FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![Required information.

Problem 22-52 (LO 22-3) (Algo)

[The following information applies to the questions displayed below]

Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In

year 1, Julio and Milania each received distributions of $10,000 from Falcons Corporation.

Sales revenue

Cost of goods sold

Falcons Corporation (an 5 Corporation)

Income Statement

December 31, Year 1 and Year 2

Salary to owners Julio and Milania.

Employee wages

Depreciation expense

Section 179 expense

Interest income (related to business income)

Municipal bond income

Government fines

Overall net income

Distributions

Year 1

$ 335,000

(42,000)

(40,000)

(30,000)

(20,000)

(30,000)

10,000

1,700

0

$184,700

$ 20,000

Year 2

465,000

(65,000)

(80,000)

(60,000)

(40,000)

(50,000)

18,500

4,400

(3,000)

$ 189,900

$ 50,000](https://content.bartleby.com/qna-images/question/137907d2-7cd9-45ce-83ce-572520aa2fad/013c6b6e-278c-4fd8-8243-ca313281af80/qszvxu7_thumbnail.jpeg)

Transcribed Image Text:Required information.

Problem 22-52 (LO 22-3) (Algo)

[The following information applies to the questions displayed below]

Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In

year 1, Julio and Milania each received distributions of $10,000 from Falcons Corporation.

Sales revenue

Cost of goods sold

Falcons Corporation (an 5 Corporation)

Income Statement

December 31, Year 1 and Year 2

Salary to owners Julio and Milania.

Employee wages

Depreciation expense

Section 179 expense

Interest income (related to business income)

Municipal bond income

Government fines

Overall net income

Distributions

Year 1

$ 335,000

(42,000)

(40,000)

(30,000)

(20,000)

(30,000)

10,000

1,700

0

$184,700

$ 20,000

Year 2

465,000

(65,000)

(80,000)

(60,000)

(40,000)

(50,000)

18,500

4,400

(3,000)

$ 189,900

$ 50,000

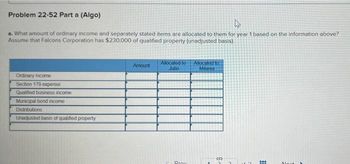

Transcribed Image Text:Problem 22-52 Part a (Algo)

4

a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above?

Assume that Falcons Corporation has $230,000 of qualified property (unadjusted basis).

Ordinary income

Section 179 expense

Qualified business income

Municipal bond income

Distributions

Unadjusted basis of qualified property

Amount

Allocated to

Julio

Prox

Allocated to

Milania

-S

***

Mont

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Skip to question [The following information applies to the questions displayed below.] BCS Corporation is a calendar-year, accrual-method taxpayer. BCS was formed and started its business activities on January 1 of this year. It reported the following information for the year. Indicate BCS's deductible amount for this year in each of the following alternative scenarios. (Leave no answers blank. Enter zero if applicable.) b. BCS accrued an expense of $50,000 for amounts it anticipated it would be required to pay under the workers' compensation act. During the year, BCS actually paid $10,000 for workers' compensation–related liabilities.arrow_forwardI nee all solution......A3arrow_forwardNn.64. Subject :- Accountarrow_forward

- 1. For calendar year January to December 2020, A duly accredited private educational institution with valid accrediation reported net taxable income in its 1702 amounting to P1,000,000. If its total assets is less than P100,000, 000, its income tax due in 1702 isa. 32.5kb. 50,000c. 55,000d. 10,000 2. For calendar year January to December 2020, A private educational institution with no Valid accreditation reported net taxable income in its 1702 amounting to P1,000,000. If its total assets is less than P100,000, 000, its income tax due in 1702 isa. 250,000b. 200,000c. 275,000d. 225,000 3. For calendar year January to December 2020, A duly accredited private not for profit hospital reported net taxable income in its 1702 amounting to P1,000,000, P550,000 of which are from unrelated businesses. If its total assets is less than P100,000, 000, its income tax due in 1702 isa. 250,000b. 200,000c. 275,000d. 225,000 4. In the general professional partnership of X and Y, P1,500,000 net income…arrow_forwardPT. A in the year 2020 reported an accounting profit before tax of IDR 800.000.000.000. The following information is related to the year 2020: The entity donated IDR 40.000.000.000 to the surrounding community PT A has interest income of IDR 100.000.000.000 which is subject to final tax of 20%. PT A purchased a fixed asset of IDR 200.000.0000, which is depreciated for 4 year for book purposes while for tax purposes is depreciated in 8 years (straight line with no residual value). PT A made a provision for uncollectible account receivable of IDR 10.000.000.000 which is not deductible for tax purposes Required: Prepare a schedule of the deferred tax (asset) and liability. assume there is no beginning deferred tax asset or liability. Compute the net deferred tax expense (benefit). Prepare the journal entry to record income tax expense, deferred taxes, and the income taxes payable for 2020arrow_forwardIn the process of using the net worth method, ou find that the reported taxable income of a person is $92,000 and overall personal expenes are $61,000. The net worth you calculate through various records at year end is $611,000 while the net worth amount at the beginning of the year is $430,000. Any unexplained net worth increase or decrease would be?arrow_forward

- ABC SAOG is a taxable entity in Oman. The business incurred General expense of OMR 12,500 during the tax year 2019 was charged on the Profit & Loss Account. Investigation records shows that OMR 5,000 of the above expenses are not related to the purpose of producing the gross income. The tax treatment for the tax year 2019 is a. Non-deductible expenditure of OMR 7,500 b. Deductible expenditure of OMR 5,000 c. Non-deductible expenditure of OMR 5,000 d. Non-deductible expenditure of OMR 12,500arrow_forwardGodo Subject: acountingarrow_forwardADetermine the amount of taxable income and separately stated items in each of the cases below. Assuming the corporation is a Subchapter S corporation. Ignore any carryforward items. a. Corporate financial statement net income of $52,000 including tax expense of $15,000, charitable contributions of $3000, and depreciation expense of $37,000, Depreciation expense for tax purposes is $46,000. b. Corporate financial statement net income of $139,000 including tax expense of $68,000, charitable contributions of $28,000, depreciation expense of $103,000, and meals expenses of $31,000. Depreciation expense for tax purposes is $145,000. c. Corporate financial statement: net income of $226,000 including tax expense of $111,000, charitable contributions of $16,000, municipal bond interest of $19,000, meals expense of $41,000, capital gains of $6,000 and depreciation expense of $142,000. Depreciation expense for tax purposes is $131,000, and the corporation has $7000 charitable contribution…arrow_forward

- it says answer is wrongarrow_forwardAssume that TDW Corporation (calendar-year-end) has 2023 taxable income of $652,000 for purposes of computing the §179 expense. The company acquired the following assets during 2023: (Use MACRS Table 1, Table 2, Table 3, Table 4. and Table 5.) Asset Machinery Computer equipment Furniture Total Placed in Service September 12 February 10 April 2 Basis $2,270,250 263,325 880,425 $ 3,414,000 Problem 10-57 Part b (Algo) b. What is the maximum total depreciation, including §179 expense, that TDW may deduct in 2023 on the assets it placed in service in 2023, assuming no bonus depreciation? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Maximum total depreciation deduction (including §179 expense)arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] BCS Corporation is a calendar-year, accrual-method taxpayer. BCS was formed and started its business activities on January 1 of this year. It reported the following information for the year. Indicate BCS's deductible amount for this year in each of the following alternative scenarios. (Leave no answers blank. Enter zero if applicable.) e. On December 1 of this year, BCS acquired equipment from Equip Company. As part of the purchase, BCS signed a separate contract that provided that Equip would warranty the equipment for two years (starting in December 1 of this year). The extra cost of the warranty was $12,000, which BCS finally paid to Equip in January of next year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education