Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

ll

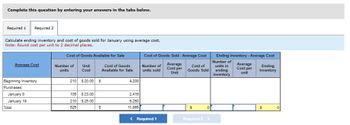

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Calculate ending inventory and cost of goods sold for January using average cost.

Note: Round cost per unit to 2 decimal places.

Cost of Goods Available for Sale

Cost of Goods Sold - Average Cost

Ending Inventory - Average Cost

Average Cost

Number of

units

Unit

Cost

Cost of Goods

Available for Sale

Number of

units sold

Average

Cost per

Unit

Cost of

Goods Sold

Number of

units in

ending

inventory

Average

Cost per

unit

Ending

Inventory

210 $20.00 $

4,200

Beginning Inventory

Purchases:

January 8

January 19

Total

105 $23.00

2,415

210 $25.00

5,250

525

$

11,865

< Required 1

Required 2

$

0

$

0

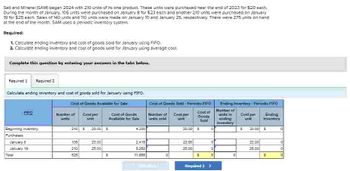

Transcribed Image Text:Salt and Mineral (SAM) began 2024 with 210 units of its one product. These units were purchased near the end of 2023 for $20 each.

During the month of January, 105 units were purchased on January 8 for $23 earn and another 210 units were purchased on January

19 for $25 each Sales of 140 units and 110 units were made on January 10 and January 25, respectively. There were 275 units on hand

at the end of the month. SAM uses a periodic inventory system.

Required:

1. Calculate ending Inventory and cost of goods sold for January using FIFO

2. Calculate ending inventory and cost of goods sold for January using average cost

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Calculate ending inventory and cost of goods sold for January using FIFO.

Cost of Goods Available for Sale

Cost of Goods Sold Frodo FIFO

Number of Costper

Cost of Goods

Available for Sale

Number of

old

Cast par

Cost of

Goods

2105 20:00

S

#200

20:00 S

Beginning inventory

Purchases

January B

105

23.00

2.415

23.00

January 10

210

25:00

5:250

25.00

525

$

11.865

$

Required 2 >

Exing Inventory Fsmodio FIFO

Number of

anding

inventory

Cost per

unit

Ending

Inventory

$ 20:00 S

0

22.00

2500

$

प्र

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Langstons purchased $3,100 of merchandise during the month, and its monthly income statement shows a cost of goods sold of $3,000. What was the beginning inventory if the ending inventory was $1,250?arrow_forwardMasonrys records show the raw materials inventory had purchases of $1,000and an ending raw materials inventory balance of $200. If the cost of materials used during the month was $900, what was the beginning inventory?arrow_forwardSamuelson and Messenger (SAM) began 2021 with 300 units of its one product. These units were purchased near the end of 2020 for $22 each. During the month of January, 200 units were purchased on January 8 for $25 each and another 260 units were purchased on January 19 for $27 each. Sales of 190 units and 200 units were made on January 10 and January 25, respectively. There were 370 units on hand at the end of the month. SAM uses a periodic inventory system. Required: 1. Calculate ending inventory and cost of goods sold for January using FIFO. 2. Calculate ending inventory and cost of goods sold for January using average cost. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate ending inventory and cost of goods sold for January using FIFO. FIFO Beginning Inventory Purchases: January 8 January 19 Total Cost of Goods Available for Sale # of units Cost per unit 300 $ 22.00 200 260 760 25.00 27.00 $ $ Cost of Goods Available for Sale 6,600…arrow_forward

