FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

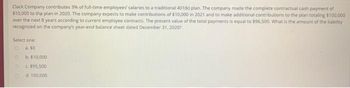

Transcribed Image Text:Clack Company contributes 3% of full-time employees' salaries to a traditional 401(k) plan. The company made the complete contractual cash payment of

$10,000 to the plan in 2020. The company expects to make contributions of $10,000 in 2021 and to make additional contributions to the plan totaling $100,000

over the next 8 years according to current employee contracts. The present value of the total payments is equal to $96,500, What is the amount of the liability

recognized on the company's year-end balance sheet dated December 31, 2020?

Select one

O

a. 50

D

b. $10,000

c. $95,500

d. 100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ix) Wages and salaries are expected to be $2,304,000 per annum and will be paid monthly.x) In the month of August, furniture & fixtures, which cost $455,000, will be sold to anemployee at a loss of $20,000. Accumulated depreciation on the furniture & fixtures at thattime is expected to be $305,000. The employee will be allowed to pay a deposit equal to60% of the selling price in August with the balance settled in two equal amounts inSeptember & October.xi) As part of its investing activities, the management of Sallat Household Furnishings &Appliances is in the process of completing a major addition to the business property, whichis estimated to cost $1,200,000, and which is being funded by external borrowing. $420,000of the principal, along with interest of $14,200 is due to be paid on July 15, 2022.xii) The cash balance on September 30, 2022, is expected to be an overdraft of $147,500.arrow_forwardThe EPBO for a particular employee on January 1,2024, was $36,000. The APBO at the beginning of the year was $7,200. The appropriate discount rate for this postretirement plan is 10%. The employee is expected to serve the company for a total of 25 years with 5 of those vears already served as of January 1,2024. What is the APBO On December 31, 2024? Note: Round your answer to the nearest whole dollar.arrow_forwardUnder the assumptlon: Unused vacation leaves do not vest (accumulating and non-vesting), What is the balance of llablity for compensated absences for the year ended December 31, 2019? * ABC Corp allows each employee to earn 15 days of paid vacation leave per year. Unused vacation leave can be carried up to two years from the year there were earned, thereafter it shall expire. The company has 50 employees (assumed have been employed throughout 2019 and 2020) with an average salary of P900 per day. Salary rates increased by 10% in 2020. According to past experience, 75% of allowed leaves to be carried-forward are ultimately exercised by the employees. Total leave vacation taken by employees during 2019 and 2020 were 400 days and 480 days, respectively. Your answerarrow_forward

- Under vacatlon leave cannot be carrled over next year (non-accumulating), What amount should be reported as vacation pay expense In 2019? * ABC Corp allows each employee to earn 15 days of paid vacation leave per year. Unused vacation leave can be carried up to two years from the year there were earned, thereafter it shall expire. The company has 50 employees (assumed have been employed throughout 2019 and 2020) with an average salary of P900 per day. Salary rates increased by 10% in 2020. According to past experience, 75% of allowed leaves to be carried-forward are ultimately exercised by the employees. Total leave vacation taken by employees during 2019 and 2020 were 400 days and 480 days, respectively. Your answerarrow_forwardMullen Company pays its employees every other Friday, December 31, 2020, was a Sunday. On Friday, January 5, 2021, Mullen paid wages of $147,000, which covered the 14-day period from December 20, 2020, through January 2, 2021. Wages were eamed evenly across all days, including Saturdays and Sundays. Employee income taxes withheld for this payroll period totaled $17,185, while the FICA tax withheld was $13,300. (Ignore the employer payroll taxes in this exercise.) Prepare the entry to accrue the company's wages and payroll taxes at December 31, 2020. (Assume the $147,000 in wages was the gross amount of the payroll. Record debits first, then credits. Exclude explanations from any journal entries.) Dec Date 2020 31 Salary Expense Salary Payable Journal Entry Accounts Employee Income Tax Payable FICA Tax Payable Y Debit Creditarrow_forwardPrepare journal entries to record the following transaction: Ulta Inc. allows each employee to earn 15 paid vacation days each year with full pay. Unused vacation time can be carried over to the next year. By the end of 2020, three employees carried over to 2021 a total of 20 vacation days, which is represented 2020 salary of $6,000arrow_forward

- Marie earns $557.69 weekly. The company has approved a 2% increase retroactive to January 1, 2023. 20 pay periods have been processed in the current year. Calculate Marie's gross earnings for the next pay period, including the current salary and the retroactive increase. This will be paid on one cheque.arrow_forwardOn August 31, 2016, ABC Co offered an early retirement package to employees who have rendered at least 20 years of service to the company. The termination package consisted of the following: Lump-sum payment based on December 31 2016 monthly salary level times the number of years in service. Periodic future annual payments based on 50% of December 31, 2016, monthly salary level to be received every December 31 starting on December 31, 2018, and end in the year prior to the commencement of the regular pension, which is on the 30th year from the employment of the employee. A complimentary watch with an estimated fair value of 85,000 as of August 31, 2016, subject to availability of its cash equivalent, will be given to employees with at least 25 years of service in the company. Medical benefits package costing currently at 15,000 and expected to increase by 10% every year. The medical coverage will end on the 30th year from the employment of the employee, which is the commencement of…arrow_forwardOn January 1, 2019, FrankKeating Company decided to grant its employees 10 vacation days and five sick days each year. Vacation days are earned can be carried over to the next year but not sick days. Each employee took an average of four sick days in 2019. During the year, each of Mike’s sixty employees earned P300 per day (increases by 5% each year) and had three unused vacation pays as of yearend. How much is the Vacation Pay Expense? How much is the Sick Pay Expense? How much is the Liability for Compensated Absences?arrow_forward

- Global Enterprises, Inc. signed a one-year $42,000 note payable at 8% inerest on April 1, 2025. If Global only adjusts it's accounts once a year at year end, how much interest expense was accrued on December 31, 2025?arrow_forwardAn employee has $75 withheld from each monthly paycheck that is deposited in an account. The account earns 12% interest annually, and the interest is compounded monthly. Assuming the employee makes deposits for two and a half years, determine the total account balance on the date of the final deposit.arrow_forwardOn December 31 (the end of the fiscal year), Ramesh Company received the PBO report from the actuary. The following information was included in the report: ending PBO, $112,000; benefits paid to retirees, $14,500; interest cost, $8,800. The discount rate applied by the actuary was 10%. What was the beginning PBO?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education