ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

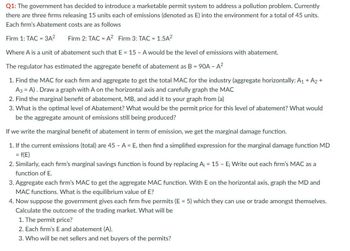

Transcribed Image Text:Q1: The government has decided to introduce a marketable permit system to address a pollution problem. Currently

there are three firms releasing 15 units each of emissions (denoted as E) into the environment for a total of 45 units.

Each firm's Abatement costs are as follows

Firm 1: TAC = 3A²

Firm 2: TAC = A2 Firm 3: TAC = 1.5A²

Where A is a unit of abatement such that E 15 - A would be the level of emissions with abatement.

The regulator has estimated the aggregate benefit of abatement as B = 90A - A²

1. Find the MAC for each firm and aggregate to get the total MAC for the industry (aggregate horizontally: A1 + A2 +

A3 = A). Draw a graph with A on the horizontal axis and carefully graph the MAC

2. Find the marginal benefit of abatement, MB, and add it to your graph from (a)

3. What is the optimal level of Abatement? What would be the permit price for this level of abatement? What would

be the aggregate amount of emissions still being produced?

If we write the marginal benefit of abatement in term of emission, we get the marginal damage function.

1. If the current emissions (total) are 45 - A = E, then find a simplified expression for the marginal damage function MD

= f(E)

2. Similarly, each firm's marginal savings function is found by replacing A₁ = 15 - E; Write out each firm's MAC as a

function of E.

3. Aggregate each firm's MAC to get the aggregate MAC function. With E on the horizontal axis, graph the MD and

MAC functions. What is the equilibrium value of E?

4. Now suppose the government gives each firm five permits (E = 5) which they can use or trade amongst themselves.

Calculate the outcome of the trading market. What will be

1. The permit price?

2. Each firm's E and abatement (A).

3. Who will be net sellers and net buyers of the permits?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 13. The marginal benefit of being able to emit a ton of sulfur dioxide emissions for two firms are given by: MBx = 1000 – (Ex / 2 ) MBY = 600 – (Ey / 3 ) Note that these marginal benefit figures can be interpreted as marginal cost of abating emission down to levels Ex and Ey. Government regulators want to reduce total sulfur dioxide emissions to a total of 1800 tons. a) If the government imposes the same standard of 900 tons maximum emissions on both firms what would be the total cost of abatement (calculated as the aggregated marginal benefits forgone)? b) If the government distributed 900 tradable pollution permits (one ton each) to each firm what would be the final allocation of these permits after the firms trade them? What would be the total cost of abatement in this latter case?arrow_forwardi will 10 upvotes urgent .arrow_forwardNo hand written solution Afirm has an industrial plant that emits pollutants into a town’s lake. The plant’s marginal abatement function is MAC= 200 – 0.5E and damages caused by its emissions are given by MD = 2E where emissions are in kg. per day. What is the socially efficient level of emissions from this plant? Illustrate this in a graph. As an incentive to reduce emissions to the socially efficient level, government offers to pay the firm for each kg. of emissions it abates per day from this plant. What subsidy per kg. should the government offer? If the plant abates to the socially efficient level of emissions, what total subsidy payment would the firm receive? Identify the area in your graph. How much better or worse off would the firm be compared to if it did no abating? Identify the area in your graph. What would be the net benefit to society if we pay the firm to reduce the plant’s emissions to the socially efficient level? Identify this area in your graph.arrow_forward

- Suppose that a firm's marginal abatement cost function with existing technologies is MAC = 8 - E. If the firm adopts new pollution abatement technologies, then its marginal abatement cost function will become MAC = 4 - 0.5E. With an emissions tax of $2, the benefits of adopting the new technologies equal $_ Please round your final answer to two decimal places if necessary. Answer:arrow_forward(a) A magician recorded his magic show and broadcast it freely in internet. How would you classify the show with reference to rivalrous and excludability? (b) There are two online magic show enthusiasts, A and B in the market. Their demand functions are QA = 5 – 0.25PA and QB = 15 – 0.5PB respectively. Explain the method to obtain the market demand function for magic show which are freely available online. (c) Draw the marginal social benefit curve for online magic show. (d) If a magician produces magic show and broadcast online to both individuals at a constant marginal cost of $20, what is the market equilibrium quantity and price of online magic shows?arrow_forward1. A firm's marginal abatement cost function is given by MAC = 200-5E. Suppose that, after adopting new abatement technology, the firms marginal abatement function becomes MAC = 160-4E. Costs are in dollars per tonne and emissions are in tonnes per year. The firm is given 20 tradeable pollution permits (each permit allows it to emit one tonne of pollution) and the current market price per permit is $100. a)Given no change in the permit price how many tonnes of pollution will the firm emit? b)What will be the firms total abatement cost? Will it buy or sell permits and how many? c) What will be the net cost to the firm after trading? What will be the net gain to the firm from adopting the new abatement technologyarrow_forward

- Suppose there are only two polluting firms, called A and B, with the following marginal abatement costs: 1602AA MACe=− and 100BB MACe=−, where A e represents firm A’s emissions in tons and B e represents firm B’s emissions in tons. Suppose the government wishes to ensure that the two firms together emit 60 tons of the pollutant and uses a Tradable Emission Permit (TEP) policy. Assume that each TEP allows its holder to emit 1 ton, and that the market for permits is perfectly competitive. a. Suppose the government initially distributes the total number of TEPs it issues equally between the two firms. The permits are distributed free of charge. Once trade in permits takes place, what will be the equilibrium in the market for TEPs (i.e. which firm will buy how many TEPs from the other, and at what price)? b. Briefly describe three problems of setting up a TEP market.arrow_forwardConsider an industry with two firms that emit a uniformly mixed air pollutant (e.g., carbon dioxide). The marginal abatement cost functions for Firm 1 and Firm 2 are: MAC1 = 100 - e1 MAC2 = 100 - 4e2 Aggregate emissions for the industry are denoted as E = e1 + e2. [1] In an unregulated environment how many units of emissions does each firm emit? Firm 1’s unregulated level of emissions ____________ Firm 2’s unregulated level of emissions ____________ Total unregulated level of emissions ______________arrow_forwardSuppose that a firm's marginal abatement cost function with existing technologies is MAC = 12 - E. If the firm adopts new pollution abatement technologies, then its marginal abatement cost function will become MAC = 6 - %3D 0.5E. With an emissions tax of $4, the benefits of adopting the new technologies equal $. Please round your final answer to two decimal places if necessary. Answer:arrow_forward

- Suppose the government aims to abate 20 tons of pollution from two firms. Firm 1's abatement cost function is MAC1 = A1, firm 2's abatement function is MAC2 = 4A2, where A1 and A2 represent the amount of abatement conducted by firm 1 and firm 2 individually. How many tons should firm 1 and firm 2 abate to minimize total abatement cost? Blank #1: Firm 1's amount of abatement Blank #2 : Firm 2's amount of abatementarrow_forwardThe figure above shows a national marketable permit system for carbon dioxide. If marginal abatement costs turn out to be high and the government does supply annual permits, what will be the price of a permit? Permit Price ($/ton) S D2 P2 = 600 P7 = 300 A P, = 150 1 %3D D Quantity of Permits 50 QT 75 Q2 100 (% of uncontrolled emissions) OA. P1 Ов. Р2 OC. PT OD. PO O E. Either P0 or P1. Barrow_forward[4] At their choice of emissions after trading permits, what is each firm’s total abatement cost? Firm 1’s Total Abatement Cost ___________ Firm 2’s Total Abatement Cost ___________ [5] Alternatively, what could the regulator choose for an emissions tax to achieve the goal of 25 units in a cost-effective manner?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education