- Samuelson and Messenger (SAM) began 2021 with 360 units of its one product. These units were purchased near the end of 2020 for $25 each. During the month of January, 180 units were purchased on January 8 for $28 each and another 360 units were purchased on January 19 for $30 each. Sales of 140 units and 260 units were made on January 10 and January 25, respectively. There were 500 units on hand at the end of the month. SAM uses a perpetual inventory system. Required: 1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO. 2. Complete the below table to calculate ending inventory and cost of goods sold for January using average cost. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO. Perpetual FIFO Beg. Inventory Purchases: January 8 January 19 Total Cost of Goods Available for Sale # of units Cost…arrow_forwardSamuelson and Messenger (SAM) began 2021 with 200 units of its one product. These units were purchased near the end of 2020 for $25 each. During the month of January, 100 units were purchased on January 8 for $28 each and another 200 units were purchased on January 19 for $30 each. Sales of 125 units and 100 units were made on January 10 and January 25, respectively. There were 275 units on hand at the end of the month. SAM uses a periodic inventory system. Required:1. Calculate ending inventory and cost of goods sold for January using FIFO.2. Calculate ending inventory and cost of goods sold for January using average cost.arrow_forwardSalt and Mineral (SAM) began 2024 with 320 units of its one product. These units were purchased near the end of 2023 for $24 each. During the month of January, 160 units were purchased on January 8 for $27 each and another 320 units were purchased on January 19 for $29 each. Sales of 215 units and 180 units were made on January 10 and January 25, respectively. There were 405 units on hand at the end of the month. SAM uses a perpetual inventory system. Required: 1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO. 2. Complete the below table to calculate ending inventory and cost of goods sold for January using average cost. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO. Answer is not complete. Cost of Goods Available for Sale Cost of Goods Sold - January 10 Cost of Goods Sold - January 25…arrow_forward

- Samuelson and Messenger (SAM) began 2021 with 340 units of its one product. These units were purchased near the end of 2020 for $22 each. During the month of January, 170 units were purchased on January 8 for $25 each and another 340 units were purchased on January 19 for $27 each. Sales of 185 units and 210 units were made on January 10 and January 25, respectively. There were 455 units on hand at the end of the month. SAM uses a perpetual inventory system. Required: 1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO. 2. Complete the below table to calculate ending inventory and cost of goods sold for January using average cost. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO. Perpetual FIFO Beg. Inventory Purchases: January 8 January 19 Total Cost of Goods Available for Sale # of units Cost…arrow_forwardAt the beginning of the year, Delight Company had 100 units in its inventory at $50 each. On January 17, the company purchased 100 units for $60 each and at the end of the month sold 150 units for $95 each. During March, the company made two purchases of 200 units and 300 units for $70 and $80 each respectively. In the month of April, the company sold 450 units for $ 105 each. If the company is applying averaging, what would be the amount of gross profit for the period through April?arrow_forwardPacific Company starts the year with a beginning inventory of 3,700 units at $5 per unit. The company purchases 5,700 units at $4 each in February and 2,700 units at $6 each in March. Pacific sells 1,300 units during this quarter. Pacific has a perpetual inventory system and uses the FIFO inventory costing method. What is the cost of goods sold for the quarter?arrow_forward

- Air Force Surplus began July 2018 with 100 stoves that cost $10 each. During the month, the company made the following purchases at cost: (Click the icon to view the purchases.) The company sold 300 stoves, and at July 31, the ending inventory consisted of 70 stoves. The sales price of each stove was $48. Read the requirements. Requirement 1. Determine the cost of goods sold and ending inventory amounts for July under the average-cost, FIFO, and LIFO costing methods. Round the average cost per unit to two decimal places, and round all other amounts to the nearest dollar. Number of units Average cost Cost of goods sold Ending inventory Requirements 1. Determine the cost of goods sold and ending inventory amounts for July under the average-cost, FIFO, and LIFO costing methods. Round the average cost per unit to two decimal places, and round all other amounts to the nearest dollar. 2. Explain why cost of goods sold is highest under LIFO. Be specific. 3. Prepare the Air Force Surplus…arrow_forwardamuelson and Messenger (SAM) began 2021 with 200 units of its one product. These units were purchased near the end of 2020 for $25 each. During the month of January, 100 units were purchased on January 8 for $28 each and another 200 units were purchased on January 19 for $30 each. Sales of 125 units and 100 units were made on January 10 and January 25, respectively. There were 275 units on hand at the end of the month. SAM uses a perpetual inventory system. Required:1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO.2. Complete the below table to calculate ending inventory and cost of goods sold for January using average cost.arrow_forwardMonroe Company had a beginning inventory of 350 cans of paint at $12 each on January 1 at a cost of $4,200. During the year, the following purchases were made: February 15 : 280 cans at $14.00 April 30 : 110 cans at $14.50 July 1 : 100 cans at $15.00 Monroe marks up its goods at 40% on cost. At the end of the year, ending inventory showed 105 units remaining. Calculate the amount of sales assuming a FIFO flow of inventory.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning