Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

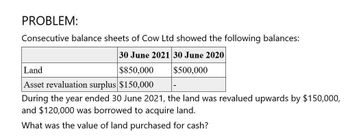

Transcribed Image Text:PROBLEM:

Consecutive balance sheets of Cow Ltd showed the following balances:

30 June 2021 30 June 2020

Land

$850,000

Asset revaluation surplus $150,000

$500,000

During the year ended 30 June 2021, the land was revalued upwards by $150,000,

and $120,000 was borrowed to acquire land.

What was the value of land purchased for cash?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prblmarrow_forwardGeneral Accountingarrow_forwardFrom the following forecast the Balance sheet for the year 2021Balance sheet as of 31/12/2020Liabilities& Equity AmountAssetsAmountEquity33,000 Plant and machinery 10,000Retained earnings 10,000 Land Property20.000Accounts payable 7,000 Accounts receivables 3.000Inventories10.000Cash in hand2000Cash at Bank5.00050,00050,0001. It is expected that the company will make a net income of10% of forecasted sales2. The company will purchase additional 5000 OMR worthmachines by taking an additional loan of 5000 OMR3. Forecasted sales OMR 100,0004. Dividend payout will be 50%5. The following estimates are also given;Accounts payable 10,000Accounts receivable 6,000Inventories 15,000Cash in hand 6.000Cash at bank 1,000arrow_forward

- The information regarding the fixed assets of Melcher Inc. as of December 31, 2020 is provided below: Expected future cash flows from the fixed assets Historical cost of fixed assets Accumulated depreciation on fixed assets Present value of expected future cash flows from fixed assets What is the amount of any impairment loss under US GAAP? O $0 $5,000 $7,000 $37,000 $80,000 $105,000 $30,000 $68,000arrow_forwardUrgentt!!! Calculate net cash from investing activitiesarrow_forwardThe following are extracts from the financial statements of Captus Ltd. As at 31 March: 2021 2020 Sh.’000’ Sh.’000’ Sh.’000’ Sh.’000’ Fixed assets: Goodwill Freehold land and building Plant and machinery (NBV) Investment at cost Current assets: Stocks Accounts receivable Investments Cash at hand and bank Current liabilities Bank overdraft Accounts payable Proposed dividends Taxation Net current assets 15% debentures Capital and reserves: Authorised, issued and paid Sh.10 Ordinary shares Share premium Revaluation reserve Retained profit 10,050 6,140 1,710 200 18,100 (2,390) (5,850) (450) (820) (9,510) 2,800 16,800 5,860 3,600 29,060 8,590 37,650 (7,500) 30,150 18,000 1,500 4,500 6,150 8,700 7,800 840 430 17,770 (6,540) (5,250) (380) (600) (12,770) 2,900 12,000 6,350 3,750 25,000 5,000 30,000 (9,000) 21,000 15,000 750 -…arrow_forward

- I need the answer as soon as possiblearrow_forwardThe information regarding the fixed assets of Broadwing Company as of December 31, 2019 is provided below: Expected future cash flows from the fixed assets Carrying value of fixed assets Present value of expected future cash flows from the fixed $80,000 $105,000 $68,000 $90,000 assets Selling price of fixed assets What is the amount of impairment loss under US GAAP? a. $10,000 b. $25,000 c. $23,000 d. $15,000arrow_forwardAdditional information: • Depreciation expense is $ 13,300. • Dividends declared and paid in cash of $ 20,000. • In 2020, the equipment will sell for $ 9,700 in cash (the amount sold equipment equals the book value of the equipment). QUESTIONS a. Prepare a 2020 cash flow statement for trading company "MARS" with using the indirect method b. Based on the answer in point a, calculate free cash flow trading company "MARS". Provide an interpretation of the cash flow calculation results.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning