FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

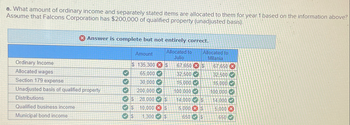

Transcribed Image Text:a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above?

Assume that Falcons Corporation has $200,000 of qualified property (unadjusted basis).

Answer is complete but not entirely correct.

Ordinary Income

Allocated wages

Section 179 expense

Unadjusted basis of qualified property

Distributions

Qualified business income

Municipal bond income

Amount

Allocated to

Julio

Allocated to

Milania

$ 135,300 $

67,650 $

67,650 x

65,000

32,500

32,500

30,000

15,000

15,000

200,000

100,000

100,000

$ 28,000 $

14,000 $

14.000

$ 10,000

$

5,000 $

5,000 x

$

1,300

$

650

$

650

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A. Zero B. P4,000,000 C. P5,000,000 D. P29,000,000arrow_forwardThe following items of gross income are exempted from taxation, except: A.Revenues of a non-stock and non-profit educational institution (5M) B. PCSO or lotto winnings in the amount of 2M C. SSS, GSIS, Pag-ibig, or Philhealth benefits (100,000) D. None of the abovearrow_forwardTotal Allowable Deductions if Mr. Queen registered his business venture as a One Person Corporationarrow_forward

- Taxpayer: Domestic Corporation (SME) It year of operation: 2017 Taxable period: 2021 Year 2017 2018 2019 2020 2021 Gross Income 7,000,000 8,000,000 8,000,000 5,000,000 7,000,000 Deductions 8,000,000 7,500,000 6,000,000 6,000,000 5,900,000 Net (1,000,000) 500,000 2,000,000 (1,000,000) 1,100,000 how much corporate income tax should paid in 2021? A. 275,000 B. 50,000 C. 25,000 D. 20,000 E. Zeroarrow_forwardTaxpayer: Domestic Corporation engaged in retail business Taxable year: 8th year of operation Taxable period data: Item IN Sales 2,500,000 Cost of sales 1,000,000 Allowable deductions excluding NOLCO 1,350,000 NOLCO 100,000 Total assets excluding land on which the business plant/equipment/office is located 10,000,000 Assuming corporation uses itemized deductions, how much is the net taxable income? How much is the regular corporate income tax? How much income tax should the corporation pay for the taxable year?arrow_forwardA-7arrow_forward

- Vishalarrow_forwardRecording NOL Carryforward and Carryback|Carryforward Toner Corporation computed the following: Year 1 taxable income, $10,000; Year 2 taxable loss, $( 40,000). At the end of Year 2, Toner made the following estimates: Year 3 taxable income, $4,000; Year 4 taxable income, $11,000; and Year 5 taxable income, $50,000. On the basis of these estimates, Toner believes the full amount of the tax loss carryforward benefit is more likely than not to be realized. There are no other temporary differences. Tax rates are 25% for Year 1, Year 2, and Year 3; and 30% for Year 4 and Year 5. Net operating loss carryforwards can only offset a maximum of 80% of taxable income in each of the future years. Required Do not give solution in image formatarrow_forwardFor each case, calculate Mr. McGowan's Net Income (Division B income). Indicate the amount and type of any loss carry overs that would be available at the end of the current year, or state that no carry overs are available.arrow_forward

- ParentCo and SubCo report the following items of income and deduction for the current year Item PC Taxable income SC taxable income income (loss) from operations $ 100,000.00 $ 10,000.00 Section 1231 loss $ (10,000.00) capital gain $ 12,000.00 Charitable contribution $ 20,000.00 $ 1,000.00 compute ParentCo and SubCo's 2022 taxable income or loss computed on a separate basis ParentCo SubCo a $ 81,000.00 $ 22,000.00 b $ 81,000.00 $ 21,000.00 c $ 70,000.00 $ 22,000.00 d $ 70,000.00 $ 21,000.00arrow_forwardCalculate the following for the Corporation that is receiving the properties/services FMV of property received Adjusted basis of property received Applicable basis code section Realized gain (income) on property Recognized gain (income) on property Gain (income) deferred, if presentarrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] BCS Corporation is a calendar-year, accrual-method taxpayer. BCS was formed and started its business activities on January 1 of this year. It reported the following information for the year. Indicate BCS's deductible amount for this year in each of the following alternative scenarios. (Leave no answers blank. Enter zero if applicable.) d. In June of this year, a display of BCS’s product located in its showroom fell and injured a customer. The customer sued BCS for $500,000. The case is scheduled to go to trial next year. BCS was required to pay $500,000 to a court-appointed escrow fund this year. If BCS loses the case next year, the money from the escrow fund will be transferred to the customer suing BCS.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education