ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

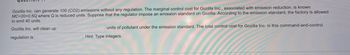

Transcribed Image Text:Gozilla Inc. can generate 100 (CO2) emissions without any regulation. The marginal control cost for Gozilla Inc., associated with emission reduction, is known

MC=20+0.5Q where Q is reduced units. Suppose that the regulator impose an emission standard on Gozilla: According to the emission standard, the factory is allowed

to emit 40 units.

Gozilla Inc. will clean up

regulation is

units of pollutant under the emission standard. The total control cost for Gozilla Inc. in this command-and-control

Hint: Type integers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Example: Question 4a.) Arthur’s demand to reduce electric and magnetic fields (EMFs) is P = 20 – 2 Q, whileRonald’s demand is P = 15 – 3 Q. If the marginal cost of reducing emissions is equal to$15 and is constant, what is the optimal amount of EMF reduction? b.) What Lindahl prices would you charge Arthur and Ronald? What might prevent you fromcollecting these prices?c.) How would your answers change if the marginal cost of reducing emissions was equal to$10 and is constant?d.) What are the consumer surpluses of Arthur and Ronald in c.)?arrow_forwardFirms in a polluting industry can be classified in two groups: newer firms with a cleaner technology that can abate pollution at a lower marginal cost MCLA = (1/2)aL and older firms with dirtier MCHA = aH, where ai is the level of abatement undertaken by firms of type i = L, H. The social marginal benefit of abating pollution from this particular industry is MBA= 120 - A, where A is the aggregate level of abatement in that industry. To design an efficient emissions standard, the government needs to determine which is the efficient abatement allocation (aL, aH). In order to do this, obtain a cost effective abatement allocation (aL, aH)that provides an aggregate abatement level A = aL + aH, and then proceed to determine the efficient level A (Hint: You should obtain that MCA = A=3)arrow_forwardConsider a market with two polluting firms with linear marginal abatement cost curves. Firm B has increasing marginal abatement costs that are everywhere half as high as Firm A’s marginal abatement costs. The maximum amount of pollution that can be tolerated is less than the total these two firms would emit if their pollution was unrestricted. Thus some aggregate amount of abatement is necessary. The pollutant in question is uniformly mixing, so it doesn’t matter which firm cuts back how much, only that between them, they cut back by the required total amount. The environmental agency decides to solve the abatement allocation problem by giving out pollution permits in amounts such that each firm would be obliged to cut back their emissions by an equal amount. Would this be “fair”? Would it be “efficient”?arrow_forward

- Firms in a polluting industry can be classified in two groups: newer firms with a cleaner technology that can abate pollution at a lower marginal cost MCLA = (1/2)aL and older firms with dirtier MCHA = aH, where ai is the level of abatement undertaken by firms of type i = L, H. The social marginal benefit of abating pollution from this particular industry is MBA= 120 - A, where A is the aggregate level of abatement in that industry. Suppose that in order to avoid the costly obtention of disaggregate information about individual firms' costs, the government just implements a uniform standard aui = A* / 2. Is this allocation efficient? If not, what is the deadweight loss?arrow_forwardSuppose that engineers have discovered a new production process for this product which results in a significant positive externality. As a result of the positive externality, for every given output level Marginal Social Value (MSV1) is now higher than consumer’s marginal willingness to pay (also known as the Demand Curve shown as D0 below). Keep in mind that the setting is still that of a monopoly. 1) Please indicate on the graph above, assuming an absence of any government intervention to correct the positive externality and adding any necessary curve(s): The monopoly price P1 and the monopoly quantity Q1 under the condition of the (uncorrected) positive externality. (Also indicate, for comparison purposes, the original monopoly price P0 and monopoly quantity Q0.) The Socially Optimal output, QSO1. The resulting Consumer Surplus CS1, the resulting Producer Surplus PS1, and the size of Dead-Weight Loss DWL1 if there is such a loss. (No need to show the economic profits earned by the…arrow_forwardSuppose there are only two polluting firms, called A and B, with the following marginal abatement costs: 1602AA MACe=− and 100BB MACe=−, where A e represents firm A’s emissions in tons and B e represents firm B’s emissions in tons. Suppose the government wishes to ensure that the two firms together emit 60 tons of the pollutant and uses a Tradable Emission Permit (TEP) policy. Assume that each TEP allows its holder to emit 1 ton, and that the market for permits is perfectly competitive. a. Suppose the government initially distributes the total number of TEPs it issues equally between the two firms. The permits are distributed free of charge. Once trade in permits takes place, what will be the equilibrium in the market for TEPs (i.e. which firm will buy how many TEPs from the other, and at what price)? b. Briefly describe three problems of setting up a TEP market.arrow_forward

- Gozilla Inc. can generate 100 (CO2) emissions without any regulation. The marginal control cost for Gozilla Inc., associated with emission reduction, is known MC=20+0.5Q where Q is reduced units. Suppose that the regulator impose an emission standard on Gozilla: According to the emission standard, the factory is allowed to emit 40 units. The level of reduction in the emission standard could be accomplished through an emission charge (quantity tax or penalty fee on emission). An emission charge of per emission unit would generate the target amount of reduction. Total (tax) revenue the regulator will collect as emission charges would be Hint: Type integers. Do not use thousands separators.arrow_forwardSuppose there are only two polluting firms, called A and B, with the following marginal abatement costs: MACA=160 2- e and MACB=100-es, where e represents firm A's emissions in tons and ea represents firm B's emissions in tons. Suppose the government wishes to ensure that the two firms together emit 60 tons of the pollutant and uses a Tradable Emission Permit (TEP) policy. Assume that each TEP allows its holder to emit 1 ton, and that the market for permits is perfectly competitive. a. Suppose the government initially distributes the total number of TEPs it issues equally between the two firms. The permits are distributed free of charge. Once trade in permits takes place, what will be the equilibrium in the market for TEPS (i.e. which firm will buy how many TEPs from the other, and at what price)? b. Briefly describe three problems of setting up a TEP market.arrow_forwardFirms in a polluting industry can be classified in two groups: newer firms with a cleaner technology that can abate pollution at a lower marginal cost MCLA = (1/2)aL and older firms with dirtier MCHA = aH, where ai is the level of abatement undertaken by firms of type i = L, H. The social marginal benefit of abating pollution from this particular industry is MBA= 120 - A, where A is the aggregate level of abatement in that industry. What Pigouvian tax t will implement the efficient allocation (aL, aH)? Is the resulting allocation an efficient allocation? What is the government's tax revenue?arrow_forward

- By selling x tons of the first commodity the firm gets a price per ton given by Px=96-4x By selling y tons of the other commodity the price per ton is given by Py=84-2y The total cost of producing and selling x tons of the first commodity and y tons of the second is given by C(x,y)=2x2+2xy+y2 Suppose that the firm’s production activity causes so much pollution that the authorities limit its output to 11 tons in total. That is x + y = 11. What is the optimal amount of y?arrow_forwardAppalachian Coal Mining believes that it can increase labor productivity and, therefore, net revenue by reducing air pollution in its mines. It estimates that the marginal cost function for reducing pollution by installing additional capital equipment is MC = 40P where P represents a reduction of one unit of pollution in the mines. It also feels that for every unit of pollution reduction, the marginal increase in revenue (MR) is MR = 1,000 - 10P How much pollution reduction should Appalachian Coal Mining undertake?arrow_forwardFirms within the country of Anviliania are currently emitting pollutants. These pollutants cause damages within Anviliania. However, the pollutants also cause damages to the properties and health of residents of countries that share borders with Anviliania. The Marginal Abatement Costs of the firms in Anviliania can be represented by the equation MAC(Anvil.) = 750 -2.3 e The Marginal Damage Costs to the residents of Anviliania are given by MDC (Anvil.) =- - 40 + 10 e The Marginal Damage Costs to all residents (including the residents of Anviliania) are MDC (Globe) = -20+ 12 e a. Draw a diagram representing this situation. b. Determine the magnitude of the local market failure and the global market failure. c. Suppose that the Anvilianian government has given production subsidies to the firms in Anviliania. As a result, the firms have increased production (and the number of firms have increased.). Consequently, the aggregate MAC is now MAC' (Anvil.) = 800 - 2.3 e. Determine the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education