Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hi expart give correct answer

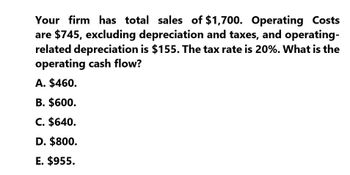

Transcribed Image Text:Your firm has total sales of $1,700. Operating Costs

are $745, excluding depreciation and taxes, and operating-

related depreciation is $155. The tax rate is 20%. What is the

operating cash flow?

A. $460.

B. $600.

C. $640.

D. $800.

E. $955.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Carter Swimming Pools has $16 million in net operating profit after taxes (NOPAT) in the current year. Carter has $12 million in total net operating assets in the current year and had $10 million in the previous year. What is its free cash flow?arrow_forwardI want correct answerarrow_forwardYour firm has total sales of $1,700. Operating Costs are $745, excluding depreciation and taxes, and operating- related depreciation is $155. The tax rate is 20%. What is the operating cash flow? A. $460. B. $600. C. $640. D. $800. E. $955.arrow_forward

- Suppose a firm has the following information: Sales = $10million; costs of goods sold (excluding depreciation) = $5 million;depreciation = $1.4 million; other operating expenses = $2 million;interest expense = $1 million. If the tax rate is 25%, what is NOPAT,the net operating profit after taxes? ($1.2 million)arrow_forwardA firm has sales of $96,400, costs of $53,800, interest paid of $2,800, and depreciation of $7,100. The tax rate is 34 percent. What is the value of the cash coverage ratio? ○ Al 1727 B) 1521 12.68 D) 12.14 0日 23.41arrow_forwardGiven are the following data for year 1:Revenue = $45 million; Variable cost = $10 million; Fixed cost = $5 million; Depreciation = $1 million; Interest expense = $3 million; Capital expenditure = $12 million; Change in working capital = $2 million. Corporate tax rate is 30%. Calculate the free cash flow to firm (FCFF) for year 1: a. $4.2 million b. $6.3 million c. $7.3 million d. $5.2 millionarrow_forward

- Consider the following income statement: Sales $ 383,208Costs 249,312Depreciation 56,700Taxes 25% Calculate the EBIT. Calculate the net income. Calculate the OCF. What is the depreciation tax shield? Pls fastarrow_forwardconsider a company with sales of $18,000.0 million, cost of goods sold of 42% of sales, other expenses including salaries ( we usually call this SG&A for selling, general and administrative) of 1750.0million, depreciation of 2250.0 million, and interest expense of 2300 million. tax rate =21%. a. generate an income statement and show net income b. what is the company's operating cash flow? c. if there are 775.2 million shares outstanding, what is the EPS? d. if the company has a payout ratio of 20%, what is the dividends per share?arrow_forwardFergus Inc. has sales of $47,000, costs of $19,900, depreciation expense of $3,400, and interest expense of $2,900. If the tax rate is 35%, what is the operating cash flow, or OCF? (Omit $ sign in your response.) Operating cash flow $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning