FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

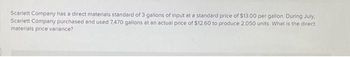

Transcribed Image Text:Scarlett Company has a direct materials standard of 3 gallons of input at a standard price of $13.00 per gallon. During July,

Scarlett Company purchased and used 7,470 gallons at an actual price of $12.60 to produce 2,050 units. What is the direct

materials price variance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- dont provide handwritiing solution ...arrow_forwardLarry's Woodworks has collected the following data for its cutting board line of products: K Direct materials standard Direct materials standard cost Actual Direct Materials Used (AQU) Actual finished goods purchased What is the direct materials quantity variance? 10 pounds per unit $0.54 per pound 40,000 pounds 4,100 units OA. $17,860 unfavorable OB. $17,860 favorable OC. $540 unfavorable OD. $540 favorablearrow_forwardThe following company information is available. The direct materials quantity variance is: Direct materials used for production 34,000 gallons Standard quantity for units produced 32,300 gallons Standard cost per gallon of direct material $10.00 Actual cost per gallon of direct material $10.10 Multiple Choice $20,400 unfavorable. $17,000 unfavorable. $10,200 unfavorable. $20,400 favorable. $10,200 favorable.arrow_forward

- marigold corp.'s variance report for the purchasing department reports 2000 units of material a purchase and 2800 units of material b purchased. it also reports standard prices of $2 for material a and $3 for material b. actual prices reported are $2.10 for material a and $2.80 for material b marigold should report a total price variance ofarrow_forwardWill Co. produces chairs. The standard direct material cost to produce one unit of chair is 4 meters of raw materials at P5.00 per meter. During 2020, 8,400 meters of raw materials were purchased at a cost of P20,160. All the purchased materials were actually used to produce 2,000 units of chairs. 1. Compute the actual price per meter material price and quantity variance and prepare journal entry to record the variance, assuming the price variance is determined at the time of usage.arrow_forwardAssume that the cost formula for one of a company’s mixed expenses is $10,000 + $4.00 per unit. The company’s planned level of activity was 2,000 units and its actual level of activity was 2,200 units. The actual amount of this expense was $18,110. The spending variance for this expense is:arrow_forward

- Assume the following: • The standard price per pound is $2.35. • The standard quantity of pounds allowed per unit of finished goods is 4 pounds. • The actual quantity of materials purchased was 53,000 pounds, whereas the quantity of materials used in production was 50,700 pounds. • The actual purchase price per pound of materials was $2.25. • The company produced 13,000 units of finished goods during the period. What is the materials quantity variance? Multiple Choice O о O $3,055 F $5,175 F $2,925 F $5,405 Farrow_forwardProvide answer the questionarrow_forwardVenneman Company produces a product that requires 5 standard pounds per unit. The standard price is $11.00 per pound. If 2,900 units required 14,900 pounds, which were purchased at $10.45 per pound, what is the direct materials (a) price variance, (b) quantity variance, and (c) total direct materials cost variance? Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. a. Direct materials price variance $fill in the blank 1 b. Direct materials quantity variance $fill in the blank 3 c. Total direct materials cost variance $fill in the blank 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education