Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need answer with correct calculation for this general accounting question

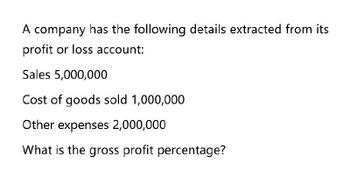

Transcribed Image Text:A company has the following details extracted from its

profit or loss account:

Sales 5,000,000

Cost of goods sold 1,000,000

Other expenses 2,000,000

What is the gross profit percentage?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardGross profit percentage?arrow_forwardA company shows the following balances: Sales Revenue Cost of Goods Sold Sales Returns and Allowances Sales Discounts Operating Expenses What is the gross profit? $230,000 $440,000 $240,000 O $140,000 $1,000,000 $560,000 $180,000 $20,000 $100,000arrow_forward

- A company reports the following amounts at the end of the year: Sales revenue Cost of goods sold Net income $ 310,000 210,000 53,000 Compute the company's gross profit ratio. (Round your final answe Gross profit ratio %arrow_forwardWhat is the gross profit percentage on these general accounting question?arrow_forwardWhat is the gross profit rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning