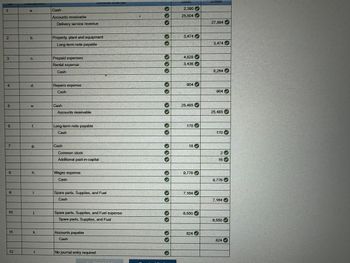

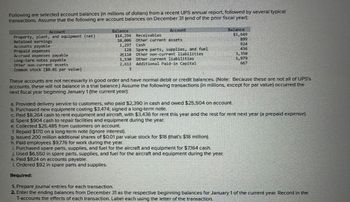

Enter the ending balances from December 31 as the respective beginning balances for January 1 of current year. Record in T-accounts the effect of each transaction. Label each usinng the letter of the transaction. Required cash, receivables, spare parts, supplies, and fuel, prepaid expenses, other current assets, property, plant, and equipment (net), other non- current assets, accounts payable, accrued expenses payable other current liabilities, long term notes payable, other non-current liabilities, common stock, additional paid-in- capital,

-Make sure to list on the correct colum of debit or credit.

Step by stepSolved in 2 steps with 4 images

- The following information was taken from the accounts receivable records of Monty Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $156,000 0.5% 31 – 60 days outstanding 65,400 2.5% 61 – 90 days outstanding 40,000 4.0% 91 – 120 days outstanding 20,800 6.5% Over 120 days outstanding 5,100 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,280 prior to the adjustment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $4,010 prior to the…arrow_forwardThe following information was taken from the accounts receivable records of Sarasota Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $160,000 0.5% 31 – 60 days outstanding 66,000 2.5% 61 – 90 days outstanding 40,200 4.0% 91 – 120 days outstanding 20,600 6.5% Over 120 days outstanding 5,600 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,200 prior to the adjustment (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,880 prior to the adjustment.arrow_forwardThe following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities 1. Working capital 2. Current ratio $310,100 359,000 146,900 570,200 293,800 $1,680,000 3. Quick ratio $278,400 201,600 $480,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year $ $252,000 283,500 94,500 358,700 229,300 $1,218,000 $294,000 126,000 $420,000arrow_forward

- Prepare the income statements and balance sheets for years 2018 and 2019 for Thompson Company using the following information. The balance sheet numbers are at the end of year figures.Item20182019Accounts Payable120.0150.0Accounts Receivable150.0180.0Accumulated Depreciation330.0360.0Cash & Cash Equivalents10.012.0Common Stock150.0200.0Cost of Goods Sold750.0850.0Depreciation25.030.0Interest Expense30.033.0Inventory200.0180.0Long-term Debt150.0150.0Gross Plant & Equipment650.0780.0Retained Earnings208.5225.0Sales1,500.01,700.0SG&A Expenses500.0570.0Notes Payable51.567.0Tax Rate21%21%(2) Answer the following questions:(a) How much did Thompson Company spend in acquiring fixed assets in 2019?(b) How much dividend did Thompson Company pay out during 2019?(c) Using the end of year numbers, did the long-term solvency ratios improve or deteriorate from 2018 to 2019? Answer this question using at least two long-term solvency ratios.(d) Using the end of year numbers, did the asset…arrow_forwardThe following information (in millions) was taken from the December 31 financial statements Accounts receivable, gross Allowance for expected credit losses Accounts receivable, net Revenues Total current assets Total current liabilities 13) Calculate the current ratio for 2020 13) 2021 $ 1.102 28 1,074 14,477 3,426 3,120 2020 $ 1.080 26 1,054 13,819 3,102 3,274 2019 $ 1.241 28 1,213 14,917 2,830 4,287arrow_forwardUse the following information for Company COLTIB to create the BalanceSheet for 2020 and 2021arrow_forward

- A company reports the following income statement and balance sheet information for the current year: Net income $132,370 Interest expense 11,510 Average total assets 2,180,000 Determine the return on total assets. Round the percentage to one decimal place.fill in the blank %arrow_forwardA company reports the following income statement and balance sheet information for the current year: Net income $435,590 Interest expense 76,870 Average total assets 4,380,000 Determine the return on total assets. If required, round the answer to one decimal place. %arrow_forwardAssuming that total assets were $8,037,000 at the beginning of the current fiscal year, determine the following: When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity c. Asset turnover d. Return on total assets e. Return on stockholders' equity f. Return on common stockholders' equity % % %arrow_forward

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities $387,600 448,800 183,600 1,032,200 531,800 $2,584,000 1. Working capital 2. Current ratio 3. Quick ratio b. The liquidity of Nilo has improved increased $394,400 285,600 $680,000 $306,800 345,200 115,000 719,800 460,200 $1,947,000 $413,000 177,000 $590,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year ✔ from the preceding year to the current year. The working capital, current ratio, and quick ratio have all ✔Most of these channes are the result of an increase ✔in nurrent accets…arrow_forwardThe following is a partial listing of accounts for XYZ, Inc., for the year ended December 31, 2020. Required: Prepare multiple step income statement for the year of 2020. Finished Goods Current Maturities of Long-Term Debt Accumulated Depreciation Accounts Receivable $ 38,872 2,515 19,960 Sales Revenue 6,273 127,260 Treasury Stock 251 Prepaid Expenses 2,199 Deferred Taxes (long-term liability) 8,506 Interest Expense 2,410 Allowance for Doubtful Accounts 915 Retained Earnings 18,951 Raw Materials 9,576 Accounts Payable 19,021 Cash and Cash Equivalents 8,527 Sales Salaries Expense 872 Cost of Goods Sold 82,471 Investment in Unconsolidated 3,559 Subsidiaries Income Taxes Payable 8,356 Work In Process 1,984 Additional Paid-In Capital 9,614 Equipment 41,905 Long-Term Debt 15,258 Rent Income 2,468 Common Stock 3,895 Notes Payable (short-term) 6,156 Income Tax Expense 2,461arrow_forwardJust Dew It Corporation reports the following balance sheet information for 2020 and 2021. Prepare the 2021 combined common-size, common-base year balance sheet for Just Dew It. (Do not round intermediate calculations and round your answers to 4 decimal places, e.g., 32.1616.)arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning