Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hello expart need help please

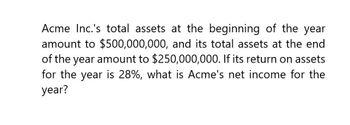

Transcribed Image Text:Acme Inc.'s total assets at the beginning of the year

amount to $500,000,000, and its total assets at the end

of the year amount to $250,000,000. If its return on assets

for the year is 28%, what is Acme's net income for the

year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- C Company has the following data for the year ending 12/31/2020 (dollars are in thousands): Net income = $600; EBIT = $1,184; Total assets = $3,000; Short-term investments = $200; Total capital employed = $2,193; and tax rate = 30%. The company’s WACC is 11.07%. What was its Economic Value Added (EVA) for the year 2020? Round your answer to the nearest dollar. Group of answer choices: $583 $586 $577 $572 $580arrow_forwardIn 2020, Concord Corporation reported net income of $5.8 billion, net sales of $160 billion, and average total assets of $60 billion. What is Concord Corporation's return on assets? 16.9% 9.7% 20.6% 10.3%arrow_forwardRollins Corp's total assets at the end of last year were $300,000 and its EBIT was $75,000. What was its basic earning power (BEP)?arrow_forward

- For the year ended December 31, 2019, Settles Inc. earned an ROI of 9.9%. Sales for the year were $17 million, and the average asset turnover was 3.3. Average stockholders' equity was $2.3 million. Required: a. Calculate Settles Inc.'s margin and net income. b. Calculate Settles Inc.'s return on equity.arrow_forwardUsing the AFN formula approach, calculate the total assets of Harmon Photo Company given the following information: Sales this year = $3,000; increase in sales projected for next year = 20%; net income this year = $250; dividend payout ratio = 40%; projected excess funds available next year = $100; accounts payable = $600; notes payable = $100; and accrued wages and taxes = $200. Except for the accounts noted, there were no other current liabilities. Assume that the firm’s profit margin remains constant and that the firm is operating at full capacity. $3,000 $2,200 $2,000 $1,200 $1,000arrow_forwardRiver Corp's total assets at the end of last year were $405,000 and its net income was $32,750. What was its return on total assets?arrow_forward

- In 2021, Noble Tech Inc. reported that the company's Return on Assets (ROA) was 10%, and its net profit margin was 6%. Calculate the company's total asset turnover (round your answer to two decimal places).arrow_forwardA company has the following items for the fiscal year 2020: Revenue = 10 million EBIT = 4 million Net income = 2 million Total Equity = 15 million Total Assets = 30 million Calculate the company’s net profit margin, asset turnover, equity multiplier and ROEarrow_forwardGiven the most recent financial statements for FY2023. Sales for FY2024 are expected to grow by 10 percent. The following assumption must be held in the pro forma financial statements. The tax rate (percentage), the interest expense ($ amount), and the dividend payout ratio (percentage) will remain constant. COGS, SGA, Depreciation, all current asset accounts, Net PPE, intangibles, other assets, and accounts payable increase spontaneously with sales. Calculate the internal growth rate if the firm operates at full capacity and no new debt or equity is issued. (Enter percentages as decimals and round to 4 decimals) MSFT ($ in millions, shares in millions) Income Statement Sales COGS Gross Profit Research and Dev. SGA FY2023 211,915 65,863 146,052 27,195 16653 Depreciation 13681 Operating Income, EBIT 88,523 Interest Expense 1968 Pretax income, EBT 86,555 Taxes 16950 Net income 69,605 32,902 36,703 Retained Earnings Dividends Price per share Shares outstanding 330.24 7,430 Balance Sheet…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning