FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

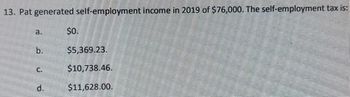

Transcribed Image Text:13. Pat generated self-employment income in 2019 of $76,000. The self-employment tax is:

a.

b.

C.

d.

$0.

$5,369.23.

$10,738.46.

$11,628.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What is the amount of self-employment tax that would be paid by Andy for the year assuming he earned $128,100 while working as an employee of the University and another S20,000 from a sales business he owns? Select one: a. S1,190.40 b. S1,726.03 C. $535.63 d. $2,825.91 e. None of thesearrow_forwardQuestion 21: For an employee who is paid monthly, completed the pre-2020 Form W-4, and claims 3 federal withholding allowances, $ subtracted from gross pay for withholding allowances prior to calculating the federal income tax withholding under the percentage method. would bearrow_forwardUse the 2016 FICA tax rates, shown below, to answer the following question. If a taxpayer is not self-employed and earns $137,000, what are the taxpayer's FICA taxes? Employee's Rates Matching Rates Paid by the Employer Self-Employed Rates 7.65% on first $118,500 of income 1.45% of income in excess of $118,500 7.65% on first $118,500 paid in wages 1.45% of wages paid in excess of $118,500 15.3% on first $118,500 of net profits 2.9% of net profits in excess of $118,500 FICA taxes are ?$arrow_forward

- Determine from the tax table the amount of the income tax for each of the following taxpayers for 2020: Taxpayer(s) Filing Status Taxable Income Income Tax Allen Single $ 30,000 $______________________ Boyd MFS 34,545 $______________________ Caldwell MFJ 55,784 $______________________ Dell H of H 67,450 $______________________ Evans Single 75,000 $______________________arrow_forwardThe self-employment tax base is 100% of self-employment income (Schedule C net income). True or False True Falsearrow_forwardThe table below shows the tax brackets for 2015 for single workers. Taxable Income Tax Rate $0 to $9,225 $9,226 to $37,450 $37,451 to $90,750 $90,751 to $189,300 $18,481.25 plus 28% of the amount over $90,750 $189,301 to $411,500 $46,075.25 plus 33% of the amount over $189,300 $411,501 to $413,200 $119,401.25 plus 35% of the amount over $411,500 10% $922.50 plus 15% of the amount over $9,225 $5,156.25 plus 25% of the amount over $37,450 $413,201 or more $119,996.25 plus 39.6% of the amount over $413,200 Calculate the income tax for a single person who has $132,200 of taxable income.arrow_forward

- how to figure out net pay ?arrow_forwardCompute for the tax due of the following individuals using the RA 10963 tax table. Show computations. 1. An employee with annual salary of P150,000, annual total contributions of P1,000 and bonus of P12,000 for the year.arrow_forwardFor the current year, the maximum percentage of social security benefits which might be included In a taxpayer's gross income is? A, 50% 85% 0% 65% 100%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education