Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Do not use

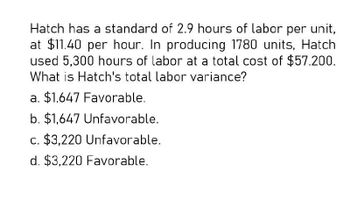

Transcribed Image Text:Hatch has a standard of 2.9 hours of labor per unit,

at $11.40 per hour. In producing 1780 units, Hatch

used 5,300 hours of labor at a total cost of $57.200.

What is Hatch's total labor variance?

a. $1,647 Favorable.

b. $1,647 Unfavorable.

c. $3,220 Unfavorable.

d. $3,220 Favorable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardThe standard number of hours that should have been worked for the output attained is 6,000 direct labor hours and the actual number of direct labor hours worked was 6,300. If the direct labor price variance was $3,150 unfavorable, and the standard rate of pay was $9 per direct labor hour, what was the actual rate of pay for direct labor? Select one: a. $7.50 per direct labor hour b. $8.50 per direct labor hour c. $9.50 per direct labor hour d. $9.00 per direct labor hour e. $9.80 per direct labor hourarrow_forwardCan you show me how this is done? Bailey’s standard labor cost of producing one unit of Product DD is 1.7 hours at a rate of $12.9 per hour. During August, 1,462 hours were incurred at a cost of $11.8 per hour to produce 1,257 units of Product DD. Bailey’s direct labor rate variance is $__________ Indicate the amount and whether it is Favorable or Unfavorable by placing F or U by amount, do not skip a space and do not use $ in your answer. For example, if your answer is $1,000 favorable, answer 1000F Selected Answer: 8.24 Correct Answer: 1,608 ± 1 (F)arrow_forward

- The per-unit standards for direct labor are 2 direct labor hours at $15 per hour. If in producing 2,300 units, the actual direct labor cost was $68,800 for 4,300 direct labor hours worked, the total direct labor variance is____? I want Solutionarrow_forwardCan you show me how this is done? How do I know if it is favorable or unfavorable? Bailey’s standard labor cost of producing one unit of Product DD is 1.8 hours at a rate of $10.1 per hour. During August, 2,515 hours were incurred at a cost of $12.9 per hour to produce 1,087 units of Product DD. Bailey’s direct labor efficiency variance is $__________ Indicate the amount and whether it is Favorable or Unfavorable by placing F or U by amount, do not skip a space and do not use $ in your answer. For example, if your answer is $1,000 favorable, answer 1000F Selected Answer: -5,639.84U Correct Answer: 5,640 ± 1 (U)arrow_forwardThe per-unit standards for direct labor are 2 direct labor hours at $15 per hour. If in producing 2,300 units, the actual direct labor cost was $68,800 for 4,300 direct labor hours worked, the total direct labor variance is____?arrow_forward

- Yang’s standard labor cost of producing one unit of Product One is 1.7 hours at a rate of $11.1 per hour. During September, 1,558 hours were incurred at a cost of $12.7 per hour to produce 1,299 units of Product One. what is Yang’s direct labor efficiency variancearrow_forwardThe per-unit standards for direct labor are 1.4 direct labor hours at $13 per hour. If in producing 2800 units, the actual direct labor cost was $45200 for 3400 direct labor hours worked, the total direct labor variance is $5760 favorable. $2360 unfavorable. $5760 unfavorable. $2800 unfavorable.arrow_forwardThe actual cost of direct labor per hour is $16.25 and the standard cost of direct labor per hour is $15.00. The direct labor hours allowed per finished unit is 0.60 hours. During the current period, 4,500 units of finished goods were produced using 2,900 direct labor hours. How much is the direct labor rate variance? A. $3,625 favorable B. $3,625 unfavorable C. $4,350 favorable D. $4,350 unfavorablearrow_forward

- The actual cost of direct labor per hour is $16.00 and the standard cost of direct labor per hour is $15.50. The direct labor hours allowed per finished unit is 0.5 hour. During the current period, 5,500 units of finished goods were produced using 3,000 direct labor hours. How much is the direct labor efficiency variance? a. $3,875 favorable b. $3,875 unfavorable c. $4,000 favorable d. $4,000 unfavorablearrow_forwardBailey’s standard labor cost of producing one unit of Product DD is 1.8 hours at a rate of $12.4 per hour. During August, 1,436 hours were incurred at a cost of $11.1 per hour to produce 1,134 units of Product DD. Bailey’s direct labor rate variance is $__________ Indicate the amount and whether it is Favorable or Unfavorable by placing F or U by amount, do not skip a space and do not use $ in your answer. For example, if your answer is $1,000 favorable, answer 1000F Selected Answer: 9,371.28F Correct Answer: 1,867 ± 1 (F)arrow_forwardGet Answer Of this One with Method of Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning