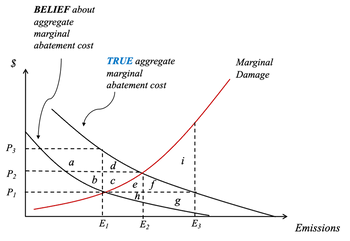

The figure below shows Marginal Damage from emissions, the regulator’s BELIEF about the aggregate marginal abatement cost (MAC) and the TRUE aggregate marginal abatement cost that is unobservable by the regulator. Use the figure to answer Questions 20 – 23.

[20] Suppose the regulator issued E1 permits to the industry. What is the competitive market permit price?

[21] Suppose the regulator issued E1 permits to the industry. What area(s) represent the welfare loss due to the uncertainty in aggregate marginal abatement costs?

[22] Suppose the regulator uses its BELIEF about the AMAC function to achieve efficient emissions control using a per-unit uniform emissions tax.

a) What per-unit tax would the regulator set?

b) What level of aggregate emissions would result given the regulator’s tax?

[23] Suppose the regulator uses its BELIEF about the AMAC function to achieve efficient emissions control using a per-unit uniform emissions tax.

a) What area(s) represent the welfare loss due to the uncertainty in aggregate marginal abatement costs?

b) Which policy (taxes or permits) appears to result in a larger welfare loss due to uncertainty?

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

[22] Suppose the regulator uses its BELIEF about the AMAC function to achieve efficient emissions control using a per-unit uniform emissions tax.

a) What per-unit tax would the regulator set?

b) What level of aggregate emissions would result given the regulator’s tax?

[23] Suppose the regulator uses its BELIEF about the AMAC function to achieve efficient emissions control using a per-unit uniform emissions tax.

a) What area(s) represent the welfare loss due to the uncertainty in aggregate marginal abatement costs?

b) Which policy (taxes or permits) appears to result in a larger welfare loss due to uncertainty?

[22] Suppose the regulator uses its BELIEF about the AMAC function to achieve efficient emissions control using a per-unit uniform emissions tax.

a) What per-unit tax would the regulator set?

b) What level of aggregate emissions would result given the regulator’s tax?

[23] Suppose the regulator uses its BELIEF about the AMAC function to achieve efficient emissions control using a per-unit uniform emissions tax.

a) What area(s) represent the welfare loss due to the uncertainty in aggregate marginal abatement costs?

b) Which policy (taxes or permits) appears to result in a larger welfare loss due to uncertainty?

- Scenario 10-1 The demand curve for gasoline slopes downward and the supply curve for gasoline slopes upward. The production of the 1,000th gallon of gasoline entails the following: a private cost of $3.10 • a social cost of $3-55 a value to consumers of $3.70 Refer to Scenario 10-1. Suppose the equilibrium quantity of gasoline is 1,150 gallons; that is, QMARKET = 1,150. Then the equilibrium price of a gallon could be a. $3.30. b. $3.80. c. $3.00. d. $2.80.arrow_forwardPlease drag and drop the markers 1 through 5 below to denote the appropriate position on the diagram that answers the question. a) Show with marker 1 the efficient level of marginal abatement costs. b) Show with marker 2 the marginal abatement costs if each produce must reduce pollution to 7.5 units. c) Denote with marker 3 the area that measures total abatement costs for each polluter. d) Show with marker 4 the marginal abatement costs if sources 1 and 2 merged and were constrained to a maximum total emissions of 15 units. e) Show with marker 5 the total abatement costs if both sources merged and were constrained to a maximum total emissions of 15 units. Marginal Cost (in dollars) MC MC, Quantity of Emissions Reduced A Source 1 10 5 4 13 14 15 15 14 13 12 11 10 8 O Source 2 5arrow_forwardShow work..arrow_forward

- Given the following information: Initially, a perfectly competitive market for a product is in equilibrium, with an upward-sloping straight-line market supply curve, a downward-sloping straight-line market demand curve, and a market price of $30 per unit. Consumption of this product causes pollution. Initially, the marginal external cost of the pollution caused by consuming the product is $9 per unit. There is no government policy toward the externality. The government then mandates a shift to a new product version, and all firms adopt and produce the latest version. Consumers view the new product version as equally as good as the initial product version. Consumption of the new version of the product causes less pollution, and the marginal external cost decreases by $3 per unit. For each firm, production of the new product version does not change fixed cost, but it does increase average variable cost by $3 per unit. If necessary, the market adjusts to a new equilibrium. There is…arrow_forwardImagine a firm’s marginal abatement cost function with existing technologies is: MAC = 100 – 2E. If the firm adopts new pollution abatement technologies, its marginal abatement cost function will be: MAC = 50 – E. If the government raises the tax on emissions from $4 to $12, the benefits of adopting the new technologies increase by $____arrow_forwardQuestion 22 Refer to Figure 2 in Question 20. What price and quantity combination best represents the socially optimum price and number of concerts that should be organized? Group of answer choices P1 and Q0 P1 and Q1 P2 and Q0 P2 and Q1arrow_forward

- Consider an industry with two firms that emit a uniformly mixed air pollutant (e.g., carbon dioxide). The marginal abatement cost functions for Firm 1 and Firm 2 are: MAC1 = 100 - e1 MAC2 = 100 - 4e2 Aggregate emissions for the industry are denoted as E = e1 + e2. 1. In an unregulated environment how many units of emissions does each firm emit? Firm 1’s unregulated level of emissions ____________ Firm 2’s unregulated level of emissions ____________ Total unregulated level of emissions ______________ Suppose a regulator has a goal of reducing the total level of emissions from the amount from the amount you answered in [1] to 25 units. The regulator would like to achieve the goal of 25 units of total emissions in a cost-effective way. To do so it issues 25 permits, 10 are given to Firm 1 and 15 are given to Firm 2. A firm can only emit a unit of pollution if they have a permit for that unit, otherwise they must abate. After the permits are allocated,…arrow_forwardExample: Question 4a.) Arthur’s demand to reduce electric and magnetic fields (EMFs) is P = 20 – 2 Q, whileRonald’s demand is P = 15 – 3 Q. If the marginal cost of reducing emissions is equal to$15 and is constant, what is the optimal amount of EMF reduction? b.) What Lindahl prices would you charge Arthur and Ronald? What might prevent you fromcollecting these prices?c.) How would your answers change if the marginal cost of reducing emissions was equal to$10 and is constant?d.) What are the consumer surpluses of Arthur and Ronald in c.)?arrow_forwardCarbon dioxide emissions have been linked to worsening climate conditions. The following table lists some possible public policies aimed at reducing the amount of carbon dioxide in the air. For each policy listed, identify whether it is a command-and-control policy (regulation), tradable permit system, corrective subsidy, or corrective tax. Public Policy Command-and-Control Policy Tradable Permit System Corrective Subsidy Corrective Tax The government limits total carbon-dioxide emissions by all factories to 130,000 tons per decade. Each individual factory is given the right to emit 170 tons of carbon dioxide, and factories may buy and sell these rights in a marketplace. Trees take carbon dioxide out of the air and convert it to oxygen, so the government funds a tree-planting initiative by offering $480 to any citizen who plants a tree. The government orders every factory to adopt a new technology, which reduces…arrow_forward

- Suppose that engineers have discovered a new production process for this product which results in a significant positive externality. As a result of the positive externality, for every given output level Marginal Social Value (MSV1) is now higher than consumer’s marginal willingness to pay (also known as the Demand Curve shown as D0 below). Keep in mind that the setting is still that of a monopoly. 1) Please indicate on the graph above, assuming an absence of any government intervention to correct the positive externality and adding any necessary curve(s): The monopoly price P1 and the monopoly quantity Q1 under the condition of the (uncorrected) positive externality. (Also indicate, for comparison purposes, the original monopoly price P0 and monopoly quantity Q0.) The Socially Optimal output, QSO1. The resulting Consumer Surplus CS1, the resulting Producer Surplus PS1, and the size of Dead-Weight Loss DWL1 if there is such a loss. (No need to show the economic profits earned by the…arrow_forwardI need 100% accurate answerarrow_forwardConsider an industry with two firms that emit a uniformly mixed air pollutant (e.g., carbon dioxide). The marginal abatement cost functions for Firm 1 and Firm 2 are: MAC1 = 100 - e1 MAC2 = 100 - 4e2 Aggregate emissions for the industry are denoted as E = e1 + e2. [1] In an unregulated environment how many units of emissions does each firm emit? Firm 1’s unregulated level of emissions ____________ Firm 2’s unregulated level of emissions ____________ Total unregulated level of emissions ______________arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education