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Dinesh Bhai

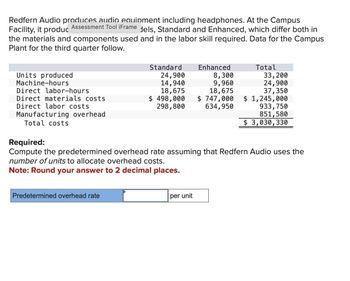

Transcribed Image Text:Redfern Audio produces audio equipment including headphones. At the Campus

Facility, it produc Assessment Tool iFrame dels, Standard and Enhanced, which differ both in

the materials and components used and in the labor skill required. Data for the Campus

Plant for the third quarter follow.

Units produced

Machine-hours

Direct labor-hours

Direct materials costs

Direct labor costs

Manufacturing overhead

Total costs

Standard

24,900

14,940

18,675

$ 498,000

298,800

Predetermined overhead rate

Enhanced

8,300

9,960

18,675

$ 747,000 $ 1,245,000

634,950

933, 750

851,580

$3,030,330

Total

per unit

Required:

Compute the predetermined overhead rate assuming that Redfern Audio uses the

number of units to allocate overhead costs.

Note: Round your answer to 2 decimal places.

33,200

24,900

37,350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question No 01 What is a difference between “Musharaka and Mudaraba”? What are the common basic rules between them to be followed? What are the uncommon rules between them?arrow_forwardEgyghh gyuarrow_forwardUse the following accounts; Cash Foreign exchange gain Foreign exchange loss Capital Bank Short-term investments Loss on sale of short-term investment Gain on sale of short-term investment RA established his own company, r@ktas Co. The following transactions are the events that occurred during December 2018, the company's first month: Date 12/1 The owner invested $ 200,000 cash for capital. 12/5 r@ktas Co., opened deposit account on Don't Trust Bank and put 2.000 Euro (Exchange rate was 1 Euro= 1,5 Dollar) 12/10 The Company purchased short-term investment with cash for $2,500. 12/18 The Company sold short-term investment with cash for $2.000 Note: • Exchange rate was 1 Euro= 1,4 Dollar at the end of the period. Requirements: 1- Give the journal entry for each transaction. 2- Post each transaction to Taccounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education